Third Country Invoicing (TCI) refers to the arrangement,

where an invoice that accompanies the Preferential Certificate of Origin (CO)

and used for the clearance of goods in the importing Party, is not issued

from the exporting Party but from another country who may not necessarily

be a Party to the same FTA.

In some FTAs, TCI is commonly referred to as Third Party Invoicing.

Case study

Retrieved from:Handbook on Rules of Origin for Preferential Certificates of Origin

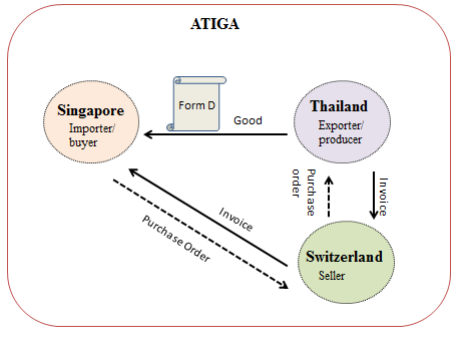

An originating good is exported from Thailand to Singapore with a Form D

(i.e. Preferential CO under ATIGA).

However, the invoice billed to Singapore is issued from Switzerland

(i.e. any countries except Thailand and Singapore).

Singapore can still accept the Form D and grant preferential access to the

good indicated in the Form D even though the invoice is not issued from

Thailand but another country that is not a Party to ATIGA.

Under such circumstances, the applicant of the Preferential CO would

have to indicate details of the invoice issued from a third country in the

Preferential CO.