“Verification” is a process of confirming the originating status of goods that

have already been imported under preferential tariff treatment of FTA.

Customs conducts verification of origin in accordance with the provision of each

FTA and Customs-related laws and regulations.

In order to benefit from the preferential tariff under an FTA, the imported good

must qualify as originating in accordance with the applicable rules of origin

of the FTA. Through verification, Customs ensures the proper application of

preferential tariff treatment under FTA.

As for the verification with the importer, Customs sends a written request for

information on the originating status of the imported good(s).

Customs determines whether the good qualifies as originating on the basis of

the information and documents provided by the importer.

If the originating status of the good is not confirmed through the verification

with the importer, Customs may carry out verification with the exporter or producer.

Customs sends a written request for information to the exporter or producer, or

conducts a verification visit to the premises (e.g. factories or offices) of the

exporter or producer.

If Customs cannot confirm the originating status of the good through the above

process, preferential tariff treatment would be denied.

Furthermore, depending on the cases, the good may be subject to an additional

tax/penalties for underpayment of Customs duties.

Here is the findings of the survey analyzed Origin Verification trend, based on

questioning WCO Member Customs administrations.

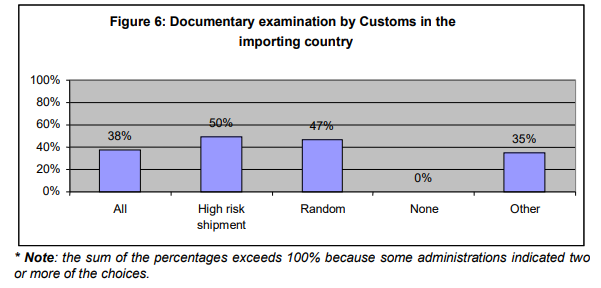

Documentary examination

109 Customs administrations that responded to the question on the cases

where a documentary examination is undertaken at the import clearance,

the documentary examination is undertaken on the following basis:

■All, 41 (38%);

■High risk shipment, 54 (50%);

■Random, 51 (47%);

■None, 0 (0%);

■Other, 38 (35%)

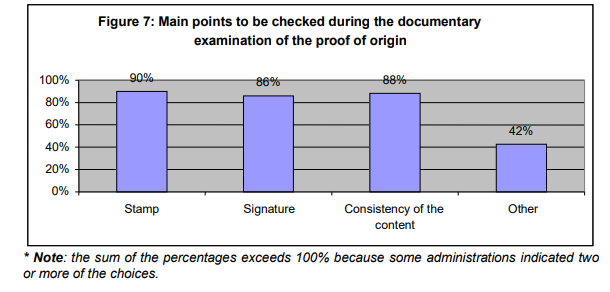

Points to be checked at the documentary examination

■Stamp, 98 (90%);

■Signature, 94 (86%);

■Consistency of the content, 96 (88%);

■Other, 46 (42%).

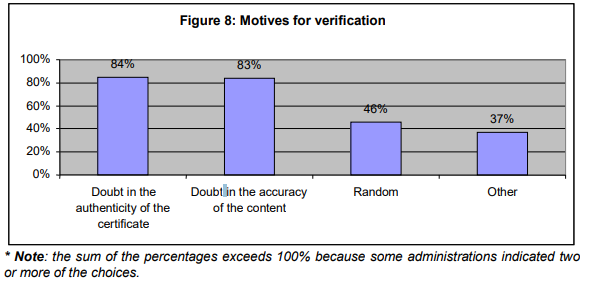

Motives for verification

109 Customs administrations that responded to the question on the main

reasons to conduct verification, doubt in the authenticity and doubt in the accuracy of the

content of the proof of origin were both common reasons for carrying out verification.

The result of the survey is as follows:

■Doubt in the authenticity of the certificate, 92 (84%);

■Doubt in the accuracy of the content, 91 (83%);

■Random, 50 (46%);

■Other, 46 (37%).

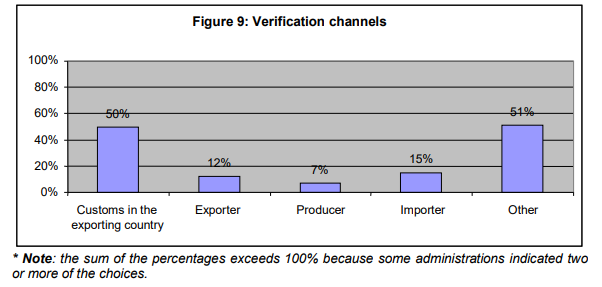

Verification channels

109 Customs administrations that responded to the question on the addressee of

the verification request, the verification through the competent authorities in the

exporting country was the most commonly accepted channel. The competent authorities

include Customs, chambers of commerce, trade/industry ministries, other authorized

bodies, etc.

Among the choices provided in the survey, the Customs in the exporting country was the

mostly chosen channel for verification. The following is the result:

■Customs in the exporting country, 54 (50%);

■Exporter, 13 (12%);

■Producer, 8 (7%);

■Importer, 16, (15%);

■Other, 56 (51%).

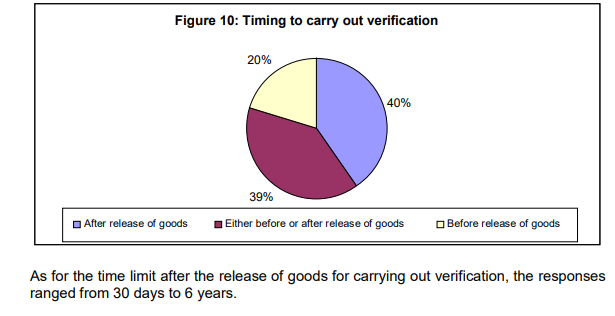

Timing

109 Customs administrations that responded to the question regarding the

timing of verification, 44 (40%) indicated that they carry out verification only after the

release of goods. 43 (39%) indicated that they carry out either before or after release.

On the other hand, 22 (20%) indicated that they carry out only before release.

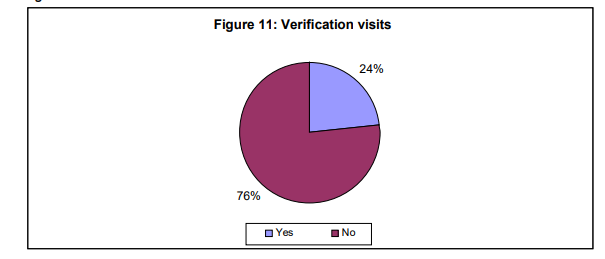

Verification visits

106 Customs administrations that responded to this question on whether

verification visits to the exporting country are conducted, 25 (24%) indicated that they do.

81 (76%) indicated that they do not.

25 Customs administrations that replied ‘yes’ to the above question, 12 (48%)

indicated that they visit the premises of the exporter. 19 (79%) indicated that they visit

the producer.

* Note: the sum of the percentages exceeds 100% because some administrations indicated both

of the choices.

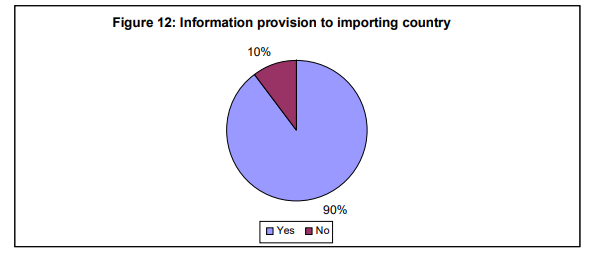

Information provision

The majority of the Customs administrations that responded provide origin information to

the requesting Customs or other authorities in the importing country. Out of the 108

Customs administrations that responded to this question, 97 (90%) indicated that they

do so. 11 (10%) indicated that they do not.

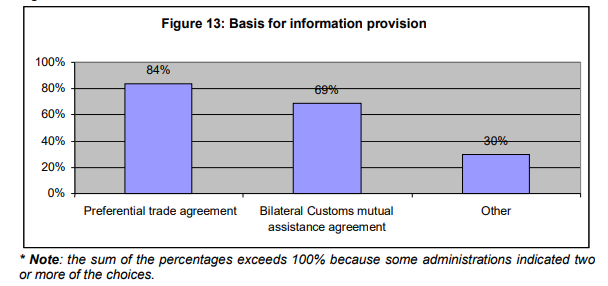

97 Customs administrations that replied ‘yes’, 81 (84%) indicated that the

preferential trade agreements were the basis for providing information. 67 (69%)

indicated that they would do so under the bilateral customs mutual assistance

agreements.

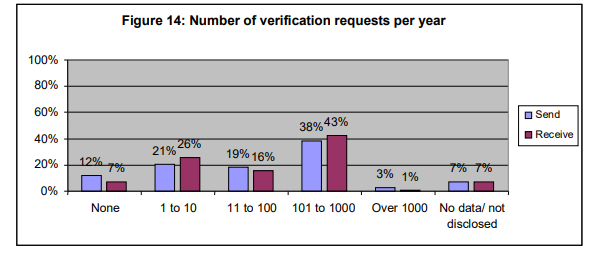

Number of Verification requests

94 Customs administrations that responded to the question on the number of

verification request, around 40% fell under the range over 100 per year. It would imply

that sending and receiving the verification requests are becoming one of the daily

businesses for many Customs administrations. The details are as follows:

<Number of verifications requests sent per year>

■None, 12 (12%);

■1 to 10, 20 (21%);

■11 to 100, 18 (19%);

■101 to 1000, 37 (38%);

■Over 1000, 3 (3%).

■No data / not disclosed, 7 (7%)

<Number of verifications requests received per year>

■None, 7 (7%);

■1 to 10, 24 (26%);

■11 to 100, 15 (16%);

■101 to 1000, 40 (43%);

■Over 1000, 1 (1%).

■No data / not disclosed, 7 (7%)

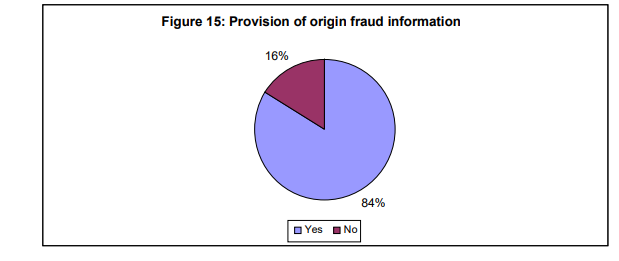

Provision of origin fraud information

75 Customs administrations that responded to the question, 63 (84%)

indicated that they would inform the exporting country if an origin fraud case were

identified. 12 (16%) indicated that they would not do so.

Retrieved from:World Trends in Preferential Origin Certification and Verification

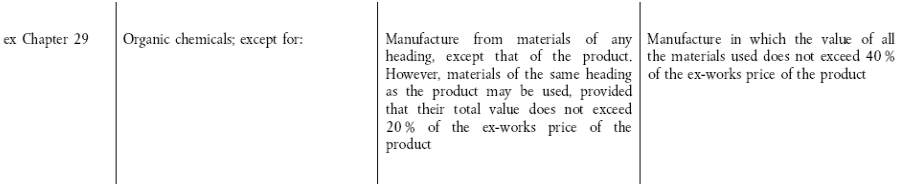

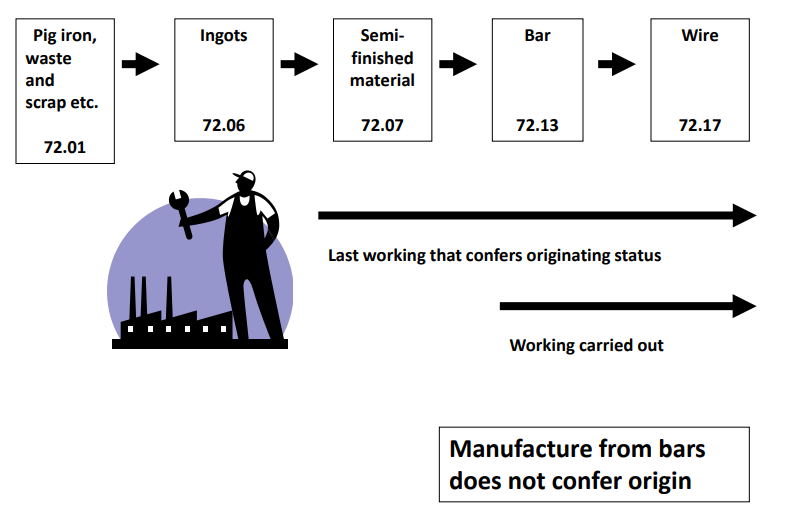

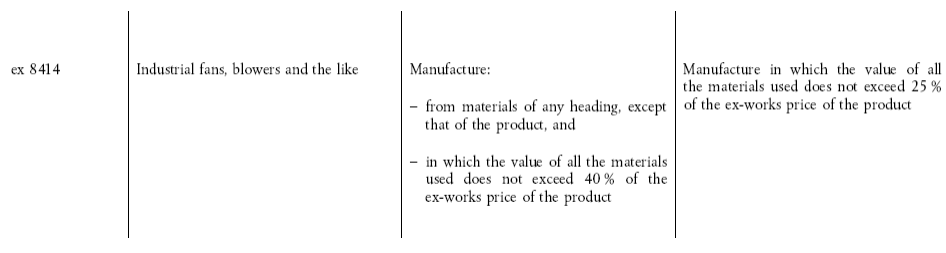

*This rule (PSR) varies depending on the agreement

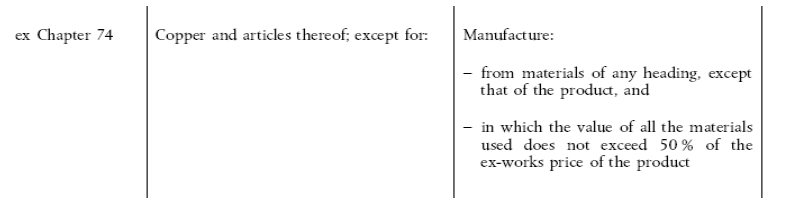

*This rule (PSR) varies depending on the agreement