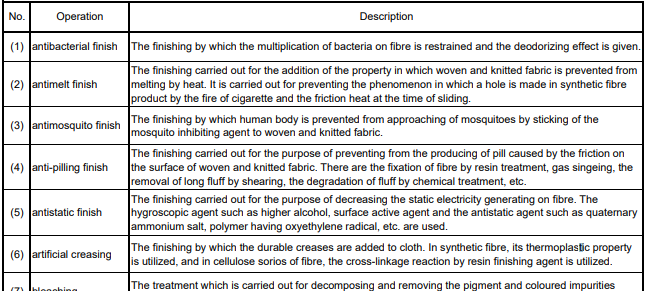

原産品申告書作成で使う可能性のある英単語、フレーズを紹介します。

| 日本語 | 英語 | 略語 |

| 与える(原産資格を) | confer | |

| 油 | oil | |

| EPA | Economic Partnership Agreement | |

| 委員会 | Committee | |

| 鋳型 | die | |

| 生きている動物 | live animal | |

| 育成 | raise | |

| 維持 | maintain | |

| 維持 | substantial transformation | |

| 一次製品 | primary materials | |

| 一致 | accordance | |

| 迂回 | circumvention | |

| 生まれた | born | |

| 裏付け文書 | supporting documentation | |

| 運賃込み条件 | cost and freight | C&F |

| 運賃 | freight | |

| HS | Harmonized System | |

| 鋭利にする | sharpening | |

| 餌付け | feed | |

| エネルギー | energy | |

| FTA | Free Trade Agreement | |

| 得る | obtain | |

| 得る | obtain,obtained | |

| 得る | derive,derived | |

| 塩蔵 | brine | |

| 負う | incur,incurred | |

| 欧州連合関税法典 | Union CustomCode | UCC |

| 行う(加工等) | undergo | |

| 行う(加工等) | performe,performed | |

| 行う(加工等) | undertake,undertaken | |

| 行った(加工等) | underwent | |

| 行われる | take place | |

| 行われる | carry out | |

| 行われる | carried out | |

| 会計 | accounting | |

| 解決 | resolve | |

| 開示 | disclosure | |

| 解釈 | interpretation | |

| 解釈 | construe,construed | |

| 回収 | recovery | |

| 解説資料 | instructional | |

| 海洋生物 | marine life | |

| 価格 | value | |

| 確実なもの | certainty | |

| 確実にする | ensure | |

| 格付 | grading | |

| 獲得する | procure | |

| 確認 | confirm | |

| 加工 | processing | |

| 加工工程基準 | Specific manufacturing | SP |

| 加工工程基準 | Specific Processing | SP |

| 加工工程基準 | Specific processing operation criterion | SP |

| 科す | impose | |

| 合体させる | incorporate | |

| ~かどうかに関わらず | regardless of whether | |

| 貨物 | consignment | |

| 殻の除去 | husking | |

| 殻むき | shelling | |

| 皮をむく | peel | |

| 関税 | customs duties | |

| 関税、関税表、関税率 | tariff | |

| 関税上の特恵待遇 | preferential tariff treatment | |

| 関税評価 | Customs Valuation Agreement | |

| 完成品 | finished product | |

| 関税分類の変更 | change in tariff classification | CTC"}”>CTC |

| 関税分類変更 | change of tariff classification | CTC |

| 関税分類変更基準 | tariff shift requirements | |

| 関税率表解説 | Explanatory Notes | |

| 関税率表の解釈に関する通則 | General Rules for the Interpretation of the Harmonized System | GRI |

| 間接材料 | indirect material | |

| 完全生産品 | Wholly Obtained | WO |

| 完全に | exclusively | |

| 完全累積 | Full cumulation | |

| 乾燥 | dry | |

| 監督、管理 | supervision | |

| 還付 | Refund,Refunds | |

| 関連する | relevant | |

| 関連する | respect to | |

| 期間 | period | |

| 疑義 | doubt | |

| 器具 | apparatus | |

| 規制 | regulation | |

| 規定する | stipulate | |

| 規定 | provision | |

| 規定、明示 | specify,specifies | |

| 希薄 | dilution | |

| 基本的 | basic | |

| 協議 | consultation | |

| 供給 | supply | |

| 供給者 | supplier | |

| 供給不足の物品 | Short Supply List | SSL |

| 行政 | administrative | |

| 協定の効力発生 | entry into force of this Agreement | |

| 許可 | permit,permitted | |

| 拒絶 | deny,denies | |

| 拒否 | denial | |

| 許容 | tolerances | |

| 漁ろう | fishing | |

| くず | scrap | |

| 砕く、研磨する | grinding | |

| 国、締約国 | Party | |

| 組み合わせ | matching | |

| 組立 | assembly | |

| 組み立て | assembly | |

| 組み立ててない | unassembled | |

| グリース | grease | |

| 加える、追加する | add | |

| 計算 | calculation,calculated,calculate,calculating | |

| 経費 | expense | |

| 検査 | inspection | |

| 原産 | origin | |

| 原産 | originating | |

| 原産材料の価格 | value of originating materials | VOM |

| 原産材料のみから生産される産品 | Produced Entirely | PE |

| 原産材料のみから生産される産品 | Produced Exclusively | PE |

| 原産材料 | originating material | |

| 原産資格 | originating status | |

| 原産資格を与えることとならない作業 | Insufficient operations | |

| 原産地に関する申告 | statement on origin | |

| 原産地基準 | Origin Criterion | |

| 原産地基準 | Origin Criteria | |

| 原産地不明の材料 | material of undetermined origin | |

| 原産品 | originating product | |

| 原産品 | originating good | |

| 原産品明細書 | Explanatory sheet | |

| 原則 | principle | |

| 現地調達率 | Regional Value Contents | RVC |

| 検認(原産性の事後確認) | verification | |

| 検認 | verification | |

| 研磨 | polish | |

| 原料 | material | |

| 原料 | raw materials | |

| 項 | Heading | |

| 項(HS4桁) | heading | |

| 号 | Sub Heading | |

| 号(HS6桁) | subheading | |

| 行為 | conduct | |

| 甲殻類 | crustacean | |

| 耕作 | cultivate | |

| 交差累積 | cross cumulation | |

| 工場 | plant | |

| 工場渡し | ex-works | EXW |

| 控除方式 | Build-down Method | |

| 控除方式 | Maximum Allowance for NonOriginating Material | |

| 控除方式 | Build-down method | BD |

| 構成する | constitute | |

| 構成要素 | components | |

| 拘束的関税分類情報 | Binding Tariff Information(BTI) | |

| 拘束的原産情報 | Binding Origin Information(BOI) | |

| 公認、認定 | authorisation | |

| 項の変更 | Change in Tariff Heading | CTH |

| 号の変更 | Change in Tariff Sub Heading | CTSH |

| 鉱物 | mineral | |

| 香味付け | flavour | |

| 考慮しない | disregard | |

| 考慮する | taken into account | |

| 超える | exceed | |

| 国際分類例規 | Classification | |

| 国内 | domestic | |

| 国内使用 | home use | |

| 穀物 | cereal | |

| 互恵関税率 | Reciprocal Tariff Rate | RTR |

| 固体 | solid | |

| 米 | rice | |

| 根拠 | authority | |

| 混合 | mixing | |

| 混在 | commingle,commingled | |

| 梱包 | package | |

| 梱包 | packing | |

| こん包容器 | packing materials | |

| 採取 | pick | |

| 採集 | gather | |

| 採集 | gathering | |

| 栽培 | grown | |

| 材料 | material | |

| 材料の価額に対する調整 | adjusted value of the good | AV |

| 作業 | operation | |

| 作業 | working | |

| 作成 | made out | |

| 作成する | draw up | |

| 酸化物 | oxide | |

| 参照 | refer | |

| 参照する | referred | |

| 参照する | refer | |

| 産品 | product | |

| 産品の価額 | value of the good | |

| 資格 | qualification | |

| 資格がある、満たす | qualify,qualified | |

| 閾値 | specified level | |

| 識別 | distinguishing | |

| 自己証明制度 | Self-Certification System | |

| 自己生産 | self-produced | |

| 資産 | asset | |

| 事実の | factual | |

| 施設 | premise,premises | |

| 施設 | facility | |

| 従う | compliance | |

| 実質的変更 | substantial transformation | |

| 実質的変更基準を満たす産品 | Product Specific,product-specific rule | PS,PSR |

| 自動車 | automotive | |

| 示す | demonstrate | |

| 収益 | revenues | |

| 従価、付加価値 | ad valorem | |

| 収穫 | harvest | |

| 習慣的 | customary | |

| 収集 | collect | |

| 修正 | amend | |

| 重点価額方式 | Focused Value Method | |

| 取得 | acquire | |

| 取得 | acquisition | |

| 狩猟 | hunting | |

| 潤滑油 | lubricant | |

| 準じて、従って | pursuant | |

| 純費用 | Net Cost | NC |

| 純費用方式 | Net Cost Method | |

| 準用 | pursuant | |

| 浄化 | cleaning | |

| 証拠 | evidence | |

| 商工会議所 | Chamber of commerce | |

| 詳細 | detail | |

| 使用して | provide | |

| 商品 | merchandise | |

| 除去 | removal | |

| 除去 | remove | |

| 触媒 | catalyst | |

| 植物 | plant | |

| 植物性生産品 | plant product | |

| 所定の様式 | prescribed format | |

| 思料 | deem | |

| 印をつける | marking | |

| 申告 | statement | |

| 申告 | declare | |

| 審査 | examination | |

| 迅速 | prompt,expeditiously | |

| 正確性 | correctness | |

| 正確性 | accuracy | |

| 生産 | production | |

| 生産者 | producer | |

| 正当とする | justification | |

| 製粉 | milling | |

| 成分 | ingredients | |

| 責任を負う | responsible | |

| 切断 | cutting | |

| セットにする | making-up of sets | |

| 設備 | equipment | |

| 洗浄 | washing | |

| 船舶 | vessel | |

| 総意 | consensus | |

| 総計 | aggregate | |

| 相互の合意 | mutual agreement | |

| 装置 | device | |

| 相当する | equivalent | |

| 遡及発給 | ISSUED RETROACTIVELY | |

| 遡及発給 | ISSUED RETROSPECTIVELY | |

| 対角累積 | Diagonal cumulation | |

| 第三国 | third country | |

| 第三国インボイス | Third Country Invoicing | |

| 第三国インボイス | Third Country Invoicing | TCI |

| 第三国インボイス | Third Party Invoicing | |

| 第三者証明制度 | third-party certification system | |

| 対象 | subject | |

| 代替可能 | fungible | |

| 代替性のある材料 | fungible materials | |

| 高める、増す | enhance | |

| 多国間累積 | Multilateral cumulation | |

| 脱水 | dehydration | |

| 種 | seed | |

| 単位 | unit | |

| 担保提供 | provision of security、provision of collateral | |

| 地域累積 | regional cumulation | |

| 稚魚 | fingerling | |

| 着色 | colour | |

| 抽出 | extract,extracted | |

| 中断 | interruption | |

| 超過(過大申告) | excess | |

| 調査 | review | |

| 貯蔵 | storage | |

| 通関手数料 | customs brokerage fees | |

| 通知 | notification | |

| 使い損じ | spoilage | |

| 努める,(努力義務) | endeavour | |

| 積上げ方式 | Build-up Method | |

| 積上げ方式 | Minimum Requirement of Domestic Content | |

| 積上げ方式 | Build-up method | BU |

| 詰める | placing | |

| 艶出し、うわぐすりがけ | glazing | |

| 提出 | submit | |

| 締約国 | Party | |

| 適合 | conformity | |

| 適用 | application | |

| 適用できる | applicable | |

| 適用を妨げない | Without prejudice | |

| 適用を妨げない | apply | |

| 鉄 | iron | |

| 手続 | procedure,procedures | |

| 点検、検査 | inspect | |

| 電子的様式 | electronic format | |

| 電子様式 | electronic format | |

| 天然の物質 | naturally occurring substance | |

| 添付 | accompany | |

| 同一の | identical | |

| 道具 | tool | |

| 同行 | accompany | |

| 登録 | register | |

| 通し船荷証券 | through Bill of Lading,through BL | |

| 特徴的 | characteristics | |

| 特定 | identification | |

| 特定 | identity | |

| とさつ | slaughtere | |

| 特恵否認 | denial of preferential tariff rate | |

| 取り消す | withdraw | |

| 取り出す | retrieval | |

| 取引 | transaction | |

| 取引価額 | transaction value | |

| 塗料 | paint | |

| 成る | consist | |

| ナンバリング | numbering | |

| 荷受人 | consignee | |

| ~に関わらず | Notwithstanding | |

| 2工程ルール | Double transformation rule | |

| 二国間自由貿易協定 | Bilateral free-trade agreements | |

| 二国間累積 | Bilateral cumulation | |

| 二次製品 | secondary material | |

| 認定輸出者自己証明制度 | Approved Exporter Self-Certification System | |

| 燃料 | fuel | |

| の場合に | provide,provided | |

| 媒体(情報記録用 | medium | |

| 廃品 | waste | |

| 配分、割り当て | apportion | |

| 破砕 | breaking-up | |

| 派生物 | derivatives | |

| 発行 | issue | |

| はり付ける | affixing | |

| はり付ける、 添付する | affix | |

| 範囲 | extent | |

| 範囲 | scope | |

| 非加工証明書 | Certificate of Non-Manipulation | |

| 引取(貨物の) | release | |

| 引く | subtract,subtracting | |

| 非原産品 | non-originating good,non-originating goods | |

| 非原産材料 | non-originating material | |

| 非原産材料 | non-originating material,non-originating materials | |

| 非原産材料価格 | value of non-originating materials | VNM"}”>VNM |

| 非締約国 | non-Parties,non-Party | |

| 否認 | reject | |

| 被覆 | coverings | |

| 秘密 | confidential | |

| 秘密 | confidentiality | |

| 秘密工程 | secret process | |

| 秘密方式 | secret formula | |

| 費用 | cost | |

| 漂白 | bleach | |

| 品目別原産地規則 | product specific rules of origin | SRO |

| 部 | section | |

| 不一致 | discrepancy | |

| 封をする | seal | |

| 付加価値 | Regional Value Contents | RVC |

| 付加価値 | Qualifying Value Content | QVC |

| 付加価値基準 | value requirement | |

| 副産物 | by-product,byproduct | |

| 含む | encompass | |

| 負債 | liabilitie | |

| 不十分 | insufficient | |

| 不十分な | inadequate | |

| 不正確 | incorrect | |

| 付属書 | Annex | |

| 付属品 | accessory | |

| 部注 | section note | |

| 物質 | substance | |

| 物理的 | physically | |

| 物質的 | physical | |

| 不適当 | improper | |

| 不当 | non-allowable | |

| 船荷証券 | bills of lading | |

| 部の表題 | section title | |

| 部品 | parts | |

| 部品表 | Bill of materials | BOM |

| 不明 | undetermined | |

| 不利益 | prejudice | |

| ふるいにかける | screening | |

| ふるいにかける | sifting | |

| プレス | press | |

| 分解 | disassembly | |

| 分解してある | disassembled | |

| 分割 | split | |

| 粉じん | dust | |

| 分離 | segregate | |

| 分離 | segregation | |

| 分類 | classify | |

| 分類 | classify,classified,classifying | |

| 変形、変換 | transform | |

| 変更、修正 | modification | |

| 変更する | alter | |

| 変性 | denaturation | |

| 包括的自由貿易協定 | Multilateral free-trade agreements | |

| 紡織用繊維 | textile | |

| 法人 | juridical person | |

| 方法、方式 | method | |

| 方法、方式 | manner | |

| 法令違反 | violations of laws | |

| 捕獲 | capturing | |

| 保険 | insurance | |

| 保険料運賃込み値段 | cost,insurance and freight | CIF |

| 保護 | protect | |

| 保持する | retain | |

| 捕食生物 | predator | |

| 保税工場 | bonded factory | |

| 保存 | keep | |

| 保存 | preserve | |

| 本船渡し | free on board | FOB |

| 混ぜ合わせる、調合する | compound | |

| 満たさない | fail | |

| 満たす | fulfil,fulfilling | |

| 満たす | satisfy,satisfies, satisfied | |

| 満たす | meet,met,meets | |

| 認める | satisfaction | |

| 認める(特恵関税率適用を) | grant | |

| 認める、受け入れる | allow | |

| みなす | consider | |

| 無視する | disregard | |

| 無脊椎 | invertebrate | |

| 明記、記載 | state | |

| 目録、棚卸し表 | inventory | |

| 基づいて | under | |

| 有効 | valid | |

| 有効性 | validity | |

| 輸出加工企業 | enterprises established and operating in export processing zones | EPE |

| 輸出加工企業 | Export Processing Enterprises | EPE |

| 輸出者 | exporter | |

| 輸送 | transit | |

| 輸送 | transite | |

| 輸送用のこん包材料 | containers for shipment | |

| 輸入 | import | |

| 許可前引取り承認制度 | Before Permit | BP |

| 輸入者の知識 | importer’s knowledge | |

| 容器 | container | |

| 要求(特恵関税率適用の) | claims | |

| 要件 | requirements | |

| 溶剤,溶媒 | solvent | |

| 養殖 | aquaculture | |

| 養殖 | aquaculture | |

| 要する | require | |

| 要素 | element | |

| 幼虫 | larvae | |

| 予備品 | spare parts | |

| 利子 | interest | |

| 量 | quantity | |

| 領域 | territory | |

| 類 | Chapter | |

| 類(HS2桁) | chapter | |

| 累積 | accumulation | ACU |

| 累積 | cumulation | |

| 類注 | chapter note | |

| 類の表題 | chapter title | |

| 類の変更 | Change in Chapter | CC |

| 冷凍 | freeze | |

| 連続する原産地証明書 | Movement Certificate | |

| 連続する原産地証明書 | Back to Back CO | |

| ロイヤルティ | royalty,royalties | |

| わなかけ | trapping | |

| 割当 | allocate,allocating |