The criterion “wholly obtained or produced” is one of the two basic types of

origin criteria which have to be fulfilled for the purpose of determining the

country of origin of a commodity in preferential trade relations.

It is mainly used for natural products and for goods made from natural products

which are obtained entirely in one country or area, comprising products extracted or

harvested in a country and live animals born, raised or hunted there.

The scope of wholly obtained or produced products is normally interpreted in a very

strict way, insofar as the addition of imported parts or materials excludes such products

from being wholly obtained or produced.

For the sea fishing industry, the wholly obtained or produced criterion is very important.

The sea beyond territorial waters (the open sea) is not considered to belong to the

national territory of a country.

The (Revised) Kyoto Convention requires that fish caught outside the territorial sea and

other products extracted from marine soil or subsoil outside a country’s territorial

waters have to be taken by vessels of that country in order to fulfill the criterion of

wholly obtained.

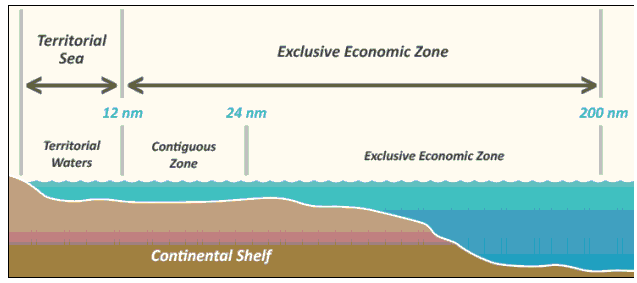

The Territorial Sea

The Territorial Sea is an area of water not exceeding 12 nautical miles (22,2 km)

in width which is measured seaward from the territorial sea baseline.

The territorial sea is regarded as the sovereign territory of the coastal state.

If this zone overlaps with another state’s territorial sea, the border is taken as the

median point between the states’ baselines, unless otherwise agreed.

The contiguous Zone

The contiguous Zone is a belt of water adjacent to the territorial sea with its outer

limits not exceeding 24 nautical miles (44,4 km).

This zone must be claimed and does not exist automatically. It allows coastal states

to exercise the control necessary to prevent and punish infringements of Customs,

sanitary, fiscal and immigration regulations.

The Exclusive Economic Zone

The Exclusive Economic Zone is the area of sea beyond and adjacent to the territorial sea.

Its outer limit cannot exceed 200 nautical miles (370 km) from the territorial sea baseline.

A coastal state has control of all economic resources within its Exclusive Economic Zone,

including fishing, mining and oil exploitation.

Retrieved from:WCO ORIGIN COMPENDIUM

With regard to goods of the sea fishing industry, the provisions on wholly obtained

or produced goods might also be supplemented by definitions of what constitutes a

vessel of a contracting party.