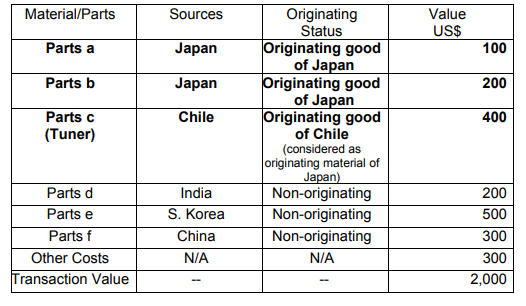

Here is a case study of De Minimis method.

Company A manufactures baby carriages (HS8715.00) in Japan and plans to

export them to Chile under Agreement between Japan and Chile.

The product specific rules for baby carriage (HS8715.00) under the Agreement are:

A change to heading 87.05 through 87.16 from any other heading; or

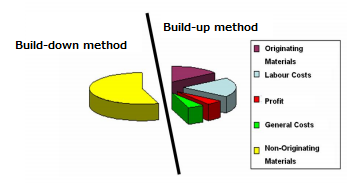

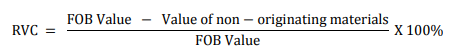

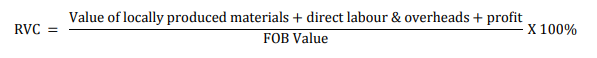

No required change in tariff classification to heading 87.05. through 87.16,

provided there is a qualifying value content of not less than 45 percent when the

Build-down method is used, or of not less than 30 percent when the Build-up

method is used.

To prove that the baby carriage qualifies as an originating good of Japan,

Company A decided to choose the CTC rule in this case.

Baby carriage is made from Indian aluminum bar (HS7604.10) and

Chinese handle grip (HS8715.00).

Since handle grip does not undergo “change in tariff classification from

any other heading”, baby carriage does not meet the CTC rule.

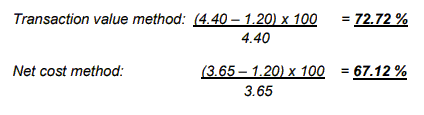

But if the value of handle grip (HS8715.00) is equivalent to 10% of transaction

value of baby carriage or less, Company A is allowed to disregard the portion of

handle grip for the purposes of the CTC rule pursuant to De Minimis provision

of Article 32.

Specific percentages referred to in Article 32(De Minimis)is here.