Here is a case study of Build-down and Build-up method

Company Y manufactures washing machines in Japan and plans to

export them to Chile under the Agreement.

The product specific rule for washing machine (HS8450.11) under the Agreement is:

A change to subheading 8450.11 through 8450.20 from any other heading; or

No required change in tariff classification to subheading 8450.11 through

8450.20, provided that there is a qualifying value content of

not less than 45 percent when the Build-down method is used,

or of not less than 30 percent when the Build-up method is used.

To prove that the washing machine qualifies as an originating good of Japan,

Company Y has to prove that the washing machine satisfies either the CTC rule,

or the 45% value-added rule (Build-down method) or the 30% value-added rule

(Build-up method).

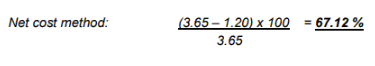

(a)Build-down method

When Company Y uses the method based on the value of non-originating materials

(Build-down method)

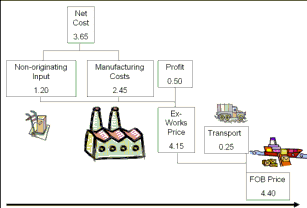

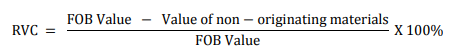

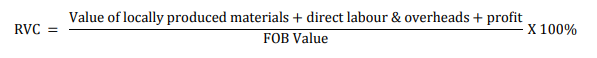

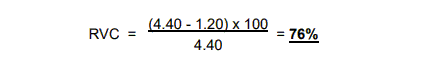

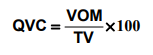

The formula for calculating the qualifying value content (Build-down method) is:

![]()

QVC is the qualifying value content of the good, expressed as a percentage;

TV is the transaction value of the good adjusted to F.O.B. basis; and

VNM is the value of non-originating materials used in the production of the good.

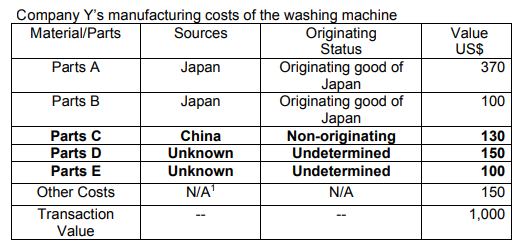

Since the origin of Parts D and E are not determined, in applying the formula,

value of those Parts should be considered as part of the value of non-originating

materials(VNM).

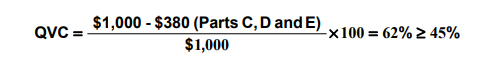

Thus, the calculation of the QVC of the washing machine is:

This calculation shows that the washing machine qualifies as an

originating good of Japan.

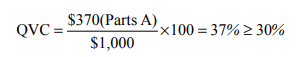

(b)Build-up method

(b) When Company Y uses the method based on the value of originating materials

(Build-up method)

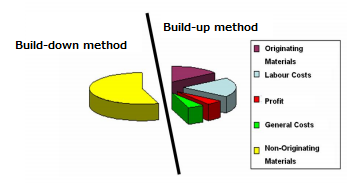

The formula for calculating the qualifying value content (Build-up method) is:

QVC is the qualifying value content of the good, expressed as a percentage;

TV is the transaction value of the good adjusted to F.O.B. basis; and

VOM is the value of originating materials used in the production of the good.

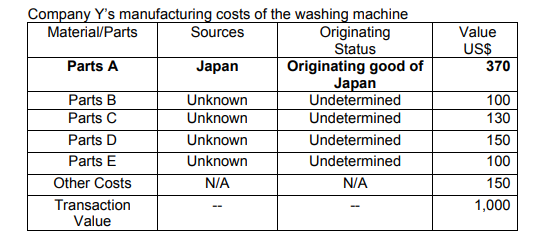

Since it is known that Parts A is originating good of Japan, Company Y found that it

would be easier to use the Build-up method because it is clear that QVC of the

washing machine will be more than 30%, taking into account the value of Parts A

only. In this case, Company Y does not need to check the originating status of other

parts and other costs.

Thus, the calculation of the QVC of the washing machine is:

This calculation shows that the washing machine qualifies as an

originating good of Japan.