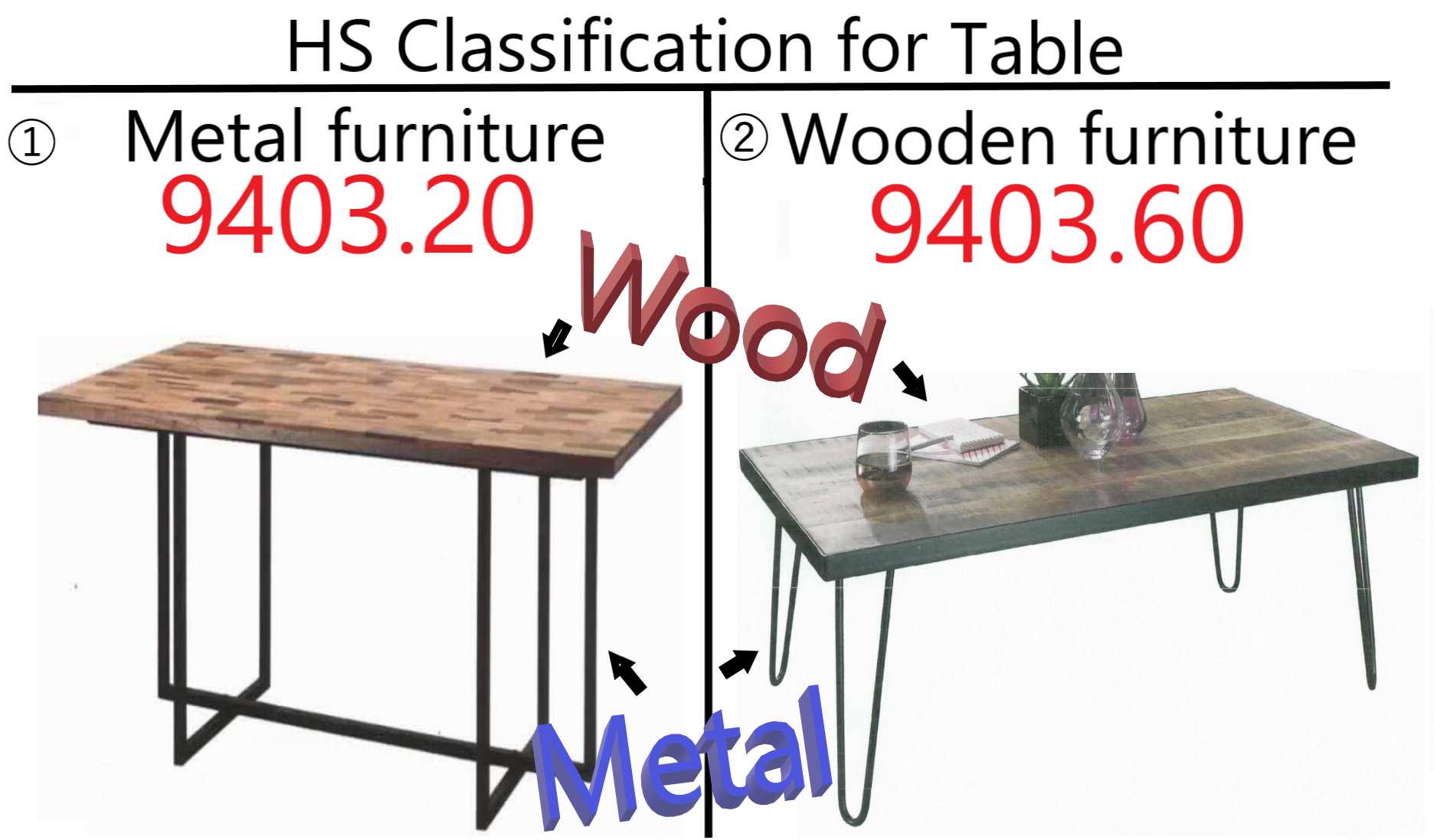

Item① and ② are similar products.

Table top is made of solid wood and legs are made of metal.

Item① is classified in 9403.20 – Other metal furniture(DEBTI11594-19-1)

Item② is classified in 9403.60 – Other wooden furniture(DEBTI29850-18-1)

According to DEBTI11598-19-1 Item① is classified as “metal furniture” because

—————–

The material character of the product is determined by its importance for use as

a stability-imparting element by the metal. (GRI3b)

—————–

According to DEBTI29850-18-1 Item② is classified as “wooden furniture” because

—————–

the physical character of the goods can not be determined by the metal frame,

which is considered a stability-conferring element, nor by the wooden table top,

which has the highest value (in a ratio of 90 to 100% by weight) ,

Thus, the product is to be classified under the latter subheading.(GRI3c)

—————–

Here is current cases

9403.20 – SEBTITV-2021-07170 (GRI3b)

![]() https://lnkd.in/geCNC2vE

https://lnkd.in/geCNC2vE

9403.60 – DEBTI36811/22-1 (GRI3c)

![]() https://lnkd.in/gibNGjie

https://lnkd.in/gibNGjie

How do you classify this kind of item??