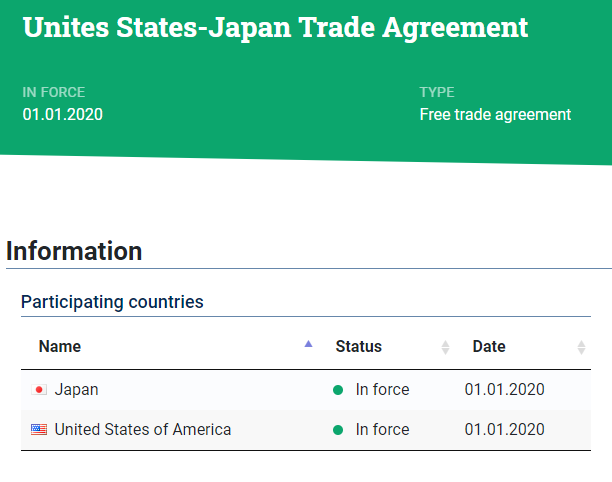

Since “Unites States-Japan Trade Agreement” was reached, Import fees from

Japan to the US can be reduced adopting “Preferential Duty rate”

This article explains the way to calculate Import fees from Japan to the US from

official document.

Basic import fees from Japan can be found from Harmonized Tariff Schedule,

and “Preferential Duty rate” from Japan products can be found from

U.S.-Japan Trade Agreement Text.

In order to find the “Preferential Duty rate” from Japan, there are several steps

to be taken.

1. Specify the “HTS code” of the product.

If the “HTS code” has not been specified, find it from Harmonized Tariff Schedule

2. Check the “Base Rate” and “Staging Category”

“Base Rate” and “Staging Category” can be found from Agreement Text

Tariff Schedule of the US .

“Base Rate” is normal Duty rate adopting every item, and “Staging Category” is

specifications of the “Preferential Duty rate” given in terms of the year from

the Agreement started.

Some items Duty rate is eliminated entirely on the date of entry into force of the

Agreement,and some items Duty rate is eliminated in annual stages, therefore

“Staging Category” varies from “A” to “K” to specify the schedule to be eliminated.

3.Check the “Eliminating schedule of the Duty”

Staging Category’s definition can be found from ANNEX II

(a) customs duties on originating goods provided for in the items in staging category

A shall be eliminated entirely, and these originating goods shall be duty-free on the

date of entry into force of this Agreement;

(b) customs duties on originating goods provided for in the items in staging category

B shall be reduced by three percentage points on the date of entry into force of this

Agreement, and these originating goods shall be duty-free in year two;

(c) customs duties on originating goods provided for in the items in staging category

C shall be eliminated in two equal annual stages, and these originating goods shall

be duty-free in year two;

(d) customs duties on originating goods provided for in the items in staging category

D shall be eliminated in five equal annual stages, and these originating goods shall

be duty-free in year five;

(e) customs duties on originating goods provided for in the items in staging category

E shall be eliminated in ten equal annual stages, and these originating goods shall be

duty-free in year ten;

(f) customs duties on originating goods provided for in the items in staging category

F shall be reduced to 50 percent of the base rate on the date of entry into force of this

II – 2

Agreement, and duties on these originating goods shall remain at the resulting duty

rates;

(g) customs duties on originating goods provided for in the items in staging category

G shall be reduced by three percentage points on the date of entry into force of this

Agreement, and shall be further reduced to 50 percent of the base rate in year two.

Duties on these originating goods shall remain at the resulting duty rates;

(h) customs duties on originating goods provided for in the items in staging category

H shall be reduced by three percentage points on the date of entry into force of this

Agreement, and shall be further reduced by three percentage points in year two.

Duties on these originating goods shall be reduced to 50 percent of the base rate in

year three, and shall remain at the resulting duty rates;

(i) customs duties on originating goods provided for in the items in staging category

I shall be reduced to 50 percent of the base rate in two equal annual stages, and duties

on these originating goods shall remain at the resulting duty rates;

(j) customs duties on originating goods provided for in the items in staging category

J shall be reduced to 50 percent of the base rate in three equal annual stages, and

duties on these originating goods shall remain at the resulting duty rates; and

(k) customs duties on originating goods provided for in the items in staging category

K shall be reduced to 50 percent of the base rate in five equal annual stages, and

duties on these originating goods shall remain at the resulting duty rates.