Pool Lounger made of PVC and Textile classified as Textile product(HS:6307)or Plastic product(HS:3926)?

This article is regarding the CBP ruling of “HQ H298313”

Source:amazon.com ©AQUA-LEISURE INDUSTRIES, INC.

Table of Contents

Item’s description

The 44-inch Monterey Pool Lounger is a “composite good” consisting of both PVC (which is a form of plastic) and polyester mesh textile fabric.

According to provided figures, the PVC represents 30% by weight and 16% by value while the polyester mesh makes up 70% by weight and 84% by value of the lounger. While the mesh fabric constitutes the most weight and value and provides the full-body support of the user giving the user the ability to sit or recline, we also have to consider that the PVC air chambers give the pool lounger the ability to float.

US Customs classified it as a Textile product(HS:6307) in Ruling NY N270096.

6307 Other made up articles, including dress patterns:

* * *

6307.90 Other:

Aqua Leisure Industries contends that it’s classifiable as a Plastic product(HS:3926)

3926 Other articles of plastics and articles of other materials of

headings 3901 to 3914:

* * *

3926.90 Other:

1.Customs’s opinion

The 44-inch Monterey Pool Lounger is a “composite good” consists of both PVC (which is a form of plastic) and polyester mesh textile fabric. According to the provided figures, the PVC represents 30% by weight and 16% by value while the polyester mesh makes up 70% by weight and 84% by value of the lounger. While the mesh fabric constitutes the most weight and value and provides the full-body support of the user giving the user the ability to sit or recline, we also have to consider that the PVC air chambers give the pool lounger the ability to float.

Without the inflatable PVC chambers, the lounger is not able to perform its main function as a pool or lake float. We thus find that the essential character of the overall product cannot clearly be ascribed to either single material.

General Rule of Interpretation GRI 3(c), directs that in such circumstances the classification will be the heading that appears last in numerical order among those which equally merit consideration. The competing headings here are 3926 (other articles of plastics) and 6307 (other made up textile articles). Heading 6307 appears last in the tariff.

2.Aqua Leisure Industries’s opinion

Aqua Leisure Industries contend that the Monterey pool lounger should be classified under heading 3926, HTSUS, because, it is the two plastic PVC air bladder components that impart the essential character of the overall pool lounger.

Aqua Leisure Industries base the argument on the decision in Swimways Corp. v. United States; wherein the Court of International Trade (“CIT”) classified various models of “Spring Floats” and “Baby Spring Floats” designed for the flotation of users in swimming pools, lakes and similar bodies of water in heading 3926, HTSUS, as an article of plastic.

Aqua Leisure Industries argue that the subject merchandise is substantially similar to the “Spring Floats” in the Swimways Corp. decision and that in light of the decision and legal analysis set forth by the CIT, CBP should reconsider its decision in NY N270096.

3.Court Opinion

In Swimways Corp., the “Spring Floats” consisted of an inflatable, polyvinyl chloride (“PVC”) bladder that when inflated with air, provided the floatation capacity for the article. The center of the “Spring Float” was a woven elastomer textile mesh that supported the user during floatation.

Swimways Corp., at 1317. In Swimways Corp. the CIT explained that although the merchandise consisted of component materials that were both significant, neither heading adequately described the article as a whole Swimways Corp., at 1321–1322. Accordingly, the CIT resolved to determine which component or material imparted the essential character of the “Spring Float” in accordance with GRI 3(b). Id., at 1322. The CIT noted that both the textile mesh and the PVC bladder contributed different significant functions; with the textile mesh providing support to its user and the PVC bladder providing the flotation characteristic. Id. Yet, the CIT concluded that the PVC bladder imparted the essential character of the article as a whole because the floatation function of the PVC bladder was essential to the functioning of the finished article. Id., at 1324. The CIT explained that because the PVC bladder enabled the article to float in water, it was the component material that allowed the “Spring Float” to perform its primary function, fundamental to its commercial identity as a “float.” Id. As such, the CIT determined that the “Spring Float” was classified in heading 3926 because it was the plastic component materials that imparted the essential character of the product.

CONCLUSION

Customs reconsider the decision that absents the performance of the plastic PVC air bladders, the pool lounger could not perform its fundamental function, which is to float.

Accordingly, Customs find that the plastic PVC air bladders impart the essential character of the product as a whole. Thus, the Monterey pool loungers are classified according to the plastic component material of which the PVC air bladders are made.

By application of GRI 3(b), Customs find that the pool lounger is provided for in heading 3926

Source: CUSTOMS BULLETIN AND DECISIONS

Author’s Opinion

This product is made of PVC 30% by weight and 16% by value while the polyester mesh makes up 70% by weight and 84% by value of the lounger. it seems GRI3(b)(Ⅷ) should be applied to classify in 6307 or GRI3(c).

GRI3(b)(VIII) The factor which determines essential character will vary as between

different kinds of goods. It may, for example, be determined by the nature of

the material or component, its bulk, quantity, weight or value, or by the role

of a constituent material in relation to the use of the goods.

But this idea is overturned by Aqua Leisure Industries’s persuasive opinion with court precedent.

I agree with the opinion that absent the performance of the plastic PVC air bladders, the product sink to the bottom of the pool, but absent the textile part, it’s nothing other than just a Float.

In this example, floating material is considered more important than textile material which gives a user to feel relaxing.

But I guess opinions could be varied depending on the Country.

Some countries may adopt GRI3(b)(Ⅷ) or GRI3(c) without thinking about essential character.

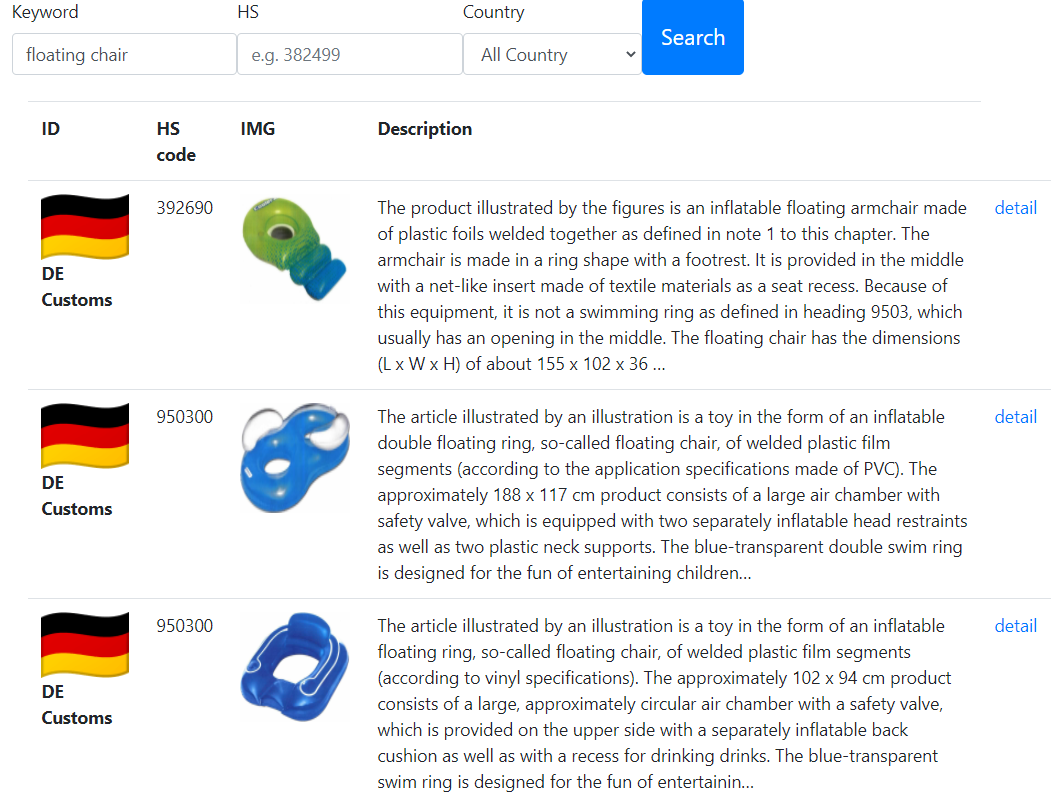

And here are other examples of German Customs rulings.

Some Pool Loungers are classified in 9503.

There is a possibility that they are considered as a toy?