“Hanging shelf” was classified as “furniture”(HS:9403) by U.S. Customs ruling N293709.

However, this U.S. decision contradicts the decision of the German customs.

Here is a targeting item.

Before Revocation

The item has a U-shaped form, and consists of two sides made of 100% polyester woven material, two cardboard inserts encased in the same material as the two sides, and two iron or steel brackets. The two textile covered inserts act as shelving for the placement and retrieval of books, notebooks, school supplies, equipment, and various other personal objects and sundries. The two iron and steel brackets allow for the item to be hung from the top shelf of a metal school locker.

At the first decision, U.S. Customs classified it in 9403.

And here is the German customs classification record, they classified it in 6307.

| Item image |  |

|---|---|

| Issued Country | German customs |

| Reference | DEBTI31879-18-1 |

| Issuing date | Sept. 10, 2018 |

| Item name | Hanging shelf |

| Classified HS code | 630790 |

| Details & Customs Opinion | Hanging shelf, so-called suitcase organizer small, art. 7185357, photo see attachment, – packed in a polybag with inserted product information, – worked in the form of an open hanging rack with a total of six compartments; according to the request in the dimensions (L x W x H): 30 cm x 30 cm x 64 cm, – with a lower compartment to be zipped, three compartments above with intermediate shelves, two smaller compartments above and below a top of about 0.3 mm thick, monochrome fabrics and side and back parts of about 0.3 mm thick, plain knitted fabrics; both fabrics are made of polyester (man-made fibers), – fitted with a suspension device in the form of two hooks of base metal at the top end, – reinforced with metal wire frames for stabilization and shaping at the top and bottom and in the area of the “”shelves””; on all edges with edging made of fabrics, – assembled by joining, – without evidence of manual labor, – is hung according to the request on a clothes rail or wardrobe and serves to accommodate clothing and light objects, – no space-related function, thus no goods for interior decoration, – does not constitute a container for heading No 4202, as it is neither mentioned by name in the wording of the position nor similar to one of the containers referred to therein, – in particular, owing to the lack of stability, no furniture (shelf) of heading 9403, – in particular with regard to its use Fabrics and knitted fabrics from S. textiles compared to non-precious metal the character of the product; Within the postition 6307, the tissues are characterizing, especially with regard to the extent. “”Other made up articles (hanging shelf), of textile materials, of fabric, not handmade”” |

After Review

U.S. Customs has reviewed N293709 and has determined the ruling letters to be in error.

The issue is Whether the subject hanging closet shelves are classified in heading 6307, HTSUS, as other made up articles or in heading 9403, HTSUS, as other furniture.

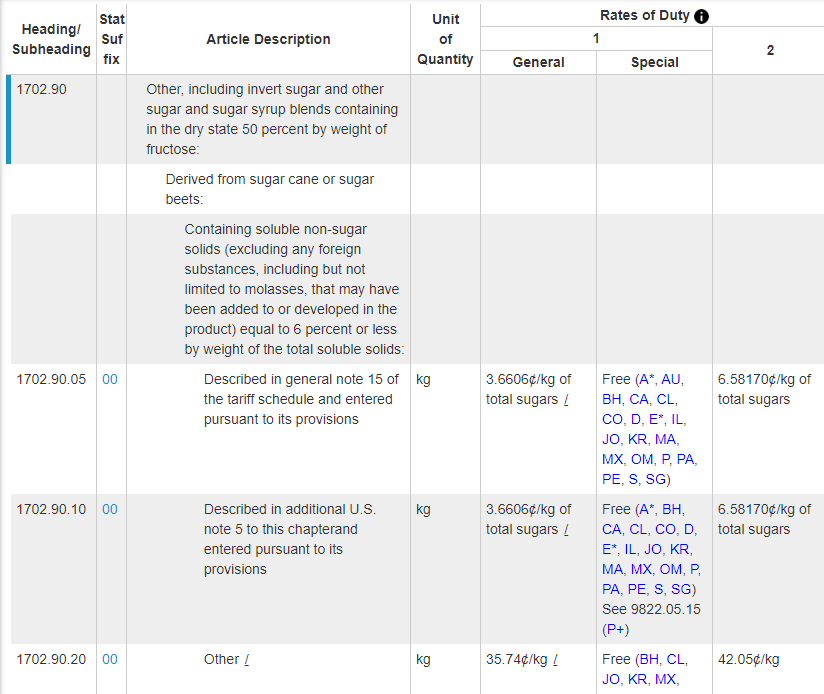

The following HTS headings are under consideration:

6307:

Other made up articles, including dress patterns:

9403:

Other furniture and parts thereof:

To determine which one is appropriate, Refer to Chapter note.

are to be classified in those headings only if they are designed for placing

on the floor or ground.

The following are, however, to be classified in the above-mentioned headings even if they are designed to be hung, to be fixed to the wall or to stand

one on the other:

(a) Cupboards, bookcases, other shelved furniture (including single

shelves presented with supports for fixing them to the wall) and unit

furniture.

must fall under shelved furniture that is designed to be hung, to be fixed to

the wall or to stand one on the other.

In N293709 U.S. Customs classified the subject merchandise in heading 9403. However, this parenthetical does not apply to the merchandise at issue here, as the subject merchandise is hung in a closet or locker and includes shelves, and is not single shelves and not presented with supports for fixing them to the wall.

Additionally, They collapse before being hung and rely on gravity for their shape. The subject textile goods, however, are not furniture.

Rather, they are textile articles for use in the organization of lockers and closets.

Lockers and closets are typically already equipped with a rod, shelf, and floor for the storage and organization of articles kept inside them. Hence, collapsible textile cubbies, pockets or shelves are of comparatively minor importance so far as use, comfort, and convenience are concerned. The parenthetical added to note 2(a) to Chapter 9403 does not describe these goods

Conclusion

By application of GRI 3(b) the subject textile hanging shelves described in NY N293709 are composite goods classified in heading 6307. According to GRI 3(b), composite goods consisting of different materials or made up of different components shall be classified as if they consisted of the material or component which gives them their essential character.

Although the GRIs do not provide a definition of “essential character,” EN (VIII) of GRI 3(b) provides guidance. According to this EN, the essential character may be determined by the nature of the material or component, its bulk, quantity, weight or value, or by the role of a constituent material in relation to the use of the goods

Source:Customs Bulletin

My opinion

Furniture’s definition is not only “designed for placing on the floor or ground”, but there is also an exception that “if they are designed to be hung, to be fixed to the wall or to stand one on the other”

Even though the targeting item looks like furniture, it does not fulfill the condition to be hung, to be fixed to the wall.

In this case, the important thing is the meaning of “Fixed”.

In my image of “Fixed” is like a bolt screwing into a wall or something completely unmovable from someplace.

Targeting items is far from it and easily collapsible, that’s why it’s not considered as furniture.

What do you think?