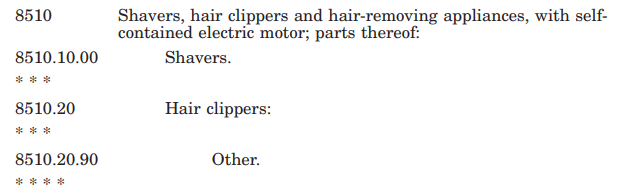

DISPENSER is usually classified as “Machines and mechanical appliances having individual functions — other” in EU countrys.

HS :847989

Reference :FR-PRO-2011-006450

Issued :Nov. 25, 2011

Description :DISPENSER MADE OF A HEAD PUMP POLYSTYRENE APPEARANCE AND BRUSH STEEL BODY WITH RUBBER COATING OF OIL. DIAMETER: 7.3 CM Height: 17 CM COLOR: PURPLE