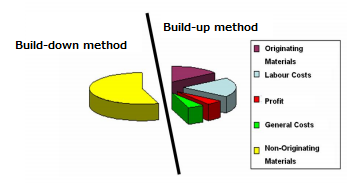

Main differences between “Build-down method” and “Build-up method”

| Build-down method | Build-up method | |

| Overview | The use of foreign input materials in the manufacturing or processing operations carried out in a contracting party or a specified area is limited to a maximum amount. |

The domestic content, e.g. the value of originating materials and the manufacturing or processing operations carried out in a contracting party or in a specified area, must be equal to or exceed a given percentage of the value of the final product. |

| Calculation method |

This method requires a comparison between the value of the foreign input or the materials with undetermined origin and the value of the final product. |

This method requires a comparison between the value added in a contracting party or in a specified area, and the value of the final product. |

| Examples of Calculation Method |

Indirect method Transaction value method Net cost method Focused value method Maximum Allowance for NonOriginating Material |

Direct method Minimum Requirement of Domestic Content |

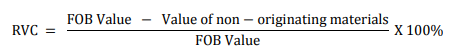

Calculation method of Build-down

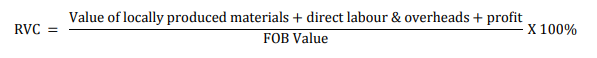

Calculation method of Build-up

Features of the Ad-valorem rule/Value-added criterion:

The exact methods for calculating the input materials and the final product are

stipulated in the aplicable agreement.

A direct comparison between the percentages used in the different methodologies

cannot be made because of the different calculation bases.

The higher the allowed percentage for use of non-originating material, the more

liberal the origin rule.

The higher the minimum requirement for the domestic content, the more

stringent the origin rule.

The ad-valorem calculation may also vary according to the price basis used for the

final product, i.e. the price of the final product at the moment when it leaves the

factory (ex-works price), or the price of the final product at the time of exportation

or importation (FOB or CIF price).

1,Suitable for goods which have been further refined or processed without a change of tariff

classification;

2,Value-added criterion is relatively easy to understand and to apply in practice;

value-added rules allow simple and flexible adjustments for different stages of

development of developing countries;

3,Economic operators are familiar with the cost components of their inputs as the values are

known for commercial and Customs purposes;

4,The administration of value-added rules is complex for small and medium sized companies

and may demand additional book-keeping and sophisticated accounting systems;

5,Requires disclosure of sensitive commercial information by suppliers;

6,Relatively high administrative burden due to the necessity to calculate the various cost

components;

7,Susceptible to the impact of fluctuating exchange rates. A weakening of the exchange rate

raises the value of the foreign inputs in relation to the total cost/ex-works price of a given

product. An increase of the exchange rate of a foreign currency (imported goods are often

invoiced in foreign currencies) will cause an increase of the value of all imported components

priced in a foreign currency. This will render a given ad-valorem rule more restrictive;

8,Susceptible to commodity value fluctuations.

Retrieved from:WCO ORIGIN COMPENDIUM