Hinges are usually classified as HS:8302.10.

But what if that hinge is used solely for Automotive parts?

You might think there is also the possibility of that being classified as Auto parts HS:8708

In order to make a clear line between HS:8302 and HS:8708, you need to understand two definitions.

1.What is excluded from heading 8708

2.Definitions of “general use parts”

What is excluded from heading 8708

According to CBP “Vehicles, Parts and Accessories Under the HTSUS”.(Section XVII GENERAL(III))

In order for motor vehicle parts or accessories to be classifiable under heading 8708, they must satisfy all three of the following conditions: otherwise, they are excluded from heading 8708.

(a) They must not be excluded by the terms of Note 2 to this Section

(see paragraph (A) below).

(b) They must be suitable for use solely or principally with the articles of Chapters 86 to

88 (see paragraph (B) below).

(c) They must not be more specifically included elsewhere in the Nomenclature (see

paragraph (C) below).

Above definitions (b) and (c) are understandable but (a) is not,so we need to refer Section XVII note2

Section XVII note2

The expressions “parts” and “parts and accessories” do not apply to the following articles、whether or not they are identifiable as for the goods of this Section:

(a) Joints、washers or the like of any material(classified according to their constituent material or in heading 84.84)or other articles of vulcanised rubber other than hard rubber(heading 40.16);

(b) Parts of general use、as defined in Note 2 to Section XV、of base metal(Section XV)、or similar goods of plastics(Chapter 39);

In this note, parts of general use are excluded from HS:8708 so what’s the definition of parts of general use? we need to refer to Note 2 to Section XV.

Definitions of “parts of general use”

Note 2 to Section XV state.

2.Throughout the Nomenclature, the expression “parts of general use” means:

(a) Articles of heading 73.07,73.12,73.15,73.17 or 73.18 and similar articles of other base metals;

(b) Springs and leaves for springs、of base metal、other than clock or watch springs(heading 91.14); and

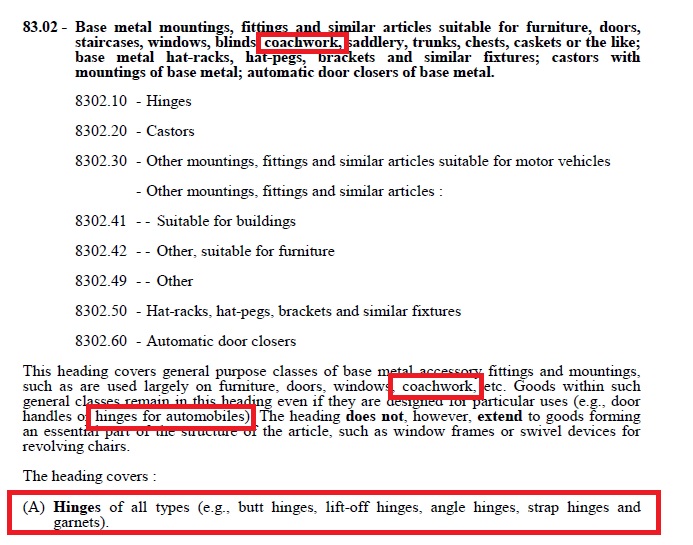

(c) Articles of headings 83.01、83.02、83.08、83.10 and frames and mirrors、of base metal、of heading 83.06。

With the above definitions, we can see that HS:8302 is excluded from HS:8708.

And also Explanately note states that “hinges for automobiles” belong to HS:8302.

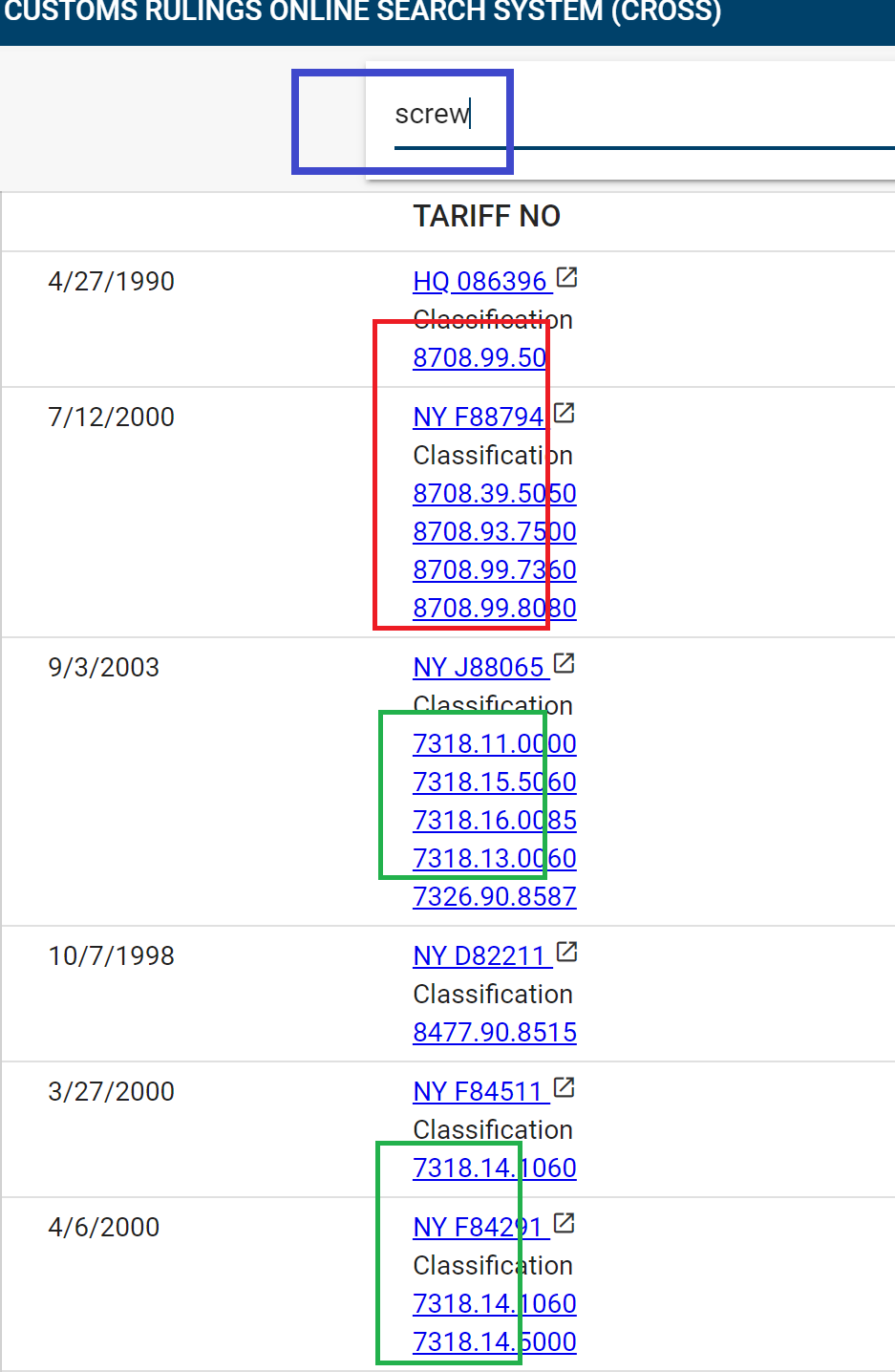

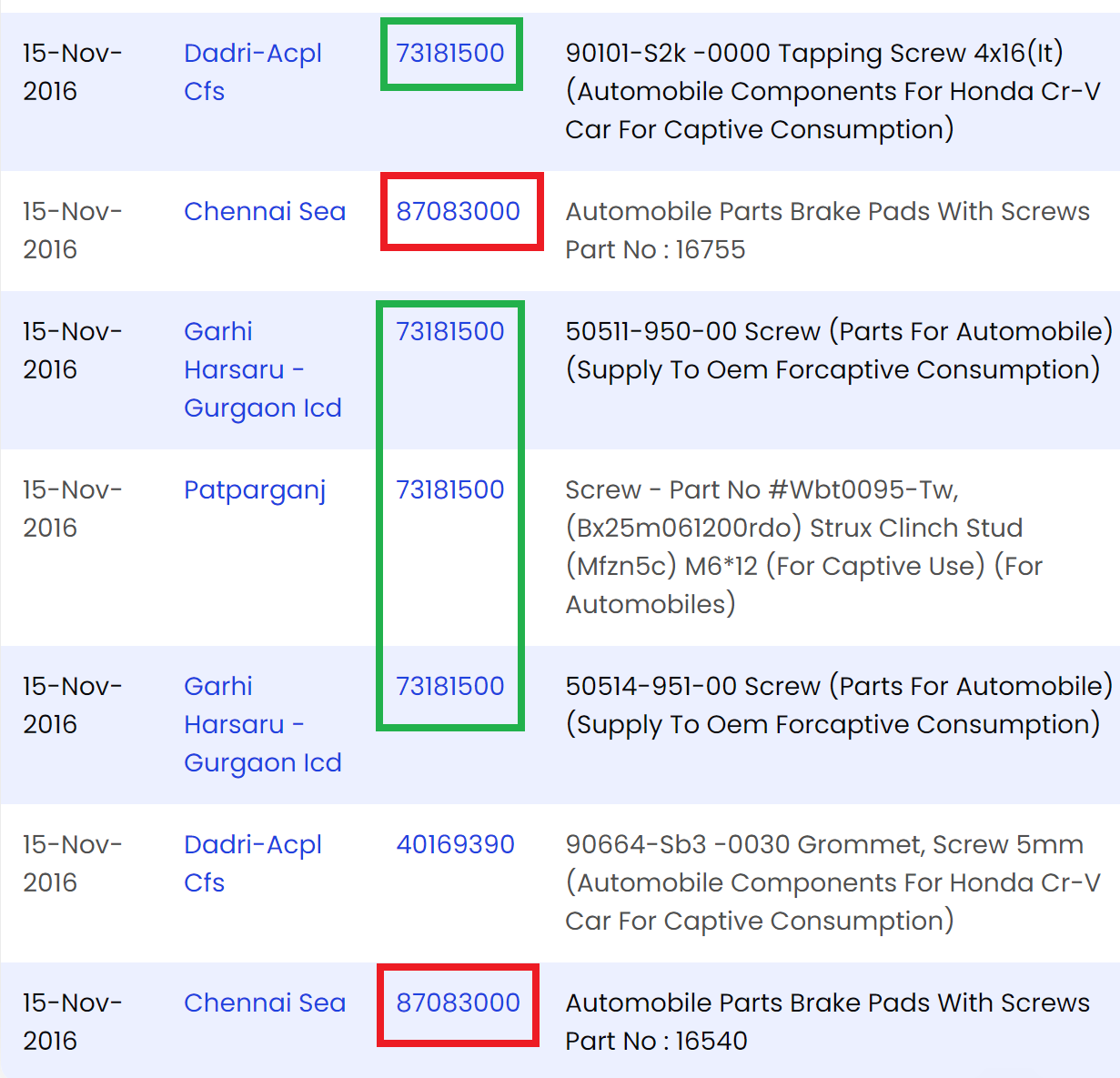

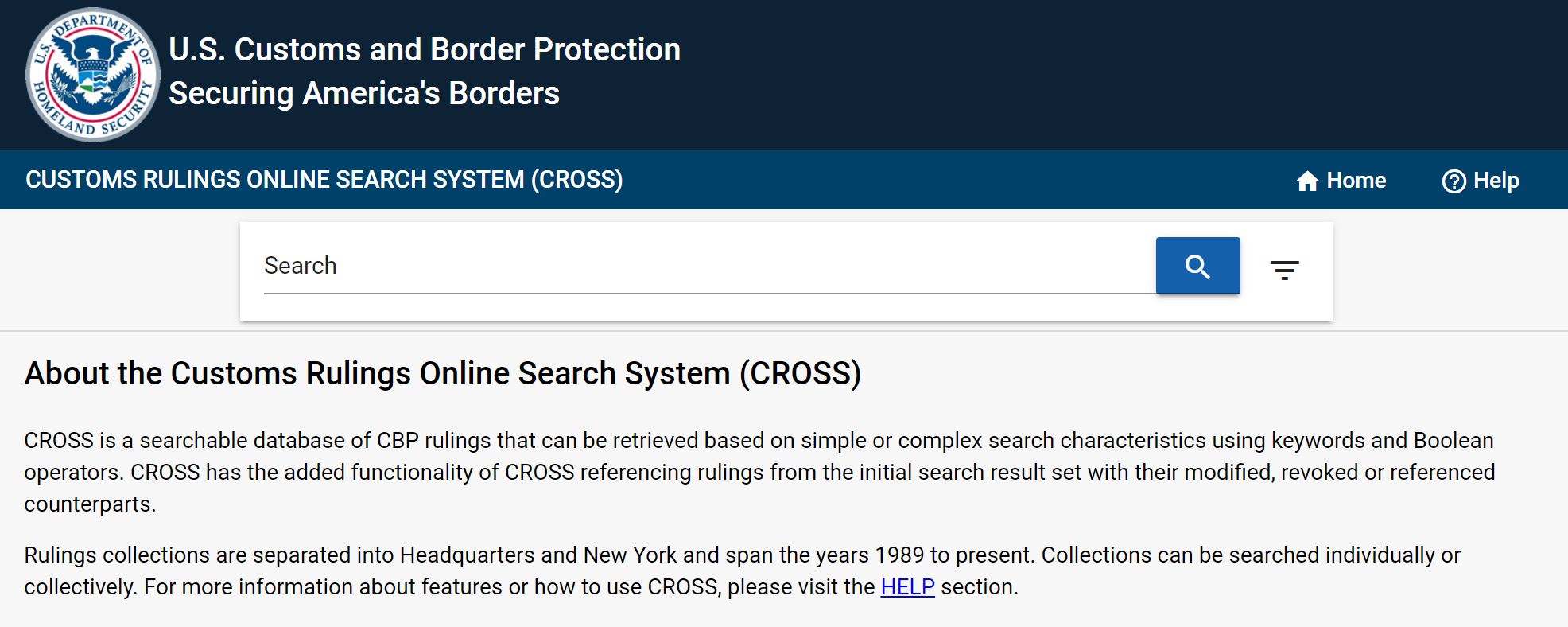

Automotive hinge’s customs rulings

| Item image |  |

|---|---|

| Issued Country | Spain |

| Reference | ES-2012-000558-0636/10 |

| Issuing date | 2012-10-29 |

| Item name | hinge |

| Classified HS code | 8302.10 |

| Details & Customs Opinion | Article commonly used consistently in the male (fixed) a hinge made of galvanized steel. Has a width of 31mm and ends in a shaft with a diameter of 15mm. Used in automotive vehicles (trailers) to support the side door of the trailer.

GIR 1 and 6, Notes 2 and 3 of Section XV, Note 2 b) of Section XVII, Note 1 to Chapter 83 and the wording of CN codes 8302, 8302.10.00, 8302.10.00.90 TARIC code. |

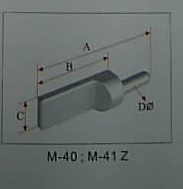

| Item image |  |

|---|---|

| Issued Country | Spain |

| Reference | ES-2012-000581-0433/10 |

| Issuing date | 2012-10-29 |

| Item name | hinge |

| Classified HS code | 8302.10 |

| Details & Customs Opinion | Article general purpose steel, consisting of the mobile part of a hinge, which is fixed in the door. It has a length of 215mm and a maximum width of 140mm. Shaped like a square and one end has a hole with a diameter of 13mm. Used in automotive vehicles (trailers) in the back door.

GIR 1 and 6, Notes 2 and 3 of Section XV, Note 2 b) of Section XVII, Note 1 to Chapter 83 and the wording of CN codes 8302, 8302.10.00, 8302.10.00.90 TARIC code. |

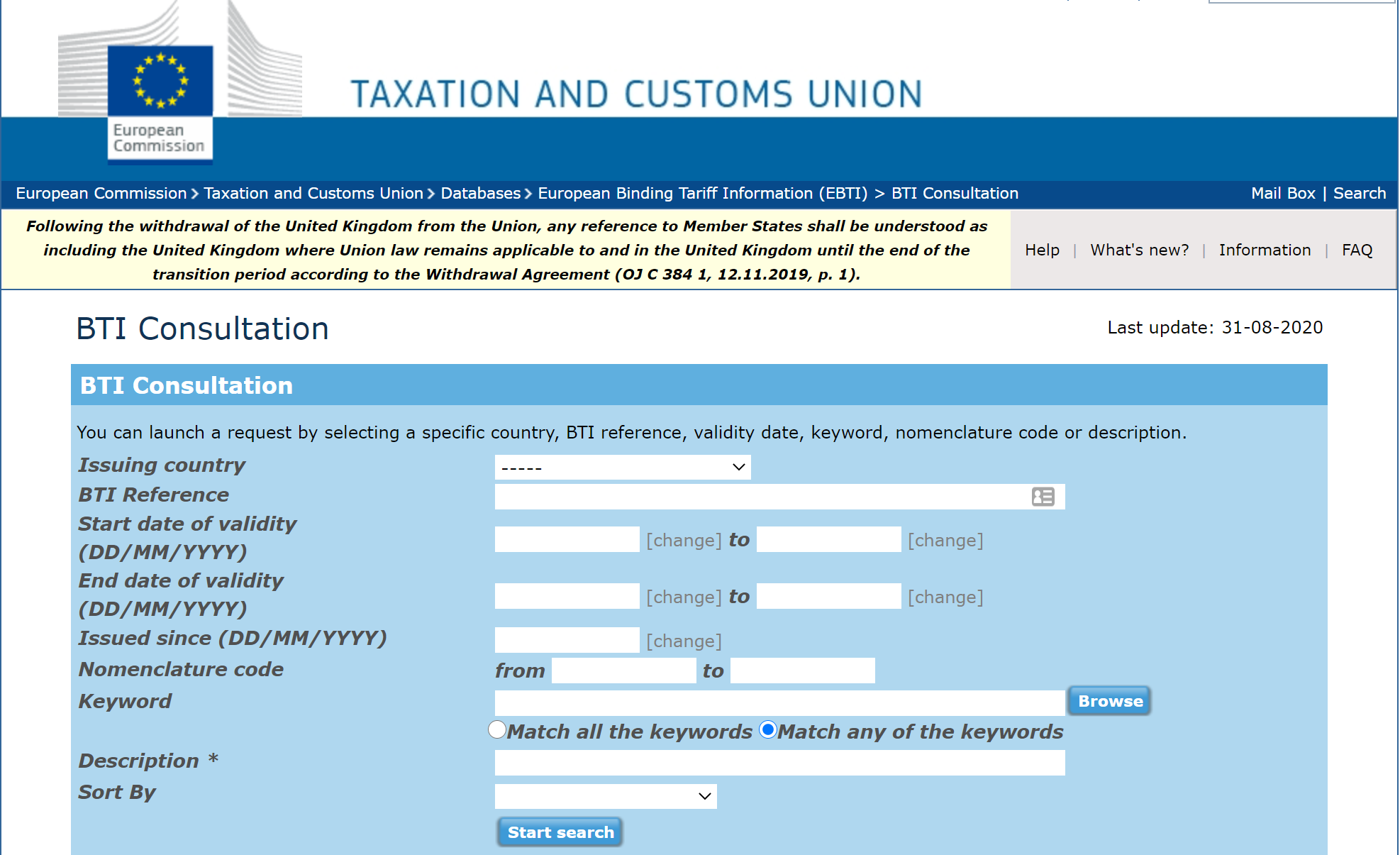

Source:European Union Website