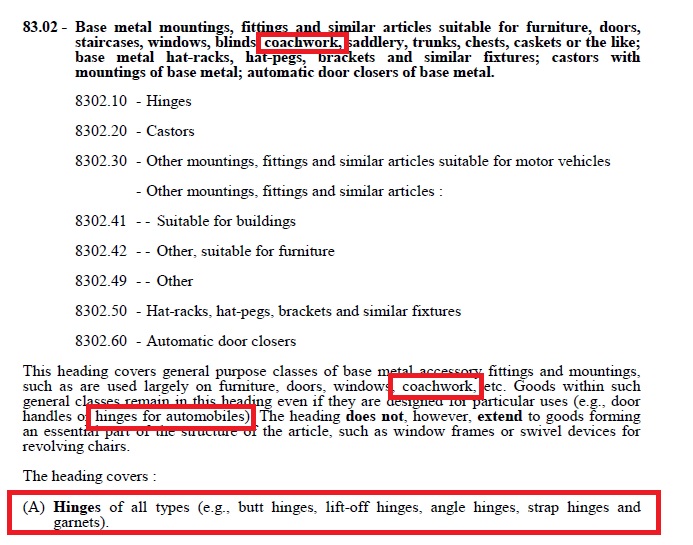

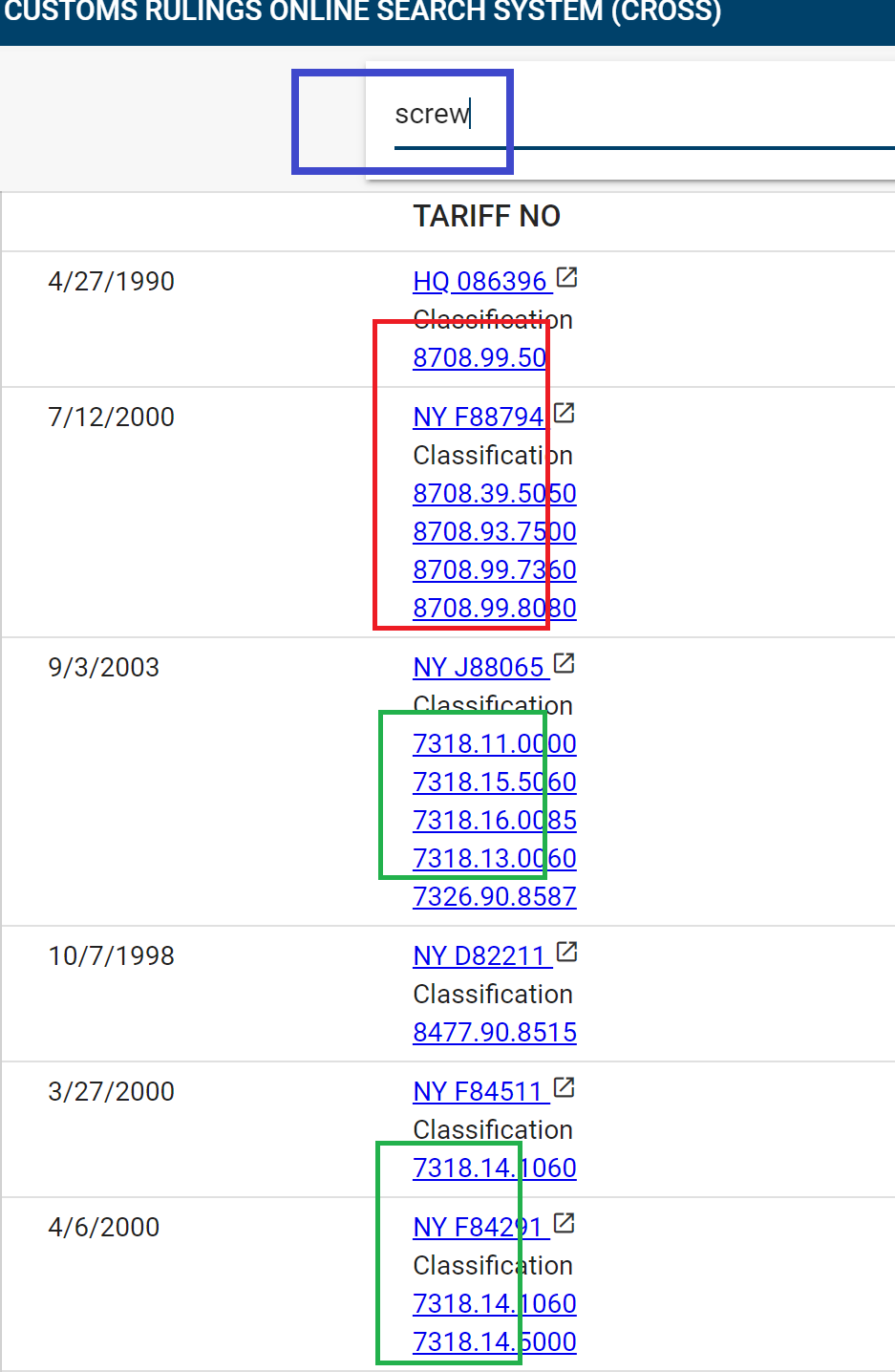

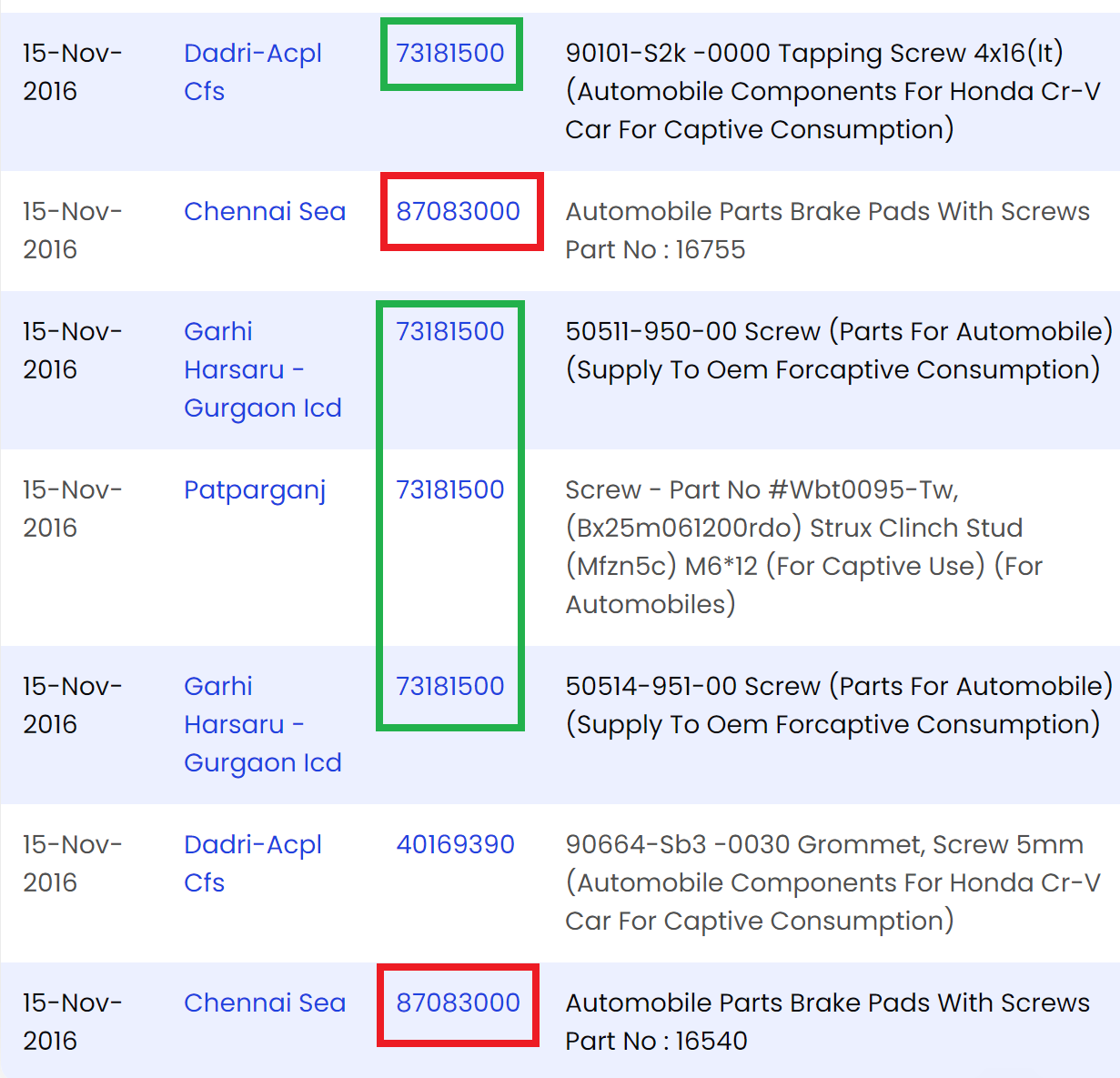

In order to determine whether automobile parts are classified as HS:8708, we need to consider this principle of being classified as automobile parts.

Section XVII GENERAL(III)

(a) They must not be excluded by the terms of Note 2 to this Section

(b) They must be suitable for use solely or principally with the articles of Chapters 86 to 88

(c) They must not be more specifically included elsewhere in the Nomenclature

In order to be classified as automobile parts, it is necessary to fulfill above all three of the conditions, therefore a part using solely or principally with the automobile is not enough to be classified as HS:8708(automobile part), it is just one condition.

Here is Supreme Court of India case

G.S. Auto International Ltd vs Collector Of Central Excise … on 15 January, 2003

it states that

whether the goods are suitable for use solely or primarily with articles of Chapter Heading Nos. 87.01 to 87.05; if the answer is in the affirmative, the goods will be classifiable under Chapter Heading 87.08,

But this factor is not enough to fulfill Section XVII GENERAL(III) to be classified as HS:8708(automobile part).

Section XVII GENERAL(III)(c) is the most important condition.

(c) They must not be more specifically included elsewhere in the Nomenclature

Since a part can be classified as other Chapter(ex.3926), it could be excluded from Section XVII (excluded from 8708) even if the part is solely or principally with the automobile

Below is the list of the items classified as “Fittings for Coachwork”(HS:3926.30)

They are nothing other than the automobile part but classified as “Plastic Fittings for Coachwork”(HS:3926.30).

They are excluded from Section XVII (HS: 8708) because of Section XVII GENERAL(III)(c).

“Fittings for Coachwork”(HS:3926.30)

door handle

Czech Customs:CZBTI37/086941/2018-580000-04/01

cable guide

German customs:DE239/17-1

cable guide

German customs:DE686/17-1

cover mounted behind the interior trim of motor vehicle door

German customs:DE966/17-1

panel for window frames

German customs:DE4899/16-1

belt deflector

German customs:DE4949/17-1

cover assembly hole are directly and permanently mounted on motor vehicles behind the inner panel on the body of the left door

German customs:DE8666/17-1

entry bar made of molded plastic

German customs:DE14779/16-1

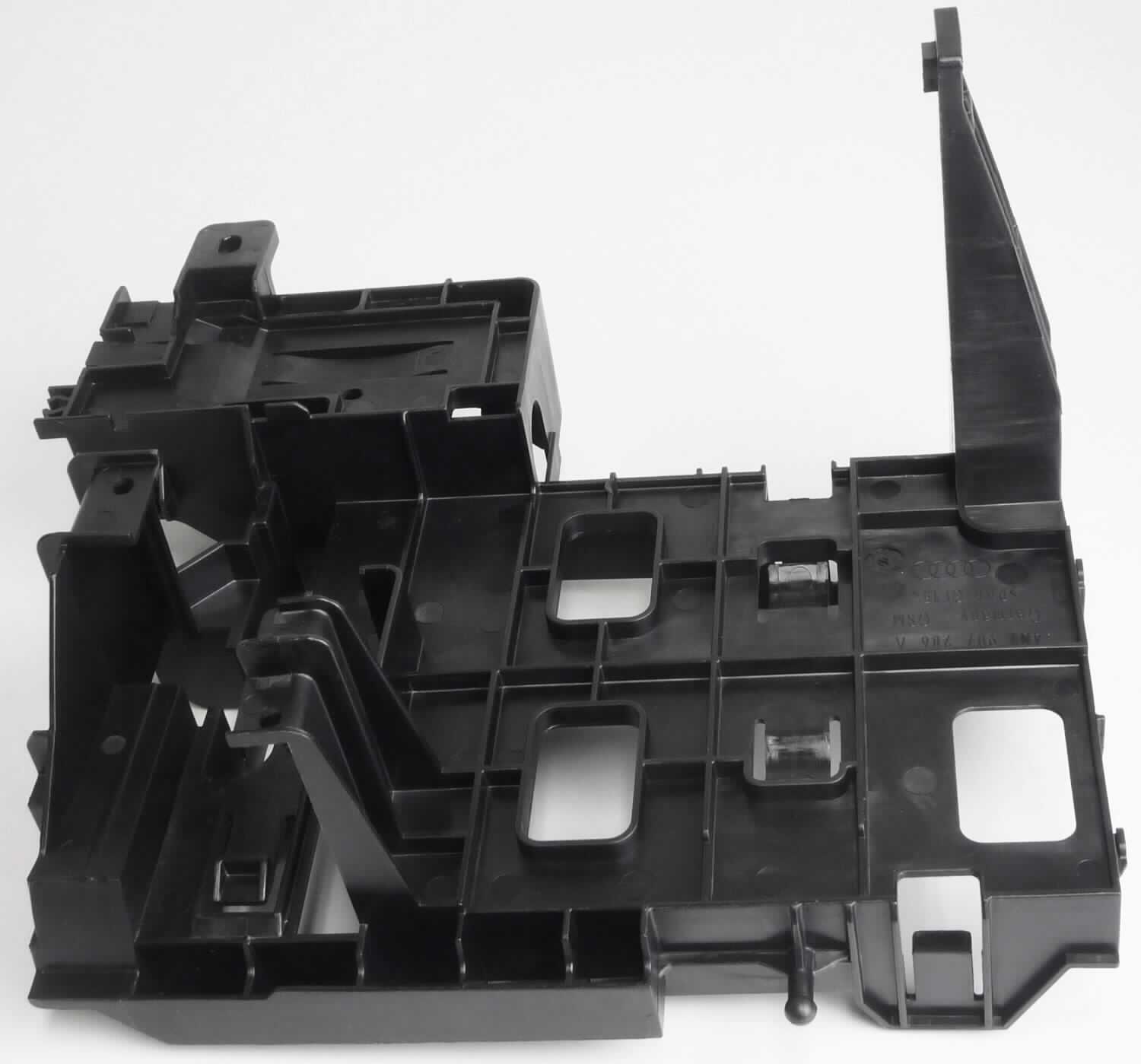

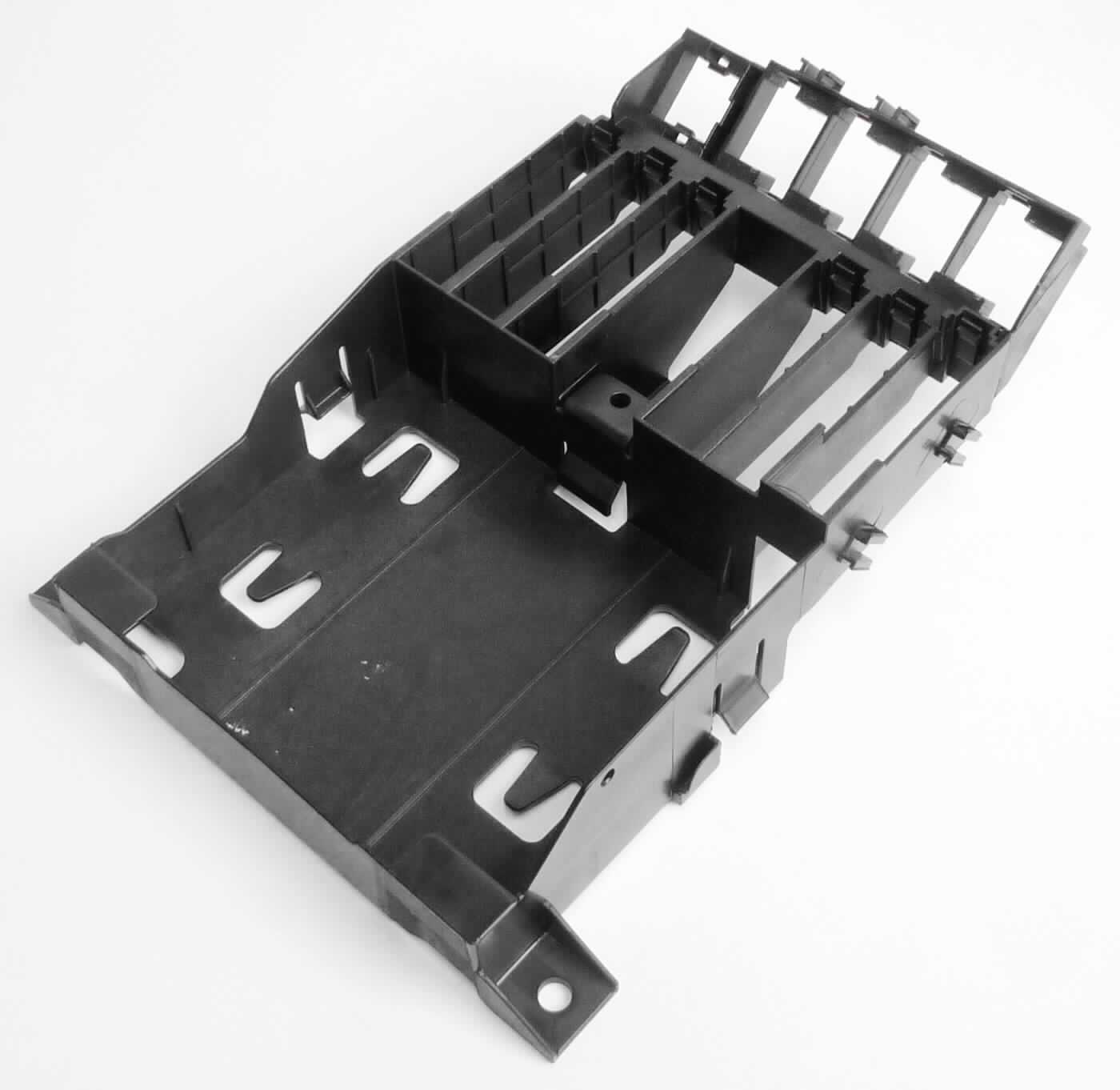

mounting bracket used to hold control units

German customs:DEBTI1836/18-1

The approximately 32.4 x 24.4 x 10.4 cm shaped product is essentially eleven Recesses for relay socket and plug couplings and a large main compartment for a control unit provided

German customs:DEBTI3532/18-1

door handle

German customs:DEBTI13185/18-1

universal mount for example, Mobile phones or iPods with two self-locking clamping devices

German customs:DEHH/15/09-1

door handle

German customs:DEHH/1118/05-1

Plates and emblems for tourist cars

spain customs:ESBTI2017SOL0000000000749

automotive plastic wheel attachment

French customs:FR-E4-2006-002796

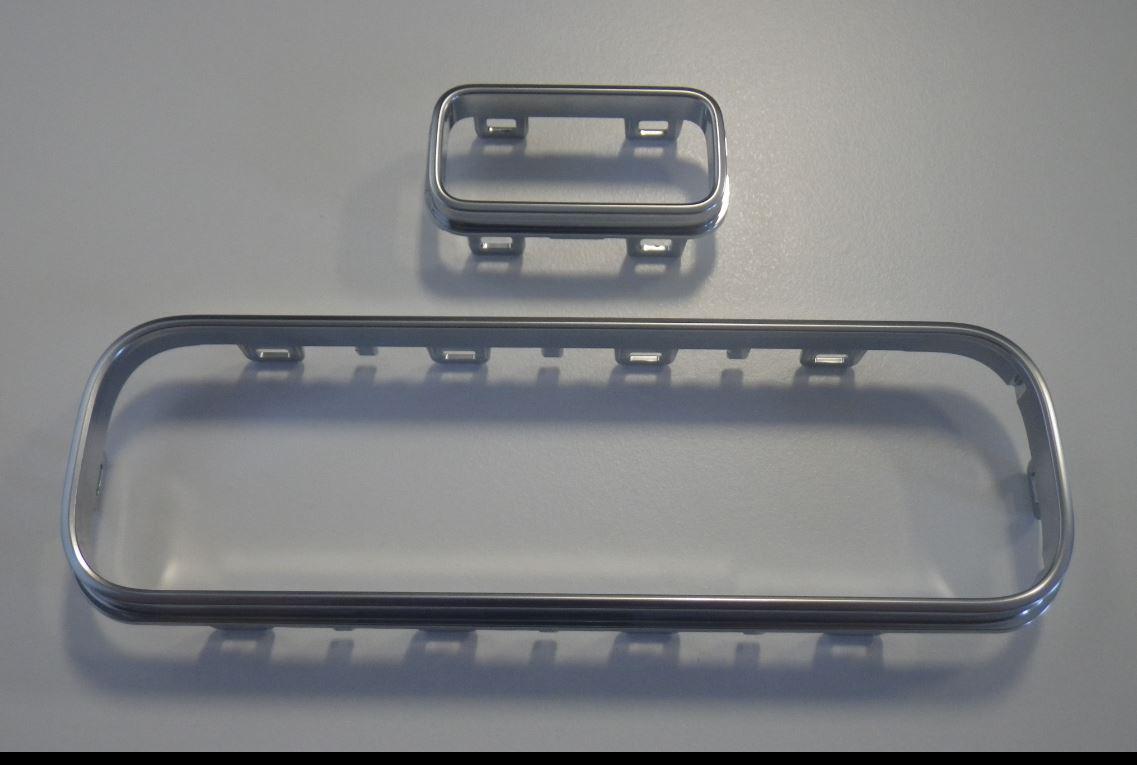

Chrome-plated plastic edging for the power window block mounted on the car door next to the driver

Latvia customs:LVBTI2019-91

Interior door handle

Slovakia customs:SK13409/09/5219/28