“Inflatable Guitar” was classified as “Toy”(HS:9503) by U.S. Customs ruling J81414.

German and UK customs made the same decision regarding similar items.

The issue is “Is it really a Toy??”

*example image of the targeting item

Item detail

The targeting item is called “Inflatable Guitar”.

Inflatable Guitar, is a toy rubber musical instrument that, when inflated by air, resembles a six string electric guitar. The item has the words “Rock ‘n Roll” on its body and when fully inflated measures 42 inches in length. The toy guitar does not play actual notes, but is designed to provide amusement through the simulation of guitar playing.

Issue

Whether the subject inflatable guitar is classified as “other articles of plastics” in heading 3926, HTSUS, or as “other toys” in heading 9503, HTSUS.

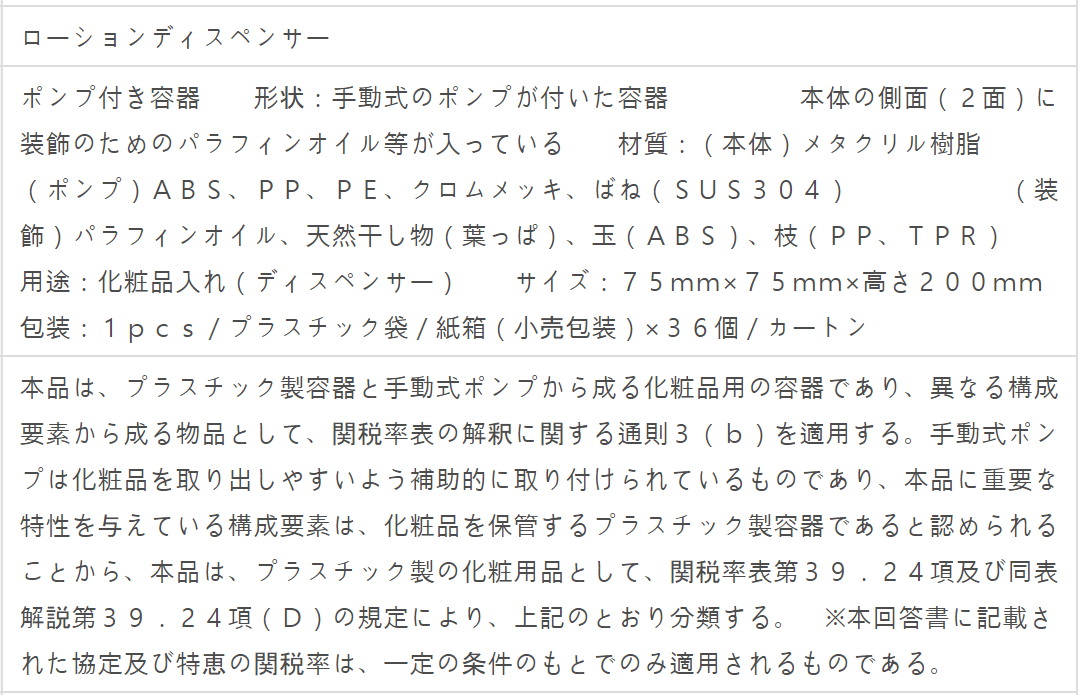

Here is the German customs classification record, they classified it in 9503

| Item image |

|

|---|---|

| Issued Country | German customs |

| Reference | DE20508-15-1 |

| Issuing date | Oct. 22, 2015 |

| Item name | inflatable microphone |

| Classified HS code | 950300 |

| Details & Customs Opinion | It is a toy in the form of an inflatable microphone made of printed, welded plastic films (according to additional application details made of PVC). The approx. 30 cm long product is equipped with a plastic valve which is pressed completely into the inflated guitar. The product is for the fun of entertaining children and adults and is together with a colorful printed cardboard insert in a plastic bag for the retail sale. Due to the lack of entertainment, a classification under heading 9505 is not considered. Such products are classified under customs tariffs as ‘other toys, not covered by CN codes 9503 0010 to 9503 0085, made of plastic, not a scale for printing on scale’. |

See How to search world customs ruling with an image.

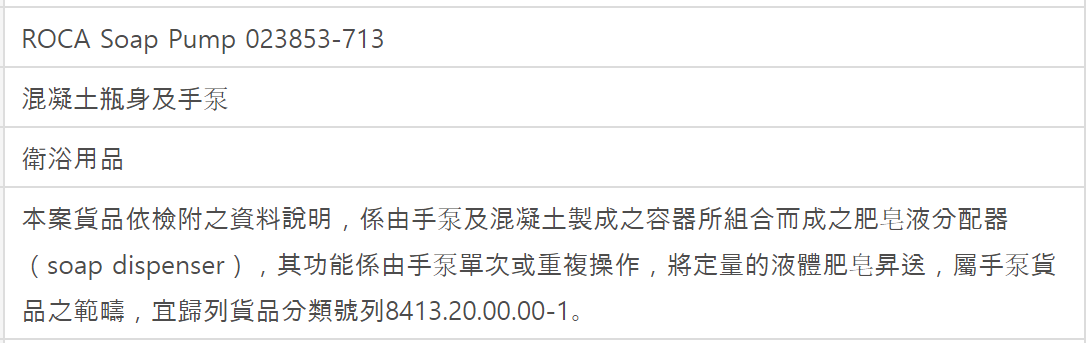

And here is the UK customs classification record, they classified it in 9503

| Item image | No image |

|---|---|

| Issued Country | UK customs |

| Reference | GB118578446 |

| Issuing date | June 12, 2009 |

| Item name | INFLATABLE TOY REPRESENTING A GUITAR |

| Classified HS code | 950300 |

| Details & Customs Opinion | INFLATABLE TOY REPRESENTING A GUITAR. OF PLASTIC. DESIGNED TO BE USED AT PARTIES AND EVENTS.

CLASSIFICATION IS DETERMINED ACCORDING TO GIRS 1. CN CODE 95030055 TOY MUSICAL INSTRUMENTS. |

Reviewing by CBP

Heading 9503, HTSUS, is the provision for “other toys.” Although the term “toy” is not defined in the HTSUS, in Minnetonka Brands, Inc. v. United States, the Court of International Trade (CIT) held that an “object is a toy only if it is designed and used for amusement, diversion or play, rather than practicality.”

In order to be considered a toy, the inflatable guitar must be designed for amusement and not practicality. Internet research reveals that identical items imported into the United States are marketed and used as party decorations and favors.

Thus, any amusement value provided by the inflat-able guitar is incidental to its practical purpose as a party favor or decoration. This is because when inflated with air, although it is shaped like an electric guitar, the article is not operable as a music-maker. It is not capable of emitting sound. Instead, the article is merely a depiction of an electric guitar

Based on the facts above, U.S. Customs has reviewed J81414 and has determined the ruling letters to be in error.

Conclusion

Consequently, as an article made up entirely of plastic that is not described by heading 9503 or elsewhere in the HTSUS, it is our decision that the inflatable guitar is classified in heading 3926, HTSUS, as “Other articles of plastics…” Specifically, it is classified in subheading 3926.90.7500,

Source:Customs Bulletin

My opinion

The interesting part of this example is that, at first US, German and UK made the same decision regarding similar items. and only US customs reconsider and revoked its classification.

Since German and UK customs rulings are old, so I don’t know how they are classified lately.

But I am uncomfortable with the opinion that inflatable guitar is not a toy because it’s used as a party favor or decoration.

It must be fun and amusing to play with an inflatable guitar.

I think amusement value is an essential factor of toys.

This kind of items classification must be interpreted differently by different people.

What do you think?

Source:

Source: