Trimer set was classified as “Shaver”(HS:8510.10) by U.S. Customs ruling N274103.

However, this U.S. decision contradicts the decision of the German customs.(HS:8510.20)

*image of the targeting item

Source: Amazon.com

Table of Contents

Before Revocation

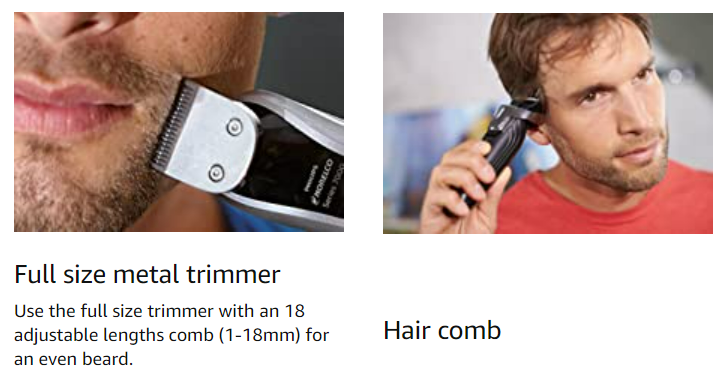

The targeting item is called “Philips Norelco Multigroom 5100”.

This shaver is a battery-powered all-in-one beard and hair trimmer with a self-contained motor. It includes 4 attachments such as,

①full size metal trimmer (Including 3 combs),

Source: Amazon.com

It also includes 3 combs such as, 18-setting beard and stubble comb (18mm), 12-setting stubble comb (12mm) and 18-setting hairclipper comb (3-20mm). The combs and the attachments are designed to cut different lengths of hair.

The full size metal trimmer is used without combs to complete the style and get clean edges on the beard. The stubble comb attachment can trim the stubble to the exact length by locking the setting that suits the desired length from 1mm to 12mm.

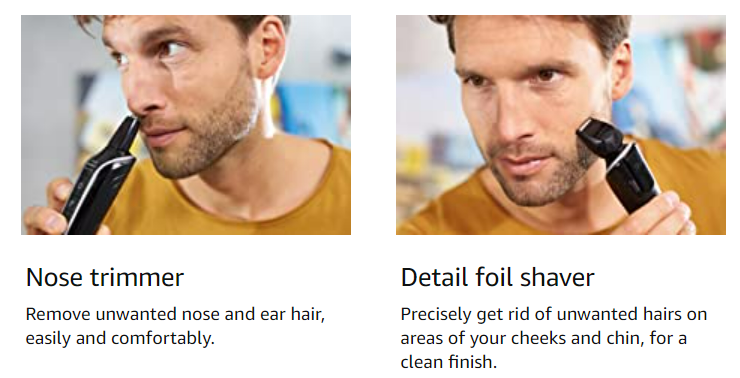

②detail trimmer, ③detail foil shaver, and ④nose trimmer.

Source: Amazon.com

The nose trimmer attachment will remove unwanted nose and ear hair. The precision trim-mer attachment creates fine lines with contours and details to define the look.

The detail foil shaver attachment will get rid of unwanted hairs in smaller areas on the cheek and chin for clean finishes.

Issue

Are the items are classified under subheading 8510.10, HTSUS, as shavers or under subheading 8510.20, HTSUS, as hair clippers?

At the first decision, U.S. Customs classified it in 8510.10.

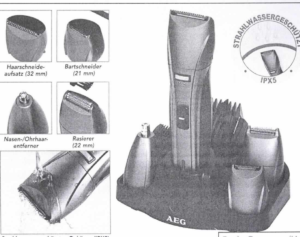

And here is the German customs classification record, they classified it in 8510.20.

| Item image |  |

|---|---|

| Issued Country | German customs |

| Reference | DE24384-16-1 |

| Issuing date | March 17, 2017 |

| Item name | Body Groomer |

| Classified HS code | 851020 |

| Details & Customs Opinion | Body Groomer, – from a handheld device with built-in electric motor, accumulator, on / off switch, charge control light, plug connection for mains adapter and hair cutting attachment with comb, nose and ear hair remover And removing (cutting) of body hair – without any main activity -, – in a common sales packaging with charging station, charger, cleaning brush and comb (see attachment). The body groomer determines the character of the whole. “”Hair cutting machine (multifunctional machine with haircutting machine and razor – without distinctive main activity – in goods collection in presentation for the retail sale with non-characteristic accessory pack) – so-called body groomer”” |

See How to search world customs ruling with an image.

After Review

The following HTS headings are under consideration:

four trimmer attachments for different uses and three trimming combs of various sizes and uses. Given that the imported items are sets for retail sale, and applying GRI3(b), we find that the trimmers, in whichever forms they take on once any of the various attachments or combs are employed, impart the essential character of the sets.

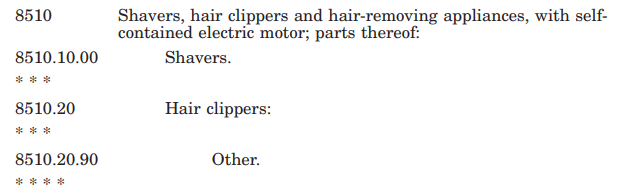

There is no dispute that the subject trimmers are classified in heading 8510, HTSUS, which provides, in relevant part, for shavers, hair clippers and hair-removing appliances, with self-contained electric motor. Rather, the issue is the proper classification at the subheading level within heading 8510,

In NY N274103, the device can accommodate four attachments that allow the device to be used as a full-size metal trimmer, detail trimmer, detail foil shaver or nose trimmer.

When used with the full-size metal trimmer attachment, the device cuts beard stubble to varying lengths while employing any of the included combs and, when used without the combs, can define clean edges on the beard or goatee.

The detail trimmer attachment is used to define even sharper edges around a user’s beard or goatee. When used with the detail foil shaver attachment, the device shaves small areas on the user’s cheeks and chin with precision.

The nose trimmer attachment allows the device to be used to trim unwanted nose and ear hair.

The full-size metal trimmer attachment and detail trimmer attachment cut hair by employing a reciprocating cutter blade that moves back and forth over a fixed metal comb.

That cutting action squarely falls within the cutting action described in EN 85.10 as that belonging to a clipper of subheading 8510.20, HTSUS.

The foil shaver attachment cuts hair by employing blades that move along the inside of a perforated foil plate and cuts hair that protrudes through the plate. That cutting action is akin to the cutting action described in EN 85.10 as that of a shaver of subheading 8510.10, HTSUS.

The nose trimmer attachment cuts hair by employing a rotating cutter that spins within a small metal tube into which hairs enter. That cutting action is akin to the cutting action described in EN 85.10 as that of a shaver of subheading 8510.10, HTSUS.

Given that the attachments allow the device of NY N274103 to possess cutting functions that are described in two subheadings of heading 8510, HTSUS, we must determine which of those functions is the device’s principal function by application of GRI 6 and Note 3 to Section XVI, HTSUS.

the full-size trimmer attachment that provides the device with the most utility because it can be effectively used to cut large swaths of hair from a beard covering a user’s entire face and neck as necessary, and also to detail clean beard edges. The remaining attachments’ intended uses are much narrower and focus upon more discrete portions of a user’s visage. We find that the detail trim-mer, foil shaver, and nose trimmer functions are subsidiary to the principal function of the trimmer.

Based on the facts above, U.S. Customs has reviewed NY N274103 and has determined the ruling letters to be in error.

Conclusion

By application of GIRs 3(b) and Note 3 to Section XVI, the trimmers of NY N274103 is properly classified as clippers of subheading 8510.20.

Source:Customs Bulletin

My opinion

Since the item is composite goods, we need to apply GIR3(b) to determine HS code.

The issue of this item is which function imparts the essential character.

full-size trimmer

or

detail trim-mer, foil shaver, and nose trimmer

Conclusively “full-size trimmer” is considered an essential character because it makes big changes whereas “detail trimmer, foil shaver, and nose trimmer” make small changes.

But I think foil shaver, and nose trimmer apply delicate technology to cut unwanted hair smoothly.

Without that delicate technology, users feel pain when they use it.

On that point, I think foil shaver, and nose trimmer apply more delicate technology than full-size trimmer.But when it comes to classifying HS code, full-size trimmer is more important.