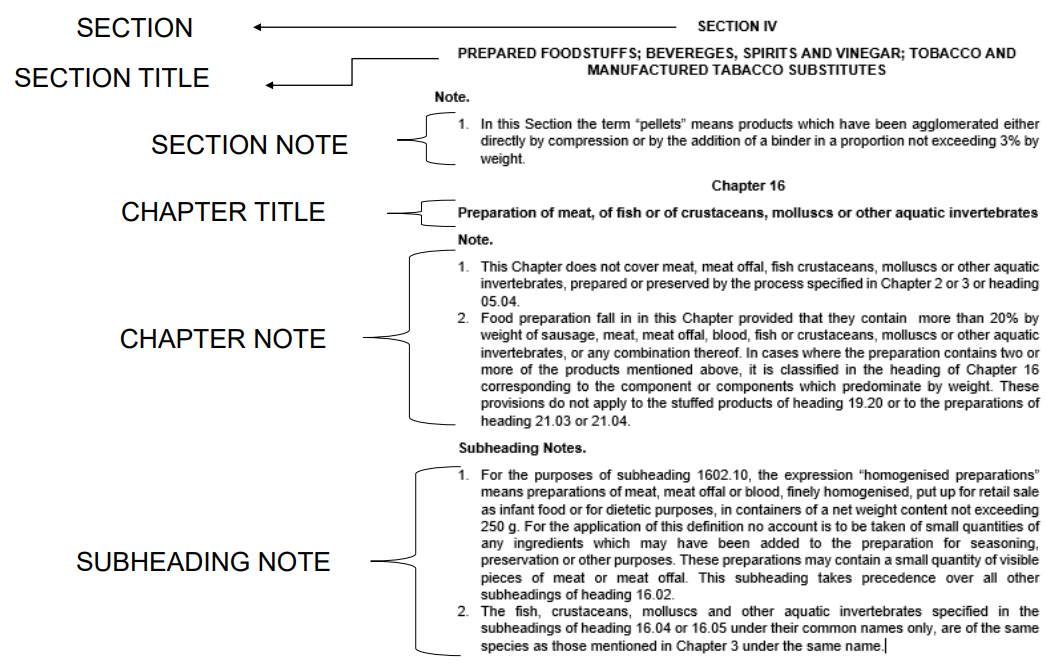

Rule 6 Subheading rule

For legal purposes, the classification of goods in the

subheadings of a heading shall be determined

according to the terms of those subheadings and any

related Subheading Notes and, mutatis mutandis, to

the above Rules, on the understanding that only

subheadings at the same level are comparable. For the

purposes of this Rule the relative Section and Chapter

Notes also apply, unless the context otherwise requires.

GRI 6 is the last of the GRIs. It prescribes that, for legal purposes, GRIs 1 to 5 govern,

mutatis mutandis (or with the necessary changes), classification at subheading levels

within the same heading. Or, in other words, GRIs 1 to 5 are to be reapplied to

determine the classification of goods at the subheading level. Goods are to be classified

at equal subheading levels (that is, at the same digit level) within the same heading

under the subheading that most specifically describes or identifies them (or as

otherwise required or directed under GRIs 1 to 5). Only subheadings at the same level

within the same heading are comparable (i.e., no consideration should be given to the

terms of any subheading within another subheading when considering the proper

classification of merchandise at the higher level subheading).

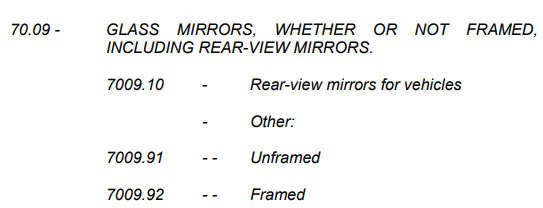

EXAMPLE 1: A framed glass mirror is found to be classified in heading

7009. Thereafter, it would have to be classified within the subheading

structure of that heading by application of GRIs 1 to 5 pursuant to GRI 6:

Initially, a determination would need to be made as to whether the framed

glass mirror is classified at the 5-digit (or “one-dash”) subheading level in

5-digit subheading 7009.1 (“rear-view mirrors for vehicles”) or in 5-digit

subheading 7009.9 (“other”). If the product is found to be classified in 5-

digit subheading 7009.1 (as a rear-view mirror for a vehicle), then the

classification analysis would end there and the product would be classified

in subheading 7009.10 (as 5-digit subheading 7009.1 is not further

subdivided). In the instant case, the framed glass mirror does not satisfy

the article description for 5-digit subheading 7009.1. Therefore, the

product would be classified at the 5-digit subheading level in 5-digit

subheading 7009.9 (as a glass mirror other than a rear-view mirror for a

vehicle). Next, a determination would have to be made as to whether the

product is classified at the 6-digit (or “two-dash”) subheading level within

5-digit subheading 7009.9 in 6-digit subheading 7009.91 (as an unframed

glass mirror other than a rear-view mirror for a vehicle) or in 6-digit

subheading 7009.92 (as a framed glass mirror other than a rear-view

mirror for a vehicle). The framed glass mirror would be classified in

subheading 7009.92 by application of GRI 1 pursuant to GRI 6.

EXAMPLE 2: A set consisting of a shovel, fork, and pick for use in

gardening would be classified in heading 8201 as each article is

specifically provided for in the terms to that heading. Within heading

8201, shovels are provided for in subheading 8201.10, forks in

subheading 8201.20, and picks in subheading 8201.30. Consequently,

one would need to resort to GRI 3 pursuant to GRI 6 in order to classify

the set at the subheading level within heading 8201. That is, one would

need to determine which of the three articles imparts the essential

character to the set pursuant to GRI 3 (b). If no one article is found to

impart the essential character to the set, then one would classify the set

under subheading 8201.30 because the subheading number for that

article occurs last in numerical order as provided for in GRI 3 (c).

As evident from the above discussion, the GRIs provide that goods must first be

classified by heading level, and only after the appropriate heading has been

determined, then by equal subheading levels (first by five-digit and then by six-digit

international levels) within that heading. When considering the appropriate

classification at a particular subheading level, no consideration should be given to any

of the terms of any lower-level subheading (as the analysis at each subheading level

should be conducted without consideration of the terms of any lower-level subheading

provision). This step-by-step analysis applies without exception throughout the

Harmonized System (and throughout any national subheading levels as found in a

particular country’s Harmonized System-based tariff system).

EXPLANATORY NOTE for RULE 6

(I) Rules 1 to 5 above govern, mutatis mutandis, classification at subheading

levels within the same heading.

(II)For the purposes of Rule 6, the following

expressions have the meanings hereby assigned to them :

(a) “subheadings at the same level” : one-dash subheadings (level 1) or

two-dash subheadings (level 2).

Thus, when considering the relative merits of two or more one-dash

subheadings within a single heading in the context of Rule 3 (a),

their specificity or kinship m relation to a given article is to be assessed

solely on the basis of the texts of the competing one-dash subheadings.

When the one-dash subheading that is most specific has been chosen

and when that subheading is itself subdivided, then, and only then,

shall the texts of the two-dash subheadings be taken into consideration

for determining which two-dash subheading should be selected.

(b)”unless the context otherwise requires” : except where Section or

Chapter Notes are incompatible with subheading texts or Subheading

Notes. This occurs, for example, in Chapter 71 where the scope assigned

to the term “platinum” in Chapter Note 4 (B) differs from that assigned to

“platinum” in Subheading Note 2. For the purpose of interpreting

subheadings ‘7110.11 and 7110.19, therefore, Subheading Note 2 applies

and Chapter Note 4 (B) is to be disregarded.

(III)The scope of a two-dash subheading shall not extend beyond that of the

one-dash subheading to which the two-dash subheading belongs; and the

scope of a one-dash subheading shall not extend beyond that of the heading

to which the one-dash subheading belongs.