In order to reduce supply chain costs, proper HS Tariff Classification needs to be

taken when it comes to adopting CTC method under the FTA.

In this article, I’m going to introduce how “Bolt” is classified by the customs across the world.

Those classifying records are retrieved from each country’s Advanced ruling database.

Those information will be a great help to understand how customs might consider classifying.

German Customs case

Reference:DE11518 / 16-1

Classified HS code : 7318.15

Issuing date : 2017-7-20

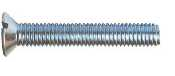

Item name:THREADED SCREWS

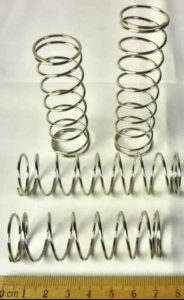

Made of steel screws with an approximately semi-circular head with a flat and with a non-to-the-head thread (no thread-forming screw) and a blunt threaded end. The products are used as releasable fasteners in civil aircraft.

Total length: about 41.6 mm, thread diameter: about 9.1 mm. Picture see attachment. Such products belong to “TARIC code 7318 1595 90” as “other steel, threaded screws, with heads”.

Retrieved from:European Union Website

Usually, Bolt is considered as part of general use, therefore it’s classified to HS:7318.15

However, there are some exceptions that bolt could be considered as part of particular machine.

US customs(CBP) case

Reference:N057558

Classified HS code : 8708.80

Issuing date : 2009-5-5

Item name:bolt-shaped piece of zinc

It seems like part of general use, but CBP considered it as part of Automotive suspension systems because it’s in use for the “Toe control” area where “Toe” needs to be balanced that actively influences the amount of toe change at a wheel to enhance cornering or braking ability.

Therefore it’s classified as a part of Suspension systems HS:8708.80

Retrieved from:U.S. Customs and Border Protection

The difference of opinion between Czech and US Customs

Here are some classification case studies of Headlamp adjusting screw.

Two customs have different opinions for almost same kind of item.

Czech Customs case

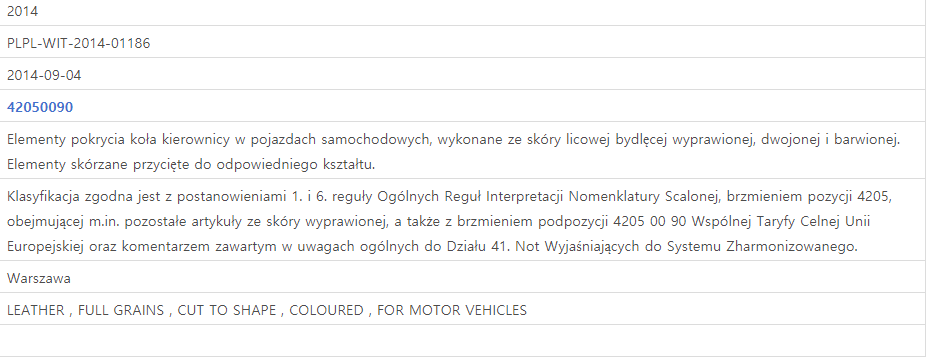

Customs:Czech

Reference:CZ40-0816-2017

Classified HS code : 3926.90

Issuing date : 2017-07-21

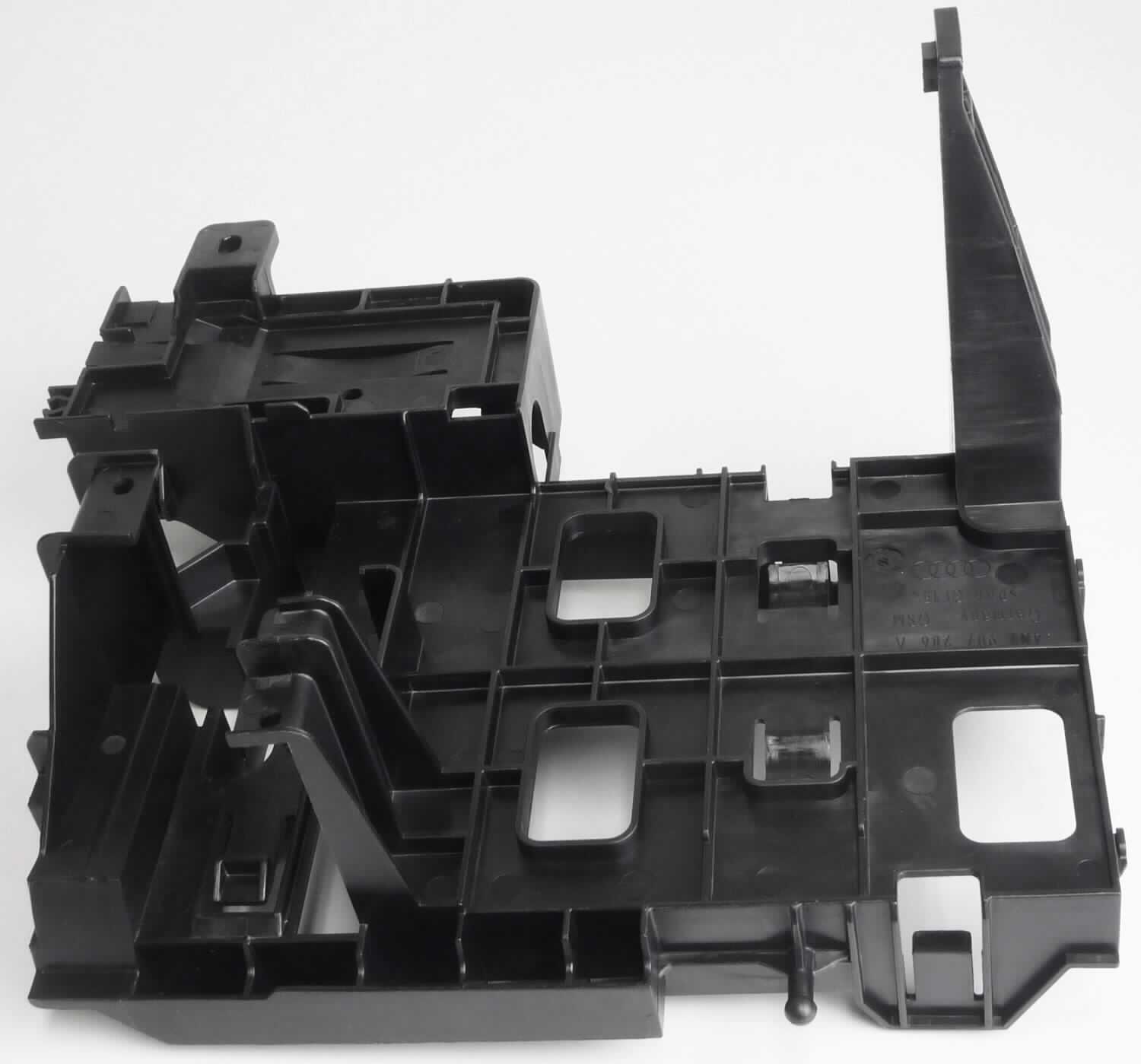

Item name:THREADED SCREWS

Retrieved from:European Union Website

According to the declared data, it is a plastic screw that manually adjusts the height of the dipped beam headlamp of the LED module of the headlamp. Screw length: approx. 56 mm.

Based on General rules 1 and 6 for the interpretation of the Combined Nomenclature. Note 1 (g) to Section XVI Note 1 to Chapter 39, it’s considered as parts of general use, therefore, it’s classified to HS:3926.90

On the other hand, US customs have a different opinion on almost the same kind of item.

US Customs case

Customs:USA

Reference:HQ 086396

Classified HS code : 8708.99

Issuing date : 1990-4-27

Item name:Headlamp adjusting screw

<no image>

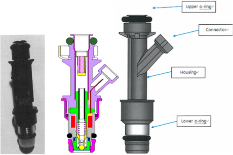

The headlamp adjusting screw consists of a screw with a head socket (designed in the fashion as a Phillips screwdriver head) and a nylon housing. The screw is made of metal and has dimensions of 1/4-28×2. The nylon housing is designed with an intake hole for the screw which is flanked on two sides by panels. The panels assist in holding the screw at a fixed point.

The screw and nylon housing are fitted together permanently as one unit and are imported and sold as such. The unit is used to adjust the headlight beam of a passenger vehicle. It is designed to fit all Cadillac automobile models from 1969 to 1981 model years, except for the Eldorado.

The subject merchandise is referred to as an adjusting screw, but is in fact a threaded mechanism that has as one of its principal components a dog-slotted screw.

The mechanism does not function as a conventional screw and nut combination does. It operates to adjust the headlamp to the position needed. It functions as a part of the automobile to the same extent that the headlight itself does. Consequently, the headlamp adjusting screw cannot be considered simply a screw or similar to a screw-nut combination.

The Explanatory Notes (EN), although not dispositive, should be looked to for the proper interpretation of the HTSUSA. See 54 Fed. Reg. 35127, 35128 (August 23, 1989).

Under *EN 73.18(A)(c), it is explained that heading 7318 excludes threaded mechanisms,

sometimes called screws, used to transmit motion, or otherwise act as an active part of a machine.

In the present case, the adjusting screw is indeed threaded similar to how a conventional screw is threaded. However, it transmits motion in the sense that it adjusts the headlamp, and therefore it is considered an active part of the automobile. Thus, we cannot classify the subject article under heading 7318, considering this exclusion.

*EN 73.18(A)(c)

Threaded mechanisms, sometimes called screws, used to transmit motion, or otherwise to act as an active part of a machine, (e.g., Archimedian screws; worm mechanisms and threaded shafts for presses; valve and cock closlng mechanisms, etc.) (Chapter 84).

Conclusion

In my opinion, US customs tend to classify “parts” as part of a particular machine while other customs classify “parts” as parts of general use.

For example, US customs tend to classify “Computer mouse pad” as part of a computer machine while other customs classify it by material based method.

Hence it is essential to know the different opinions between the US and the other countries, when it comes to establishing a supply chain network.