Table of Contents

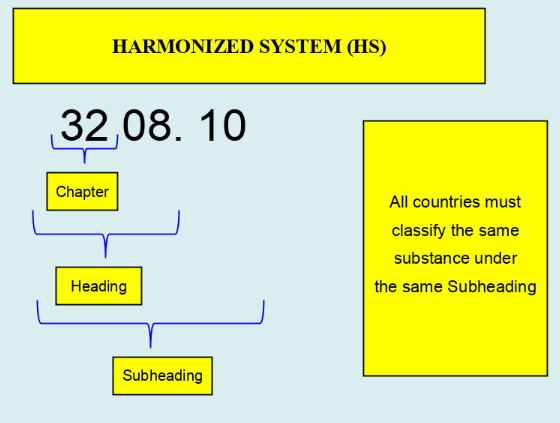

What is the Harmonized System(HS)?

The Harmonized System (HS) is an internationally standardized system of names (description) and numbers (codes) for classifying traded goods.

The HS is a product nomenclature where each product is assigned its corresponding “6-digit”

code.

It was developed and presently maintained by the World Customs Organization (WCO)

(formerly known as the Customs Cooperation Council (CCC)) headquartered in Brussels, Belgium.

The HS nomenclature is annexed to the International Convention on the Harmonized Commodity Description and Coding System.

It was developed to facilitate international trade by establishing a uniform system for

the collection, comparison and analysis of international trade statistics.

It was established in 1983 and entered into force in 1988.

Under this Convention, contracting parties are obligated to base their tariff schedules

on the HS nomenclature, although parties set their own rates of duty.

Countries that have adopted the Harmonized System are not permitted to alter in any way the descriptions associated to a heading or a subheading nor can the numerical codes at the four or six digit levels be altered.

This is what keeps the Harmonized System harmonized.

Individual countries may extend a Harmonized System code to eight or ten digits for customs

purposes.

More than 200 countries, customs and economic unions, representing more than 98% of world trade use the HS.

Primary uses of the Harmonized System

- Determination of customs tariffs (import duty)

- Collection of international trade statistics

- Rules of origin

- Ascertain eligibility of a product under a Free Trade Agreement

- Compliance with customs requirements

- Collection of government revenue

- Trade negotiations (e.g. the WTO schedule of tariff concessions)

- Monitoring prohibited and restricted goods

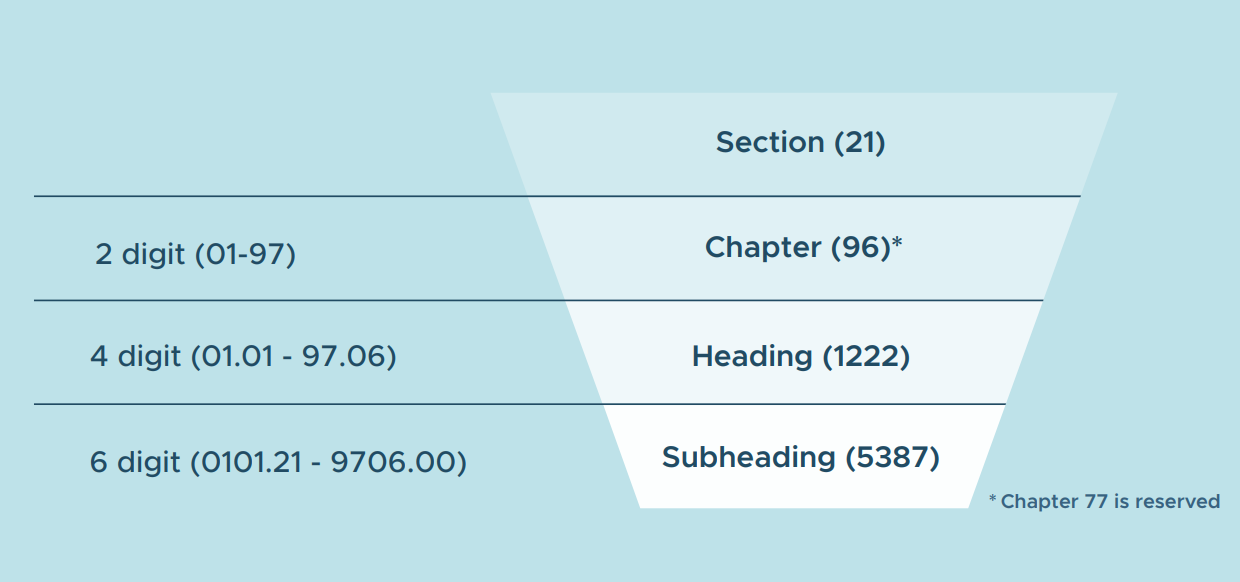

Composition of the Harmonized System

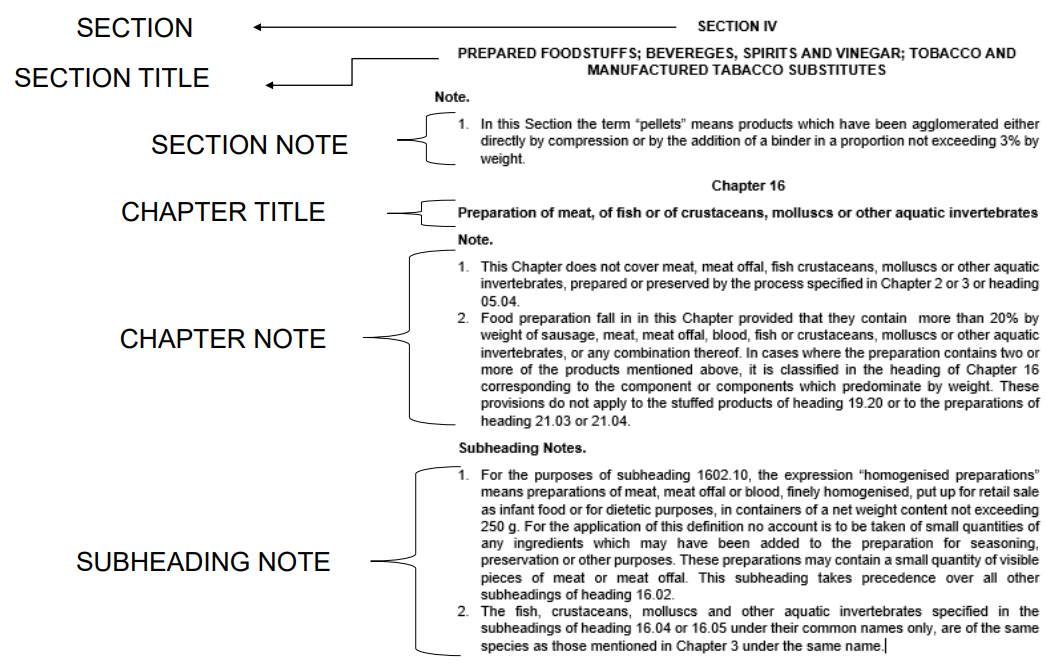

Source: WCO

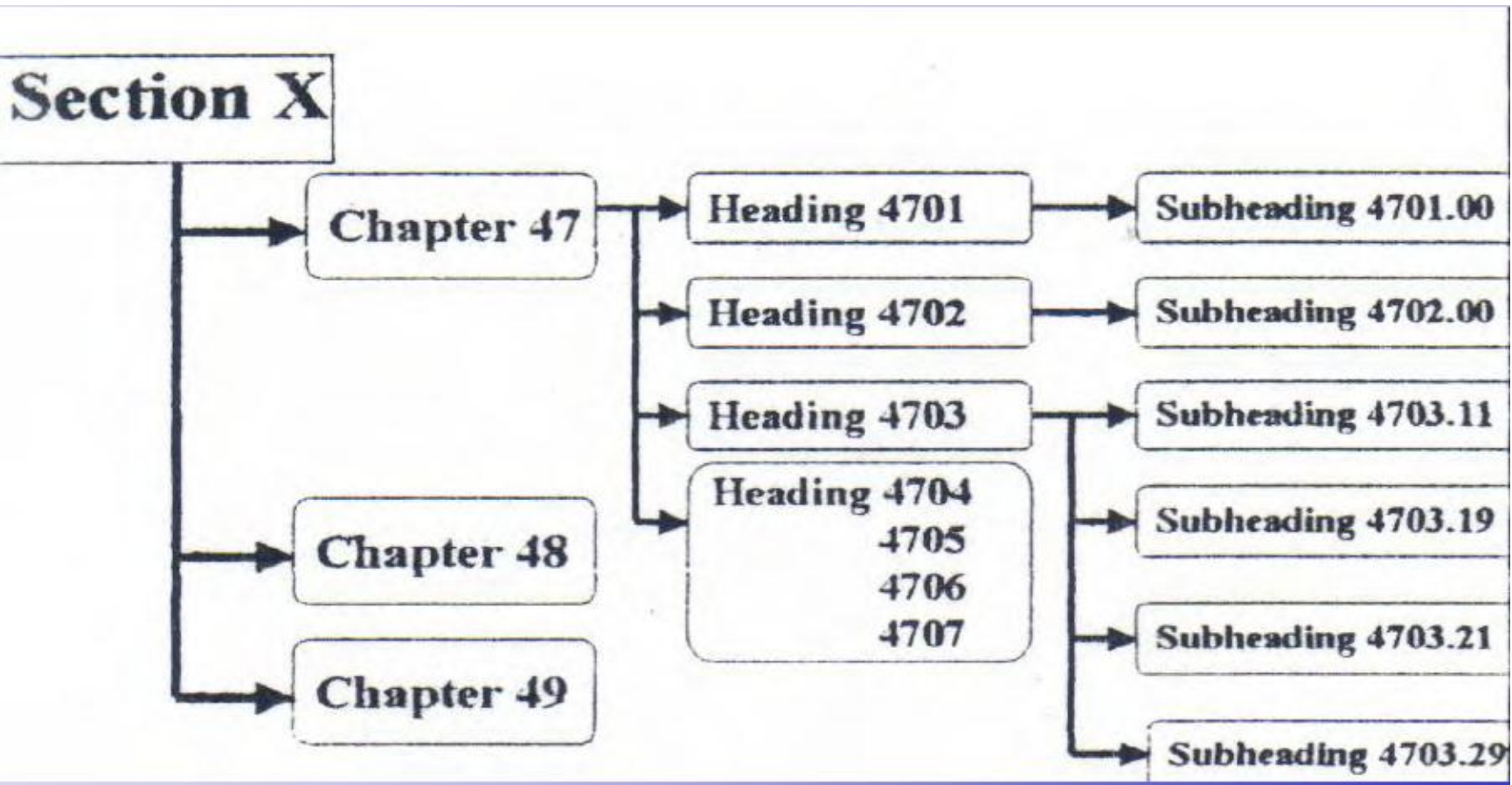

Here is an example of the structure of the harmonized system in Section 10(X)

Sections

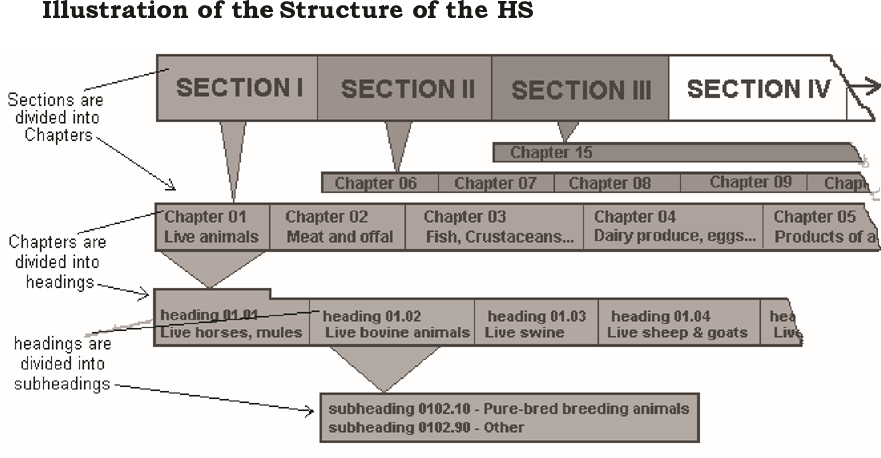

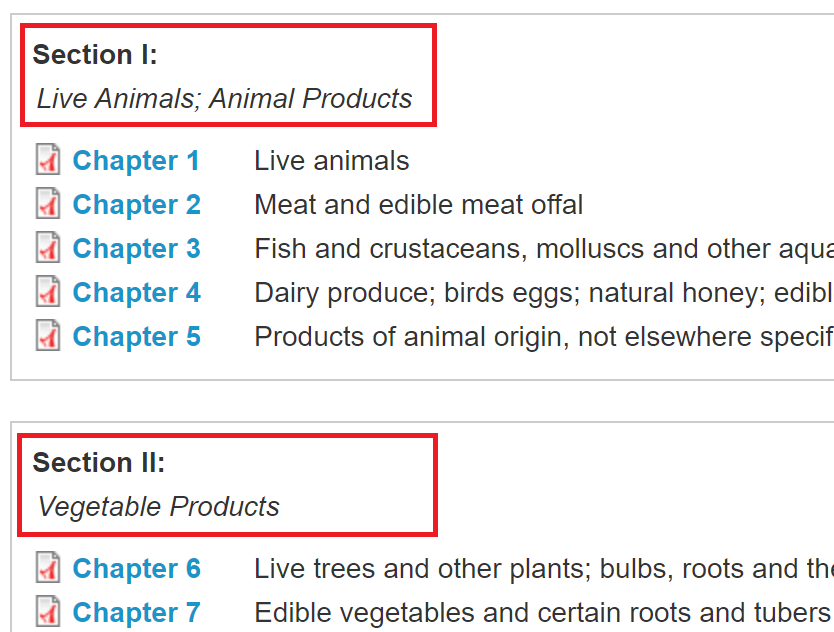

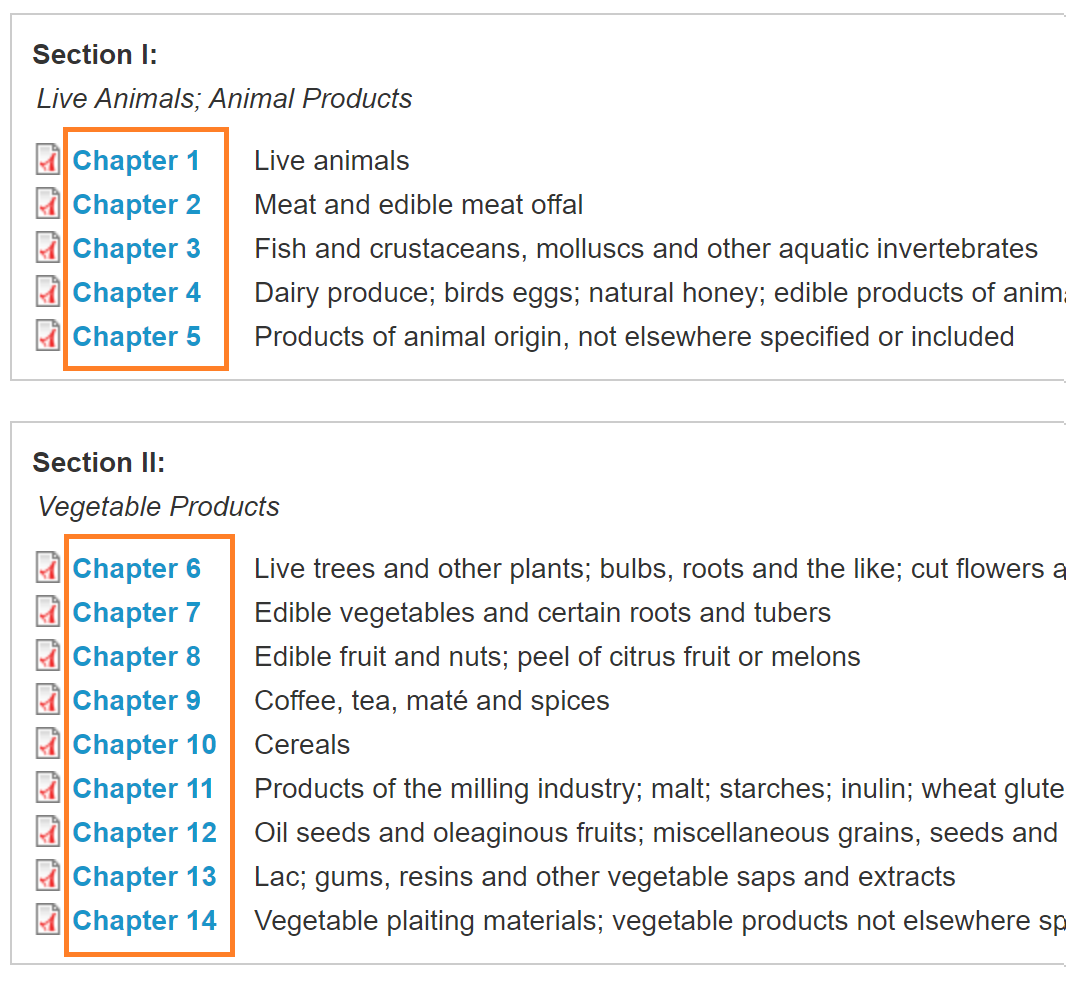

– The HS is primarily divided into 21 Sections

Example

- Section I: Live Animals; Animal Products

- Section VII: Plastics and Articles Thereof Rubber and Articles Thereof

- Section XV: Base Metals and Articles of Base Metal

- Section XVII: Vehicles, Aircraft, Vessels and Associated Transport Equipment

*The titles of Sections, Chapters and Subchapters are not legally binding

– They are for ease of reference only

– They are “pointers” or “labels” used to divide up the nomenclature.

– Help in directing you to areas of the nomenclature.

– They should not be quoted to support classification.

Example: Section XV is entitled “base metal and articles of base metal”

-However, many articles of base metal are classified in other Sections.

Chapters

– Sections are divided into Chapters

– There are 99 Chapters under the HS

– However, Chapter 77 is reserved for future use, while Chapters 98 & 99 are reserved for special uses by contracting parties to the HS Convention

Source: PHILIPPINE TARIFF COMMISSION

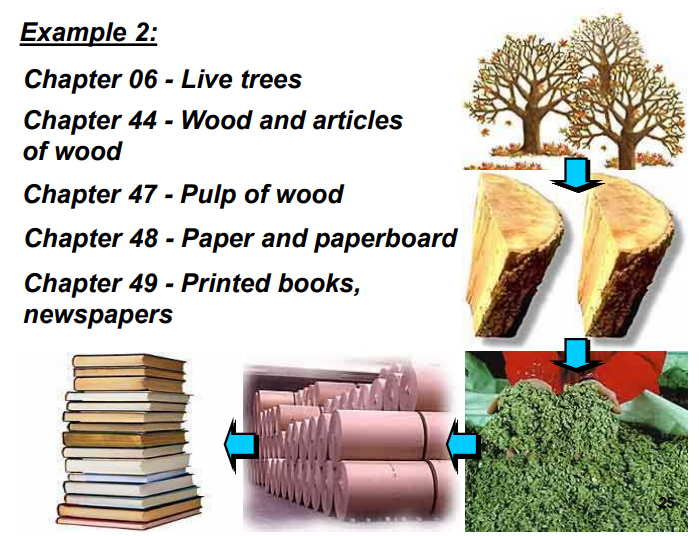

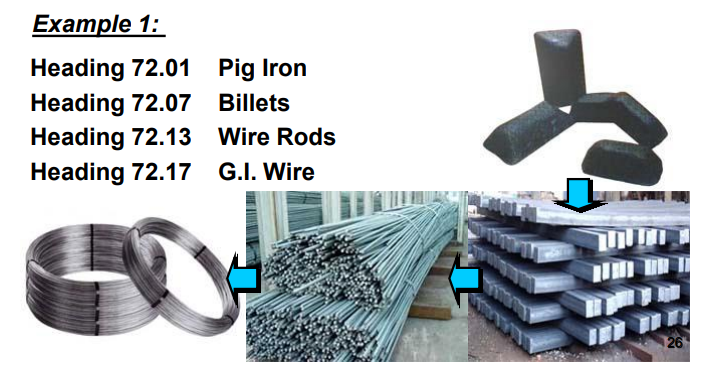

• Goods under chapters 1 to 83 are generally classified according to

material of manufacture.

• Goods under chapter 84 to 96 are generally classified according to

function

Headings

– Chapters are divided into headings

– Headings are assigned with four-digit codes

Source: PHILIPPINE TARIFF COMMISSION

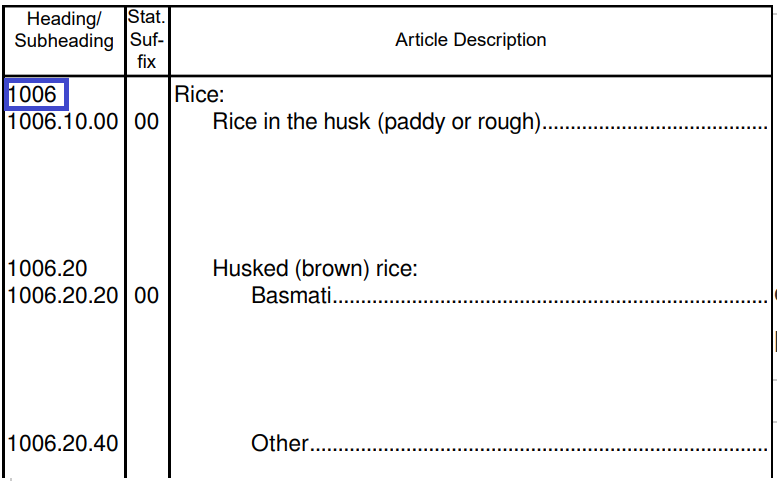

Subheadings

– Headings are further divided into subheadings

– HS subheadings are assigned with six-digit codes

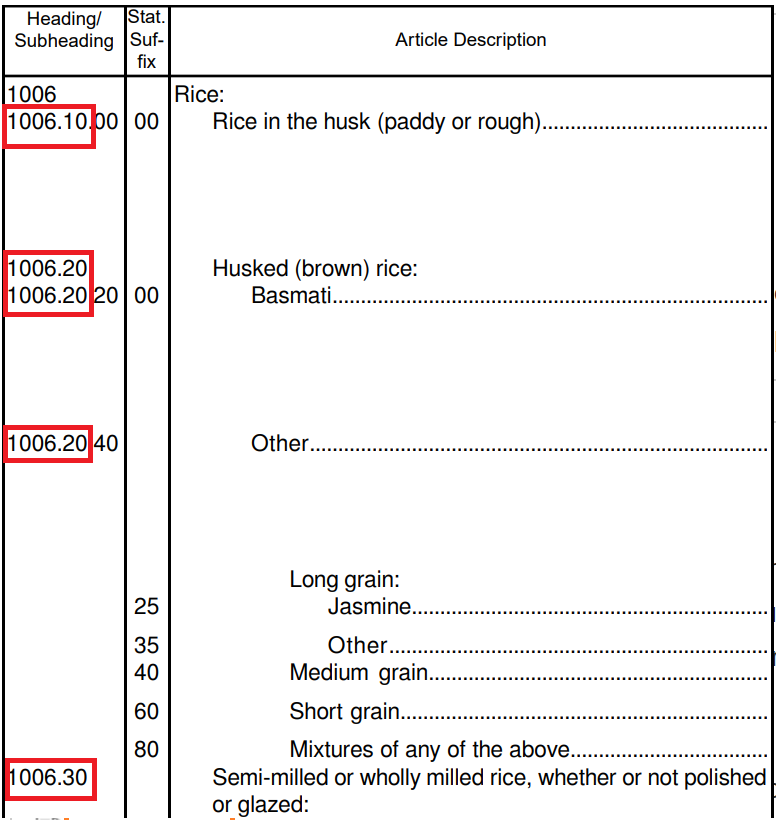

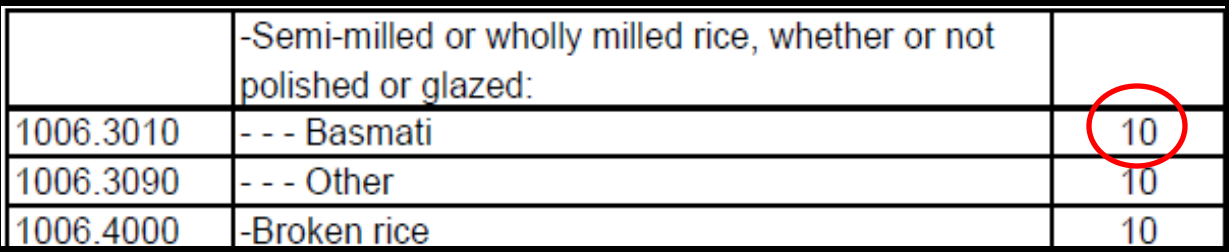

For example, the HS code for Milled rice is 1006.30

Source: Trade Development Authority of Pakistan

The full HS code for Milled rice is

1006.30.xxxx

■The first two digits 10

The first two digits are referred to as the Chapter to which the product belongs.

Here rice comes under chapter 10, which is ‘Cereals’.

■The first four digits 1006

The first four digits are referred to as the Heading.

Here rice comes under Heading 1006, which is ‘Rice’.

■The first six digits 1006.30

The first six digits are referred to as the SubHeading.

Here rice comes under SubHeading 1006.30, which is ‘Semi-milled or wholly milled rice, whether or not polished or glazed:’.

■The entire digits 1006.30.10xx

The final 4 digits shown here in Green 1006.30.xxxx are country-specific and are assigned by individual countries.

Custom duties are assigned on entire codes, so without these last Green part digits determining the custom duty applicable on your products would not be possible.

How to classify HS code

In order to determine the HS code, we need to get a full and accurate description.

Here are basic questions to ask in determining the identity of items:

• Where is it used? (LOCATION)

• What material or substance is it made of? (MATERIAL)

• What is its function or use? (FUNCTION)

• In what form/spec is it imported? (SPECIFICATION)

• Is this the only possible classification?

Example: Classify “HOOD ASSY”

– Location: Car Body

– Material: Metal

– Function: Car Hood

Therefore it belongs to…

• Section XVII

• Chapter 87

• Heading 8708

• Subheading 870829

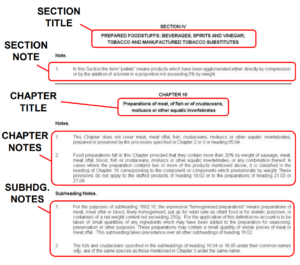

Apply the Sections, Chapter and Subchapter Notes

A commodity can be classified either by:

– Terms of the Heading

– Notes to the Sections, Chapters or Subheadings

– The General Interpretative Rules (GRI)

The Legal Notes which appear in front of most Sections and Chapters are known as Section Notes and Chapter Notes which has a legal force to determine HS code.

Source: PHILIPPINE TARIFF COMMISSION

The Legal Notes for each Section and Chapter provide:

– Exclusions

– Definitions

– Classification Provisions

– Limitations of Scope

Example of Exclusions

Note 1 Chapter 87

• This chapter does not cover railway or tramway rolling-stock designed solely

for running on rails.

• Heading 8712 includes all children’s bicycles. Other children’s cycles fall in

heading 9503.

Another example:

Source: PHILIPPINE TARIFF COMMISSION

Example of Definitions

Note 2 Chapter 87

– For the purposes of this chapter, “tractors” means vehicles constructed essentially for hauling or pushing another vehicle, appliance or load, whether or not they contain subsidiary provision for the transport, in connection with the main use of the tractor, of tools, seeds,fertilizers or other goods.

– Machines and working tools designed for fitting to tractors of heading 8701 as interchangeable equipment remain classified in their respective headings even if presented with the tractor, and whether or not mounted on it.

Another example:

Source: PHILIPPINE TARIFF COMMISSION

Example of Classification Provisions

– These notes establish the classification of certain goods.

– Example: Note 4 to section XVII establishes the classification of “amphibious motor vehicles”

Note 4 to Section XVII

For the purposes of this section: (b) Amphibious motor vehicles are classified under the appropriate heading of chapter 87;

Another example:

Source: PHILIPPINE TARIFF COMMISSION

For example, Notes 2, 3 and 4 to Chapter 31 together provide an exhaustive list the products that fall to be classified as fertilisers in headings 31.02, 31.03 and 31.04. In comparison, Note 3 to Chapter 86 specifies some of the railway and tramway track fixtures and fittings covered by heading 86.08.

Example of Limitations of Scope

– These notes limit the scope of goods to be classified in the section.

– Example: Note 2 to section XVII (which limits the scope of the expressions “Parts” and “Parts and accessories”).

Note 2 to section XVII

The expressions “parts” and “parts and accessories” do not apply to the following articles, whether or not they are identifiable as for the goods of this section:

Another example:

Source: PHILIPPINE TARIFF COMMISSION

Entire Structure of the HS

| Ch.1 | Live animals. | Sec I notes \ HS, Chapter note |

|---|---|---|

|

||

| Ch.2 | Meat and edible meat offal. | Sec I notes \ HS, Chapter note |

|

||

| Ch.3 | Fish and other aquatic invertebrates. | Sec I notes \ HS, Chapter note |

|

||

| Ch.4 | birds’ eggs; natural honey; edible products of animal | Sec I notes \ HS, Chapter note |

|

||

| Ch.5 | Products of animal origin, not elsewhere specified | Sec I notes \ HS, Chapter note |

|

||

| Ch.6 | Live trees and other plants | Sec II notes \ HS, Chapter note |

|

||

| Ch.7 | vegetables and certain roots and tubers. | Sec II notes \ HS, Chapter note |

|

||

| Ch.8 | fruit and nuts; peel of citrus fruit or melons. | Sec II notes \ HS, Chapter note |

|

||

| Ch.9 | Coffee, tea, maté and spices. | Sec II notes \ HS, Chapter note |

|

||

| Ch.10 | Cereals. | Sec II notes \ HS, Chapter note |

|

||

| Ch.11 | Products of the milling industry; malt; starches | Sec II notes \ HS, Chapter note |

|

||

| Ch.12 | Oil seeds and oleaginous fruits; miscellaneous grains | Sec II notes \ HS, Chapter note |

|

||

| Ch.13 | Lac; gums, resins and other vegetable saps and extracts. | Sec II notes \ HS, Chapter note |

|

||

| Ch.14 | Vegetable products not elsewhere specified | Sec II notes \ HS, Chapter note |

|

||

| Ch.15 | Animal or vegetable fats and oils and other products | Sec III \ HS, Chapter note |

|

||

| Ch.16 | Preparations of meat, of fish or of crustaceans | Sec IV notes \ HS, Chapter note |

|

||

| Ch.17 | Sugars and sugar confectionery. | Sec IV notes \ HS, Chapter note |

|

||

| Ch.18 | Cocoa and cocoa preparations. | Sec IV notes \ HS, Chapter note |

|

||

| Ch.19 | Preparations of cereals, flour, starch or milk | Sec IV notes \ HS, Chapter note |

|

||

| Ch.20 | Preparations of vegetables, fruit, nuts or other plants. | Sec IV notes \ HS, Chapter note |

|

||

| Ch.21 | Miscellaneous edible preparations. | Sec IV notes \ HS, Chapter note |

|

||

| Ch.22 | Beverages, spirits and vinegar. | Sec IV notes \ HS, Chapter note |

|

||

| Ch.23 | Residues and waste from the food industries | Sec IV notes \ HS, Chapter note |

|

||

| Ch.24 | Tobacco and manufactured tobacco substitutes | Sec IV notes \ HS, Chapter note |

|

||

| Ch.25 | Salt; sulphur; earths and stone; plastering materials | Sec V \ HS, Chapter note |

|

||

| Ch.26 | Ores, slag and ash | Sec V \ HS, Chapter note |

|

||

| Ch.27 | Mineral fuels, mineral oils | Sec V \ HS, Chapter note |

|

||

| Ch.28 | Inorganic chemicals | Sec VI notes \ HS, Chapter note |

|

||

| Ch.29 | Organic chemicals | Sec VI notes \ HS, Chapter note |

|

||

| Ch.30 | Pharmaceutical products | Sec VI notes \ HS, Chapter note |

|

||

| Ch.31 | Fertilisers | Sec VI notes \ HS, Chapter note |

|

||

| Ch.32 | Tanning or dyeing extracts | Sec VI notes \ HS, Chapter note |

|

||

| Ch.33 | Essential oils and resinoids | Sec VI notes \ HS, Chapter note |

|

||

| Ch.34 | Soap, organic surface-active agents | Sec VI notes \ HS, Chapter note |

|

||

| Ch.35 | Albuminoidal substances; modified starches; glues | Sec VI notes \ HS, Chapter note |

|

||

| Ch.36 | Explosives; pyrotechnic products | Sec VI notes \ HS, Chapter note |

|

||

| Ch.37 | Photographic or cinematographic goods | Sec VI notes \ HS, Chapter note |

|

||

| Ch.38 | Miscellaneous chemical products | Sec VI notes \ HS, Chapter note |

|

||

| Ch.39 | Plastics and articles thereof | Sec VII notes \ HS, Chapter note |

|

||

| Ch.40 | Rubber and articles thereof | Sec VII notes \ HS, Chapter note |

|

||

| Ch.41 | Raw hides and skins | Sec VIII \ HS, Chapter note |

|

||

| Ch.42 | Articles of leather;bags | Sec VIII \ HS, Chapter note |

|

||

| Ch.43 | Furskins and artificial fur | Sec VIII \ HS, Chapter note |

|

||

| Ch.44 | Wood and articles of wood | Sec IX \ HS, Chapter note |

|

||

| Ch.45 | Cork and articles of cork | Sec IX \ HS, Chapter note |

|

||

| Ch.46 | anufactures of straw, of esparto or of other plaiting materials | Sec IX \ HS, Chapter note |

|

||

| Ch.47 | Pulp of wood or of other fibrous cellulosic material | Sec X \ HS, Chapter note |

|

||

| Ch.48 | Paper and paperboard; articles of paper pulp | Sec X \ HS, Chapter note |

|

||

| Ch.49 | Printed books, newspapers, pictures and other products | Sec X \ HS, Chapter note |

|

||

| Ch.50 | Silk | Sec XI notes \ HS, Chapter note |

|

||

| Ch.51 | Wool, fine or coarse animal hair | Sec XI notes \ HS, Chapter note |

|

||

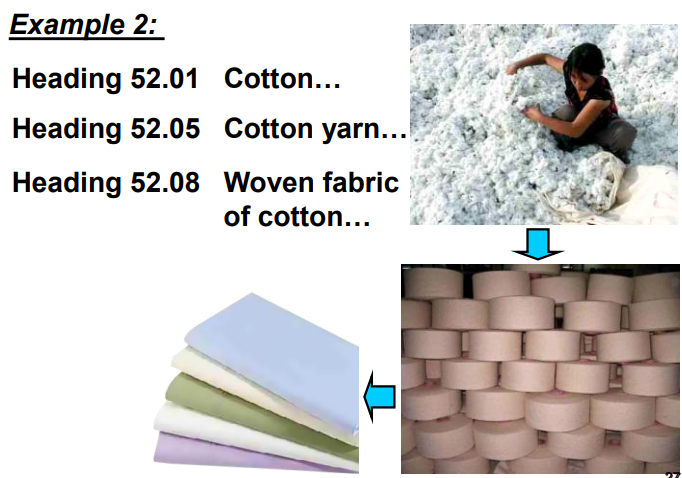

| Ch.52 | Cotton | Sec XI notes \ HS, Chapter note |

|

||

| Ch.53 | Other vegetable textile fibres | Sec XI notes \ HS, Chapter note |

|

||

| Ch.54 | Man-made filaments | Sec XI notes \ HS, Chapter note |

|

||

| Ch.55 | Man-made staple fibres | Sec XI notes \ HS, Chapter note |

|

||

| Ch.56 | Wadding, felt and nonwovens; special yarns | Sec XI notes \ HS, Chapter note |

|

||

| Ch.57 | Carpets and other textile floor coverings | Sec XI notes \ HS, Chapter note |

|

||

| Ch.58 | Special woven fabrics; tufted textile fabrics | Sec XI notes \ HS, Chapter note |

|

||

| Ch.59 | Impregnated, coated, covered or laminated textile fabrics | Sec XI notes \ HS, Chapter note |

|

||

| Ch.60 | Knitted or crocheted fabrics | Sec XI notes \ HS, Chapter note |

|

||

| Ch.61 | Articles of apparel , knitted | Sec XI notes \ HS, Chapter note |

|

||

| Ch.62 | Articles of apparel , not knitted | Sec XI notes \ HS, Chapter note |

|

||

| Ch.63 | Other made up textile articles | Sec XI notes \ HS, Chapter note |

|

||

| Ch.64 | Footwear, gaiters and the like | Sec XII \ HS, Chapter note |

|

||

| Ch.65 | Headgear and parts thereof | Sec XII \ HS, Chapter note |

|

||

| Ch.66 | Umbrellas, walking-sticks | Sec XII \ HS, Chapter note |

|

||

| Ch.67 | articles made of feathers ;artificial flowers | Sec XII \ HS, Chapter note |

|

||

| Ch.68 | Articles of stone, plaster, cement | Sec XIII \ HS, Chapter note |

|

||

| Ch.69 | Ceramic products | Sec XIII \ HS, Chapter note |

|

||

| Ch.70 | Glass and glassware | Sec XIII \ HS, Chapter note |

|

||

| Ch.71 | precious or semi-precious stones | Sec XIV \ HS, Chapter note |

|

||

| Ch.72 | Iron and steel | Sec XV notes \ HS, Chapter note |

|

||

| Ch.73 | Articles of iron or steel | Sec XV notes \ HS, Chapter note |

|

||

| Ch.74 | Copper and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.75 | Nickel and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.76 | Aluminium and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.78 | Lead and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.79 | Zinc and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.80 | Tin and articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.81 | Other base metals; articles thereof | Sec XV notes \ HS, Chapter note |

|

||

| Ch.82 | cutlery, spoons and forks of base metal | Sec XV notes \ HS, Chapter note |

|

||

| Ch.83 | Miscellaneous articles of base metal | Sec XV notes \ HS, Chapter note |

|

||

| Ch.84 | machinery and mechanical appliances | Sec XVI notes \ HS, Chapter note |

|

||

| Ch.85 | Electrical machinery and equipment | Sec XVI notes \ HS, Chapter note |

|

||

| Ch.86 | Railway or tramway locomotives | Sec XVII notes \ HS, Chapter note |

|

||

| Ch.87 | Vehicles and parts | Sec XVII notes \ HS, Chapter note |

|

||

| Ch.88 | Aircraft, spacecraft, and parts thereof | Sec XVII notes \ HS, Chapter note |

|

||

| Ch.89 | Ships, boats and floating structures | Sec XVII notes \ HS, Chapter note |

|

||

| Ch.90 | Optical, checking,medical or surgical instruments | Sec XVIII \ HS, Chapter note |

|

||

| Ch.91 | Clocks and watches | Sec XVIII \ HS, Chapter note |

|

||

| Ch.92 | Musical instruments | Sec XVIII \ HS, Chapter note |

|

||

| Ch.93 | Arms and ammunition | Sec XIX \ HS, Chapter note |

|

||

| Ch.94 | Furniture; bedding, lamps | Sec XX \ HS, Chapter note |

|

||

| Ch.95 | Toys, games and sports requisites | Sec XX \ HS, Chapter note |

|

||

| Ch.96 | Miscellaneous manufactured articles | Sec XX \ HS, Chapter note |

|

||

| Ch.97 | Works of art, collectors’ pieces and antiques | Sec XXI notes \ HS, Chapter note |

|

||

Source:European Union Website :U.S. Customs and Border Protection

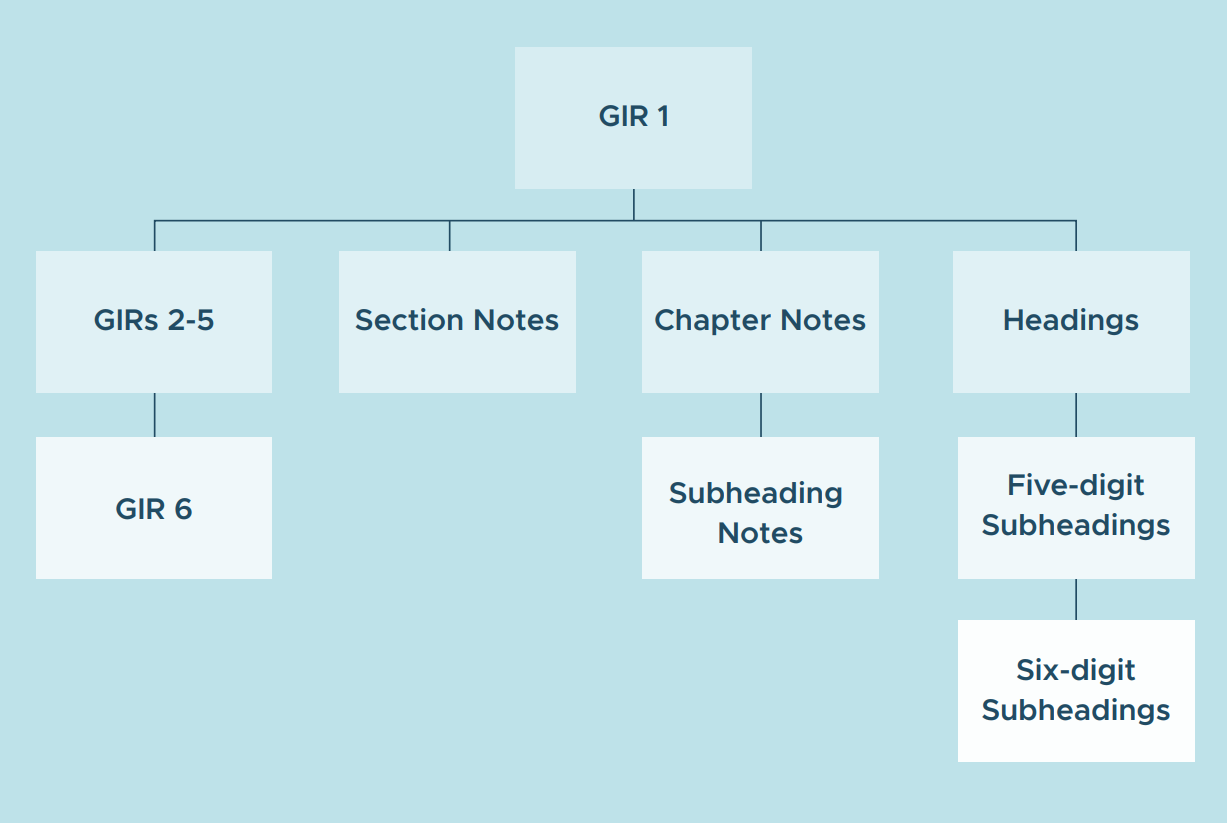

General Rules of Interpretation (GRIs)

The tariff classification of merchandise under the Harmonized System is

governed by the principles set forth in the General Rules of Interpretation(“GRIs”).

The GRIs are intended to be consulted and applied each time merchandise is

to be classified under the Harmonized System.

Accordingly, it is the GRIs that are the single set of legal principles that always

govern the classification of merchandise under the Harmonized System.

There are six GRIs in all.

Things to remember

The application of the GIRs (1-4) should always be in SEQUENTIAL ORDER:

Rule 1 is to be taken into consideration first.

If classification is not covered by the provisions of Rule 1, then apply Rule 2, and so on.

Goods must first be classified in the 4-digit HS heading whose terms most specifically

describe the goods (unless otherwise required or directed by the GIRs) and

Only 4-digit headings are comparable:

Do not compare a heading description with a subheading description.

Example: Classification of an electric toothbrush.

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Heading 85.09 as an “Electro-mechanical domestic appliances with self-contained

electric motor,….” OR Subheading 9603.21 which provides for “Toothbrushes,…”.

(Heading 96.03 provides for “Brooms, brushes…”)

NO!

Do not compare a heading description with a subheading description.

It is important to know about things to remember before understanding GRIs.

An electric toothbrush could potentially be classified in heading 8509 as an

electromechanical domestic appliance with self-contained motor and in

heading 9603 as a brush.

Within heading 9603, subheading 9603.21 provides for “toothbrushes.”

No consideration should be given to this subheading when comparing the

terms of the headings to determine the appropriate heading for classification

of the electric toothbrush (as merchandise must first be classified in the

Harmonized System at the heading level by the terms of the headings).

GRI Rule 1 Terms of the Headings, Section/Chapter Notes

THE TABLE OF CONTENTS, ALPHABETICAL INDEX, AND

TITLES OF SECTIONS, CHAPTERS AND SUB-CHAPTERS ARE

PROVIDED FOR EASE OF REFERENCE ONLY; FOR LEGAL

PURPOSES, CLASSIFICATION SHALL BE DETERMINED

ACCORDING TO THE TERMS OF THE HEADINGS AND ANY

RELATIVE SECTION OR CHAPTER NOTES AND, PROVIDED SUCH

HEADINGS OR NOTES DO NOT OTHERWISE REQUIRE, ACCORDING

TO THE FOLLOWING PROVISIONS: [that is, GRIs 2 to 6].

EXAMPLE 1: Under GRI 1, if a provision specifically and completely

describes a product, then the product would be classified in that provision

(e.g., fresh grapes are classified under heading 0806 which provides for

“grapes, fresh or dried”). In this situation, the product is classified by the

terms of a heading.

Example: Live poultry (heading 01.05)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

EXAMPLE 2: Note 3 to Section XVI to the Harmonized System directs

classification of composite machines described therein on the basis of the

“principal function” of the machines. Under GRI 1, such machines are to

be classified as so directed in that note. In this situation, the products are

classified by the terms of a section note.

Example of Terms of the Headings, Section/Chapter Notes

EXAMPLE 3: Section XV is entitled “Base metals and articles of base metal”

but jewelry of base metal is classified in Section XIV.

EXAMPLE 4: Chapter 61 is entitled “Articles of apparel and clothing accessories,

knitted or crocheted”, although the chapter also covers certain articles which are

not wholly knitted or crocheted, such as those in heading 62.12.

EXAMPLE 5: Live horses are classified in Heading 01.01.

GRI 1 further states that if the texts of the headings and of the notes cannot, by

themselves, determine the appropriate heading for classification of merchandise, then

classification is to be determined by the appropriate GRIs that follow GRI 1 (i.e., GRIs 2

to 6).

Rule 2 (a) Incomplete or unfinished; Unassembled or disassembled

RULE 2. (a) ANY REFERENCE IN A HEADING TO AN ARTICLE

SHALL BE TAKEN TO INCLUDE A REFERENCE TO THAT ARTICLE

INCOMPLETE OR UNFINISHED, PROVIDED THAT, AS ENTERED,

THE INCOMPLETE OR UNFINISHED ARTICLE HAS THE ESSENTIAL

CHARACTER OF THE COMPLETE OR FINISHED ARTICLE. IT SHALL

ALSO INCLUDE A REFERENCE TO THAT ARTICLE COMPLETE OR

FINISHED (OR FALLING TO BE CLASSIFIED AS COMPLETE OR

FINISHED BY VIRTUE OF THIS RULE), ENTERED UNASSEMBLED OR

DISASSEMBLED.

GRI 2 (a) has two parts. Part one deals with incomplete or unfinished goods and part

two deals with unassembled or disassembled goods.

Part One incomplete or unfinished goods

The first part of GRI 2 (a) extends the scope of any heading that refers to a

particular article to cover not only the complete article but also that article incomplete or

unfinished, provided that, as presented, it has the “essential character” (which is

discussed below) of the complete or finished article.

EXAMPLE1: A ceramic statuette of the Hokie Bird that will be painted after

importation would still generally have the essential character of a ceramic

statuette of heading 6913 (i.e., one would still recognize and identify the

product as a ceramic statuette) and would, therefore, be classified pursuant

to GRI 2 (a) as the finished product in heading 6913.

Example2: Preform bottle – Unfinished (heading 39.23 covers plastic bottles)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Example3: Wrist watch without strap – Incomplete (heading 91.02 covers wristwatches)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Example3: A car without wheels, is considered as a complete car.

Part Two unassembled or disassembled goods

The second part of GRI 2 (a) provides that complete or finished articles presented

unassembled or disassembled (which may occur for reasons related to the packing,

handling or transportation of the articles) are to be classified in the same heading as the

assembled article. It also provides incomplete or unfinished articles presented

unassembled or disassembled are to be classified in the same heading as the complete

or finished article provided that as presented they have the essential character of the

complete or finished article (as provided for in the first part of GRI 2 (a)).

EXAMPLE1: A shipment of an unassembled bicycle (containing all parts

and components necessary to build a bicycle) would be classified in

heading 8712 as an assembled, finished bicycle as if it were entered (or

imported) as the assembled, finished bicycle.

Example2: A complete set of wooden panels meant for assembly into a cupboard,

is considered as a finished cupboard.

EXAMPLE3: Unassembled office chair (heading 94.01 covers seats)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Rule 2 (b) Mixtures or combinations

RULE 2.(b) ANY REFERENCE IN A HEADING TO A MATERIAL

OR SUBSTANCE SHALL BE TAKEN TO INCLUDE A REFERENCE TO

MIXTURES OR COMBINATIONS OF THAT MATERIAL OR

SUBSTANCE WITH OTHER MATERIALS OR SUBSTANCES. ANY

REFERENCE TO GOODS OF A GIVEN MATERIAL OR SUBSTANCE

SHALL BE TAKEN TO INCLUDE A REFERENCE TO GOODS

CONSISTING WHOLLY OR PARTLY OF SUCH MATERIAL OR

SUBSTANCE. THE CLASSIFICATION OF GOODS CONSISTING OF

MORE THAN ONE MATERIAL OR SUBSTANCE SHALL BE

ACCORDING TO THE PRINCIPLES OF RULE 3.

GRI 2 (b) governs the classification (1) of mixtures and combinations of materials or

substances and (2) of goods consisting of two or more materials or substances. The

rule extends headings referring (1) to a material or substance to include mixtures or

combinations of that material or substance with other materials or substances and (2) to

goods of a given material or substance to include goods consisting wholly or partly of

that material or substance (but only as long as another heading does not refer to the

goods in their mixed or composite state).

If the addition of another material or substance deprives the imported good of the

character of the kind mentioned in the heading under consideration, however, then

one must resort to GRI 3 for classification of the merchandise. Or, in other words,

mixtures and combinations of materials or substances, and goods consisting of

more than one material or substance, if upon initial consideration are potentially

classifiable under two or more headings, they must be classified according to the

principles of GRI 3.

EXAMPLE1: Under GRI 2 (b), a stainless steel travel mug with a plastic

handle would be classifiable in heading 7323 as a table, kitchen or other

household article of steel despite the plastic handle (as it retains the

character of a table, kitchen or another household article of steel as

mentioned in heading 7323). If a travel mug, however, contained

relatively equal amounts of stainless steel and plastic (e.g., the outside or

outer surface of the mug is made of plastic and the inside or inner surface

(lining) of the mug is made of stainless steel), then the travel mug would

be potentially classifiable under two headings: heading 3924 as tableware,

kitchenware or other household article of plastic and heading 7323 as a

table, kitchen or other household article of steel. (Or, contrasting this

product with the initial one considered in this example, a travel mug

consisting of relatively equal amounts of stainless steel and plastic does

not have the character of a table, kitchen or other household article of

steel as mentioned in heading 7323.) In this situation, pursuant to GRI 2(b),

resort would need to be made to GRI 3 for classification of the product.

EXAMPLE2: Milk to which vitamins or minerals have been added.

EXAMPLE3: A pack of cornflakes which also contains a small amount of nuts and raisins.

Rule 3 Two or more headings

WHEN, BY APPLICATION OF RULE 2(b) OR FOR ANY

OTHER REASON, GOODS ARE, PRIMA FACIE, CLASSIFIABLE

UNDER TWO OR MORE HEADINGS, CLASSIFICATION SHALL BE

EFFECTED AS FOLLOWS:

GRI 3 provides for the classification of goods that are prima facie (or when initially

considered) classifiable under two or more headings. In such instances, the goods are

classified pursuant to this rule based on three criteria, taken in order:

Rule 3 (a) Most specific

The heading which provides the most specific description

shall be preferred to headings providing a more general

description. However, when two or more headings each refer

to part only of the materials or substances contained in mixed

or composite goods or to part only of the items in a set put up

for retail sale, those headings are to be regarded as equally

specific in relation to those goods, even if one of them gives a

more complete or precise description of the goods.

The first sentence to GRI 3 (a) provides that goods should be classified in the heading

that provides the most specific description. In general, under this criterion, (1) a

description by name is more specific than a description by class and (2) a description

that more clearly identifies a product is more specific than one which is less complete.

Example1: Chair/ladder

A wooden ladder is classified as “Other articles of wood(HS4421)”

A wooden chair is classified as “Wooden chair(HS9401)”

So where to be classified??

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Relative Specificity

A description by name is more specific than a description by class.

A description that more clearly identifies a product is more specific than one which is less complete.

the name “Wooden chair” more clearly identifies than “Other articles of wood”

Therefore this product is classified as Wooden chair(HS9401)

Example2:

Steel spoon is classified in HS82.15(Spoons) and not in HS73.23(Steel Household)

Example3:

Seats for motor vehicles are classified in HS94.01(Seats for motor vehicles)

and not in HS 87.08(Parts and accessories of the motor vehicles)

Example4: An example of a description by name in one heading that is

more specific than a description by class in another heading is as follow:

“shavers and hair clippers with self-contained electric motor” of heading

8510 is more specific than “electro-mechanical tools for working in the

hand with self-contained electric motor” of heading 8467 or

“electromechanical domestic appliances with self-contained electric motor” of

heading 8509.

Example5: An example of a description in one heading that more clearly

identifies a product than a description in another heading (and thus the

first description is more specific than the second description) is as follows:

A product identified as “unframed safety glass made of toughened or

laminated glass that is shaped and identifiable for use in airplanes” is

more clearly described by the article description “safety glass” of heading

7007 than by the article description “parts of goods of heading 8801 or

8802” (parts of aircraft and spacecraft) of heading 8803.

The second sentence to GRI 3 (a) further provides that when two or more headings

each refer to only one of the materials or substances in mixed or composite goods, or to

only some of the articles included in a set put up for retail sale, those headings are to be

regarded as equally specific in relation to those goods, even if one of them gives a more

complete or precise description of the goods. If this situation exists, then resort must be

made to GRI 3 (b). (See examples discussed below for GRI 3 (b).)

Rule 3 (b) Essential character

Mixtures, composite goods consisting of different

materials or made up of different components, and

goods put up in sets for retail sale, which cannot be

classified by reference to 3 (a), shall be classified as if

they consisted of the material or component which

gives them their essential character, insofar as this

criterion is applicable.

GRI 3 (b) deals with mixed goods, composite goods, and goods put up in sets for retail

sale as described above in the second sentence to GRI 3 (a) (i.e., each of the goods is

potentially classifiable in more than one heading because each good consists of two or

more different ingredients, materials, components or articles and no heading provides

for the goods as a whole).

By application of this criterion, such goods are classified according to the ingredient,

material, component or article that gives the mixtures, composite goods, or sets their

“essential character.”

Goods Put up in Sets for Retail Sale. For the purposes of GRI 3 (b), the term “goods put

up in sets for retail sale” means that the goods under consideration must (a) consist of

at least two different articles (i.e., the articles must be of a different type or nature, e.g.,

two table spoons are not such a “set”) which are, prima facie, classifiable in different

headings; (b) consist of products or articles put up together to meet a particular need or

carry out a specific activity; and (c) are put up in a manner suitable for sale directly to

users without repacking.

Example1:Mixture of barley (60%) of HS10.03 and oats (40%) of HS10.04

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

An example of a mixture of barley of HS1003(60%) and oats of HS1004(40%) in

different amounts. In such an instance, “barley” gives their essential character.

Therefore the mixture is classified as “barley(HS1003)”

Example2: An example of a “composite good”

coming within the purview of GRI 3 (b) would be a combined flashlight of

heading 8513 and radio of heading 8527 (i.e., both are contained in the

same housing). In such an instance, there is a product consisting of two

or more different units or components that are located in the same

housing with each component having a provision in which it could

potentially be classified and no provision exists in the Harmonized System

that provides for the composite good as a whole.

Example3: An example of a “set” coming within the purview of GRI 3

(b) would be a hairdressing kit consisting of a pair of electric hair clippers

of heading 8510, a comb of heading 9615, a pair of scissors of heading

8213, and a brush of heading 9603. In such an instance, there is a

product that consists of more than one item or article with each article

having a provision in which it could potentially be classified and no

provision exists in the Harmonized System that provides for the set as a

whole. In the above-mentioned hairdressing kit, the articles are put up

together to meet the particular need or carry out the specific activity of

grooming hair.

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Example4: A mixture for brewing, consisting of 70 % wheat and 30 % barley. The mixture is

classified in Heading 10.01 (Wheat and meslin).

Example5: Liquor-filled chocolates are classified in Heading 18.06 (Chocolate and other food

preparations containing cocoa).

Example6: A bed linen set comprising a woven bedspread, pillow-cases and bolsters put up in a

paperboard case. It is classified in Heading 63.04.

In each of the above-mentioned example 4 to 6, one would need to make a

determination as to the ingredient, material, component or article that imparts the

essential character to the particular good. The good would then be classified as if made

or consisting entirely of that ingredient, material, component or article. In some

situations, however, no ingredient, material, component or article will be found to impart

the essential character to a particular good. In such instances, resort would need to be

made to GRI 3 (c) in order to classify the good.

Rule 3 (c) Last in numerical order

WHEN GOODS CANNOT BE CLASSIFIED BY REFERENCE TO

3(a) OR 3(b), THEY SHALL BE CLASSIFIED UNDER THE HEADING

WHICH OCCURS LAST IN NUMERICAL ORDER AMONG THOSE

WHICH EQUALLY MERIT CONSIDERATION.

GRI 3 (c) states that goods should be classified under the heading that occurs last in

numerical order from among those that equally merit consideration if the goods cannot

be classified by reference to GRIs 3 (a) or 3 (b).

EXAMPLE1:

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

In the above-mentioned example of the mixed good consisting of barley

and oats in equal amounts, if neither the barley nor the oats is found to

impart the essential character to the product, then by application of GRI 3

(c) the product would be classified in heading 1004 as if consisting solely

of the oats. This is because the heading number for the oats found in the

mixture occurs last in numerical order as between it and the barley (i.e.,

1003 for the barley and 1004 for the oats).

EXAMPLE2: A belt made of 50 % leather(heading42.03) and

50 % textiles(heading62.17) is classified in Heading 62.17.

EXAMPLE3: A machine-tool for working stone(heading 84.64) as well as

wood(heading 84.65) is classified in Heading 84.65.

EXAMPLE4: Electric lamp (heading 94.05) with an alarm clock (heading 91.05)

is classified in 94.05.

EXAMPLE5: Chandeliers (heading 94.05) with electric fan (heading 84.14)

is classified in 94.05.

WHAT IS THE ESSENTIAL CHARACTER OF A PRODUCT?

The term “essential character,” as used in the GRIs, is not defined in the Harmonized

System. As concerns that term, however, it is stated in the Explanatory Notes to the

Harmonized System (which is an extrinsic interpretative aid to the Harmonized System

that is discussed below) that the factor that determines the essential character of a good

will vary as between different kinds of goods (i.e., essential character must be

determined on a case-by-case basis). The essential character of a good, may, for

example, be determined by the nature of the material or component, its bulk, quality,

weight or value, or by the role of a constituent material in relation to the use of the

goods. Other factors may be considered in determining the essential character of a

product.

Rule 4 Most akin

GOODS WHICH CANNOT BE CLASSIFIED IN

ACCORDANCE WITH THE ABOVE RULES SHALL BE CLASSIFIED

UNDER THE HEADING APPROPRIATE TO THE GOODS TO WHICH

THEY ARE MOST AKIN.

If goods cannot be classified according to GRIs 1 to 3, then resort must be made to GRI

4. GRI 4 requires that goods are to “be classified under the heading appropriate to the

goods to which they are most akin.” This rule should be applied very infrequently as

GRIs 1 to 3 will cover the classification of almost all goods. When attempting to apply

this rule, however, any determination regarding “kinship” should depend on such factors

as description, character, purpose or intended use, designation, production process and

the nature of the goods.

EXAMPLE: Exhaust Air Jack (heading 84.25)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Rule 5 Containers

IN ADDITION TO THE FOREGOING PROVISIONS, THE

FOLLOWING RULES SHALL APPLY IN RESPECT OF THE GOODS

REFERRED TO THEREIN:GRI 5 has two sections: GRI 5 (a) and GRI 5 (b).

These two sections deal with various types of containers presented with

the articles for which they are intended.

Rule 5 (a) Special containers

(a) CAMERA CASES, MUSICAL INSTRUMENT CASES, GUN CASES,

DRAWING INSTRUMENT CASES, NECKLACE CASES AND SIMILAR

CONTAINERS, SPECIALLY SHAPED OR FITTED TO CONTAIN A

SPECIFIC ARTICLE OR SET OF ARTICLES, SUITABLE FOR LONGTERM

USE AND ENTERED WITH THE ARTICLES FOR WHICH THEY

ARE INTENDED, SHALL BE CLASSIFIED WITH SUCH ARTICLES

WHEN OF A KIND NORMALLY SOLD THEREWITH. THIS RULE DOES

NOT, HOWEVER, APPLY TO CONTAINERS WHICH GIVE THE WHOLE

ITS ESSENTIAL CHARACTER;

GRI 5 (a) deals with the treatment of long-term use cases, boxes, and similar containers

presented with the articles for which they are intended. Under this rule, long-term use

containers imported with articles for which they are intended to be used are to be

classified with the articles if they are of a kind of container normally sold with such

articles (e.g., camera cases with cameras and musical instrument cases with musical

instruments). This rule, however, does not apply to containers that give the imported

article its essential character (e.g., a silver tray or dish containing tea or a high-quality

ornamental ceramic bowl containing candies or sweets). Such merchandise is to be

classified under the heading for the container.

EXAMPLE1: Violin(HS9202) with case(4202)

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

Packing materials and packing containers entered with the

goods therein shall be classified with the goods if they are of

a kind normally used for packing such goods.

Violin with a case would be classified as Violin(HS9202) if the items

satisfie Rule 5(a).

EXAMPLE2:Gumball with toy packaging

Retrieved from: HS Classification by Japan customs

It seems that it satisfies Rule 5(a) but in this situation Gumball and toy packaging

should be classified separately because of Rule 5(a) states that,

THIS RULE DOES NOT, HOWEVER, APPLY TO CONTAINERS WHICH GIVE THE WHOLE

ITS ESSENTIAL CHARACTER;

Toy packaging gives the whole it’s an essential character.

Therefore Gumballs are classified HS1704

The toy packaging is classified HS9503 as Toy.

Rule 5 (b) Packing materials & containers

(b) SUBJECT TO THE PROVISIONS OF RULE 5(a) ABOVE, PACKING

MATERIALS AND PACKING CONTAINERS ENTERED WITH THE

GOODS THEREIN SHALL BE CLASSIFIED WITH THE GOODS IF

THEY ARE OF A KIND NORMALLY USED FOR PACKING SUCH

GOODS. HOWEVER, THIS PROVISION IS NOT BINDING WHEN SUCH

PACKING MATERIALS OR PACKING CONTAINERS ARE CLEARLY

SUITABLE FOR REPETITIVE USE.

GRI 5 (b) states that packaging containers and materials not normally intended to be

reused are classified with the articles in which they are presented or imported (e.g.,

cardboard boxes or containers containing food products). This rule, however, does not

apply to packaging materials or packing containers clearly suitable for repetitive use

(e.g., certain metal drums or containers of iron or steel for compressed or liquefied gas).

Such containers are to be classified separately from the materials that they hold.

Example1: Men’s shirts individually sealed in a polybag then packed in cardboard boxes

Retrieved from: HARMONIZED COMMODITY DESCRIPTION and CODING SYSTEM or HARMONIZED SYSTEM(HS)

In this situation, Men’s shirts with the cardboard box are entirely classified

as shirts.

EXAMPLE2: Gumball dispensing machine

Gumball dispensing machine (predominantly of zinc alloy) imported with gumballs.

It is designed to accept a coin and release a candy.

It seems that it satisfies Rule 5(b), but in this situation Gumball and dispensing machine

should be classified separately because of Rule 5(b) states that,

HOWEVER, THIS PROVISION IS NOT BINDING WHEN SUCH

PACKING MATERIALS OR PACKING CONTAINERS ARE CLEARLY

SUITABLE FOR REPETITIVE USE.

Dispensing machine is considered as a container which suitable for repetitive use.

Therefore Gumballs are classified HS1704

The dispenser is classified HS7907.

Rule 6 Subheading rule

For legal purposes, the classification of goods in the

subheadings of a heading shall be determined

according to the terms of those subheadings and any

related Subheading Notes and, mutatis mutandis, to

the above Rules, on the understanding that only

subheadings at the same level are comparable. For the

purposes of this Rule the relative Section and Chapter

Notes also apply, unless the context otherwise requires.

GRI 6 is the last of the GRIs. It prescribes that, for legal purposes, GRIs 1 to 5 govern,

mutatis mutandis (or with the necessary changes), classification at subheading levels

within the same heading. Or, in other words, GRIs 1 to 5 are to be reapplied to

determine the classification of goods at the subheading level. Goods are to be classified

at equal subheading levels (that is, at the same digit level) within the same heading

under the subheading that most specifically describes or identifies them (or as

otherwise required or directed under GRIs 1 to 5). Only subheadings at the same level

within the same heading are comparable (i.e., no consideration should be given to the

terms of any subheading within another subheading when considering the proper

classification of merchandise at the higher level subheading).

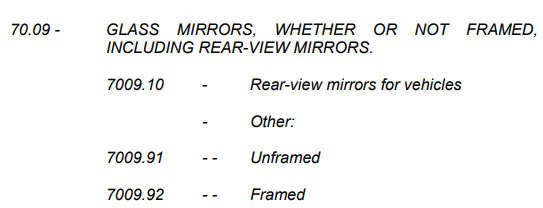

EXAMPLE 1: A framed glass mirror is found to be classified in heading

7009. Thereafter, it would have to be classified within the subheading

structure of that heading by application of GRIs 1 to 5 pursuant to GRI 6:

Initially, a determination would need to be made as to whether the framed

glass mirror is classified at the 5-digit (or “one-dash”) subheading level in

5-digit subheading 7009.1 (“rear-view mirrors for vehicles”) or in 5-digit

subheading 7009.9 (“other”). If the product is found to be classified in 5-

digit subheading 7009.1 (as a rear-view mirror for a vehicle), then the

classification analysis would end there and the product would be classified

in subheading 7009.10 (as 5-digit subheading 7009.1 is not further

subdivided). In the instant case, the framed glass mirror does not satisfy

the article description for 5-digit subheading 7009.1. Therefore, the

product would be classified at the 5-digit subheading level in 5-digit

subheading 7009.9 (as a glass mirror other than a rear-view mirror for a

vehicle). Next, a determination would have to be made as to whether the

product is classified at the 6-digit (or “two-dash”) subheading level within

5-digit subheading 7009.9 in 6-digit subheading 7009.91 (as an unframed

glass mirror other than a rear-view mirror for a vehicle) or in 6-digit

subheading 7009.92 (as a framed glass mirror other than a rear-view

mirror for a vehicle). The framed glass mirror would be classified in

subheading 7009.92 by application of GRI 1 pursuant to GRI 6.

EXAMPLE 2: A set consisting of a shovel, fork, and pick for use in

gardening would be classified in heading 8201 as each article is

specifically provided for in the terms to that heading. Within heading

8201, shovels are provided for in subheading 8201.10, forks in

subheading 8201.20, and picks in subheading 8201.30. Consequently,

one would need to resort to GRI 3 pursuant to GRI 6 in order to classify

the set at the subheading level within heading 8201. That is, one would

need to determine which of the three articles imparts the essential

character to the set pursuant to GRI 3 (b). If no one article is found to

impart the essential character to the set, then one would classify the set

under subheading 8201.30 because the subheading number for that

article occurs last in numerical order as provided for in GRI 3 (c).

As evident from the above discussion, the GRIs provide that goods must first be

classified by heading level, and only after the appropriate heading has been

determined, then by equal subheading levels (first by five-digit and then by six-digit

international levels) within that heading. When considering the appropriate

classification at a particular subheading level, no consideration should be given to any

of the terms of any lower-level subheading (as the analysis at each subheading level

should be conducted without consideration of the terms of any lower-level subheading

provision). This step-by-step analysis applies without exception throughout the

Harmonized System (and throughout any national subheading levels as found in a

particular country’s Harmonized System-based tariff system).

Source: WCO