Focused Value Method is to calculate the Regional Value Content(RVC)

Based on the Value of Specified Non-Originating Materials.

Case study of “Focused value method” e.g.” wiring harness”

A company in TPP Party A manufactures engine wiring harness (subheading 8544.30)

from the following materials:

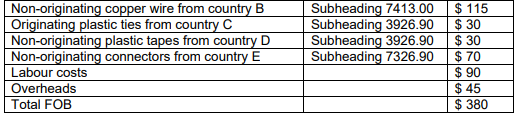

- Non-originating copper wire (subheading 7413.00) imported from country B;

- Originating plastic ties (subheading 3926.90) imported from country C;

- Non-originating plastic tape (subheading 3926.90) imported from country D;

- Non-originating connectors (subheading 7326.90) imported from country E.

The unit price of a single harness is priced as:

Using the provision in Article 3.5 of the TPP Agreement on how to calculate the

regional value content (RVC), different methods can be used to determine if the

harness is originating.

The PSR for goods of subheading 8544.30 is:

A change to a good of subheading 8544.30 from any other subheading except

from heading 74.08, 74.13, 76.05, 76.14 or subheading 8544.11 through

8544.20 or 8544.42 through 8544.60; or

regional value content of not less than:

a. 35% under the build-up method

b. 45% under the build-down method

c. 60% under the focused value method taking into account only the

nonoriginating materials of heading 74.08, 74.13, 76.05, 76.14 and

subheading 8544.11 through 8544.60.

Since subheading 7413.00 is subject to the exception in PSR 8544.30, “Non-originating

copper wire (subheading 7413.00) imported from country B;” is the material that

does not satisfy CTC rule.

Therefore subject to “Focused value method” is only this “copper wire”

RVC = Value of the Good – FVNM / Value of the Good x 100

In this case, RVC= (380-115) / 380 x100 = 69.73%

The threshold for FVNM is 60% so the harness will be considered to be originating.

It is important to note that all the other non-originating materials of subheadings not

mentioned in the specific PSR are disregarded when using the FVNM for

calculating the RVC.

Case study of “Focused value method” e.g.” wired glass sheets”

A manufacturer in a Party to CPTPP makes wired glass sheets classified to

7005.30, from cast glass of 7003.10 and steel wire of 7217 that are imported

from Brazil (a non-party).

The wired glass sheets are sold to an Australian importer for the equivalent

of AUD200 each (excluding international shipment costs).

The imported cast glass costs the manufacturer the equivalent of AUD18/kg,

with each sheet of wired glass using five kilos of cast glass.

Cost of originating materials and production processes are AUD40 per sheet.

Annex 3-D to Chapter 3 of CPTPP identifies that the ‘focused value’ PSR for

cast glass of 7003.10 is:

50 per cent under the focused value method taking into account only

the non-originating materials of heading 70.03 through 70.05

RVC = Value of the Good – FVNM / Value of the Good x 100

In this case, RVC= (200-5kg x 18) / 200 x100 = 55%

Despite the wire also being non-originating, only the non-originating cast glass is

taken into account under the focused value method.

Therefore, the RVC for the wired glass sheets is 55 per cent and they are

therefore considered TransPacific Partnership originating goods.