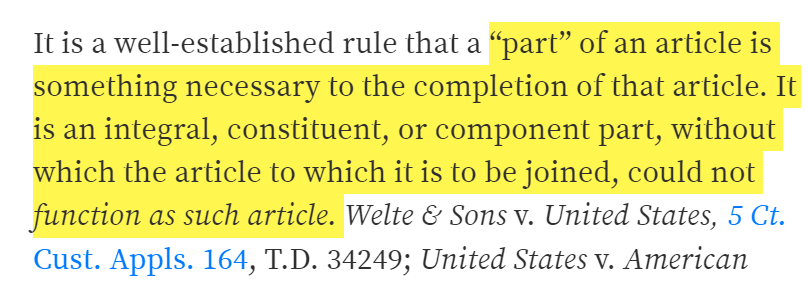

Part

“part” of an article is something necessary to the completion of that article. It is an integral, constituent, or component part, without which the article to which it is to be joined, could not function as such article.

Source: United States v. Willoughby Camera Stores, Inc., 21 C.C.P.A. 322 (1933)

Accessory

“an ‘accessory’ must bear a direct relationship to the primary article that it accessorizes.”

Source:Rollerblade, Inc., 24 Ct.

“[a]ccessories are of secondary importance,” but must “somehow contribute to the effectiveness of the principal article”

Source: HQ 960950 (Jan. 16, 1998)

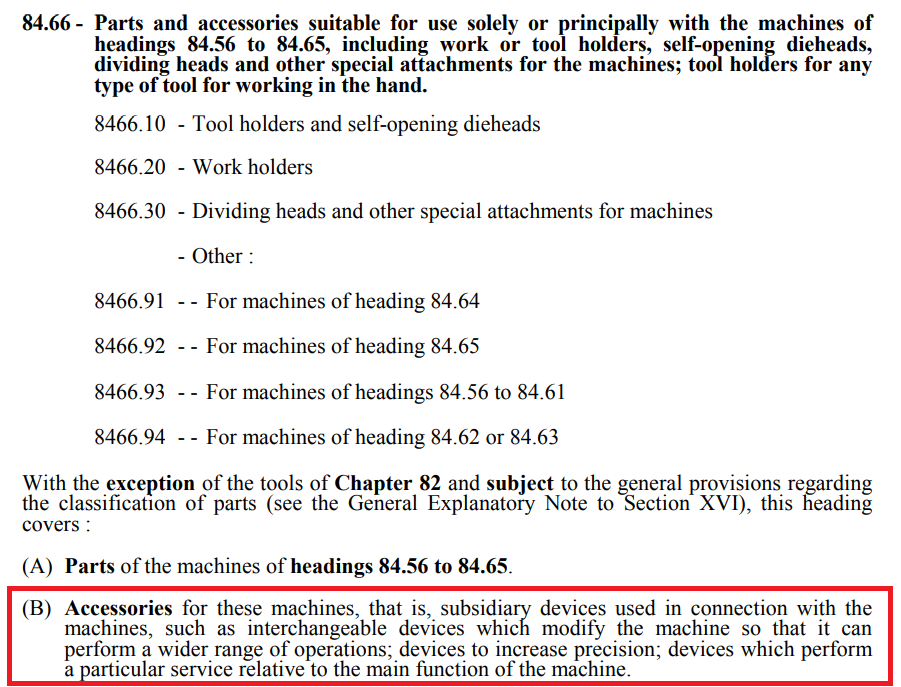

“accessory” is, subsidiary devices used in connection with the machines, such as interchangeable devices which modify the machine so that it can perform a wider range of operations; devices to increase precision; devices which perform a particular service relative to the main function of the machine.

Source: EN Heading 8466 (B)